The global agricultural adjuvants market size is anticipated to reach USD 4.8 billion by 2028, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 4.1% from 2021 to 2028. The market is predominantly driven by the increasing demand for crop protection products in the agricultural field across the globe.

Agricultural adjuvants manufacturing companies are majorly focusing on the development of sustainable and environmentally friendly products. For instance, in 2017, Solvay launched AgRHO S-Boost. This product works like a magnet for moisture and nutrients around the seed. AgRHO S-Boost is bio-based, eco-friendly, non-toxic, and biodegradable for both humans and plants while reducing water, fertilizer, and pesticide use.

Innovation and new cost-effective product developments in the market are attracting agriculturists which are expected to augment market growth. Manufacturers are focusing on developing multifunctional agricultural adjuvants for cost-effectiveness. In February 2020, Ingevity launched a new bio-based multifunctional adjuvant product line for crop protection named AltaHance. This product line provides customers an eco-friendly adjuvant with several performance benefits in a single product.

Free Sample Report: www.grandviewresearch.com/industry-analysis/agricultural-adjuvants-market

The market witnessed an increase in the price of agricultural adjuvants in 2020 due to the Covid-19 pandemic. Supply chain disruptions and restrictions related to transportation resulted in an immediate price spike of various agricultural additives. The majority of the raw materials used in agrochemicals production are imported from China. Due to the trade restrictions from China, the agrochemical producers of various nations found difficulties in maintaining the inventory which caused the major price fluctuations.

Agricultural Adjuvants Market Report Highlights

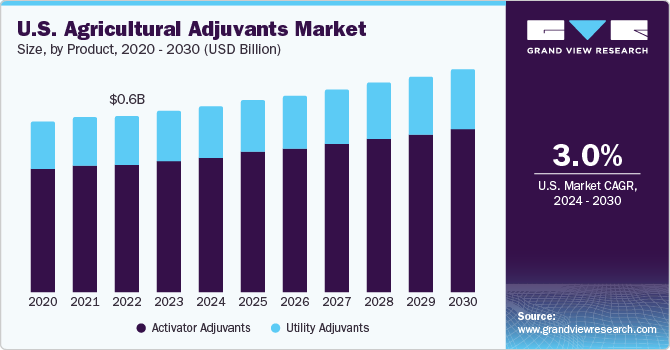

- The activator adjuvant type segment accounted for 70.0% of the global revenue share in 2020 owing to its increasing usage along with pesticides for cereals and grains. Non-ionic surfactants (activator adjuvant) are extensively used for cereals and grains along with agrochemicals. The increasing consumption of cereals and grains globally is driving the demand for activator adjuvants

- The herbicides segment dominated the market in 2020. Herbicides are the most extensively used pesticides in the world and they are mainly used to control weed formation in the agricultural cropland. According to the FAO, in 2019, the total consumption of herbicides was more than 2 million tones, more than 2 folds compared to insecticides

- In Asia Pacific, the market is projected to witness a CAGR of 5.2% from 2021 to 2028 on account of increasing demand for improved varieties of crops. Moreover, the region has the majority of the global population and countries with vast arable lands. The region’s per capita income is majorly dependent on the agricultural sector. The total arable land is shrinking due to urbanization and industrialization in India, China, South Korea, and Japan thus, agriculturists opt for agrochemicals that help in increasing productivity and yield

- The cereals and grains segment is expected to have the majority of the revenue share in the market. Herbicides utilize the majority of the adjuvant and it is majorly used for cereals and grains in the Asia Pacific and North America owing to the high cultivation of wheat and corn in the countries such as China and the U.S

- The key market players are adopting different strategies such as acquisitions, mergers, geographical expansion, and product portfolio expansion to enhance their market position and to increase their customer base. For instance, in 2017, Huntsman announced the new distribution partnership with Palmer Holland, Inc. for its agrichemical specialty products distribution in the U.S. Through this partnership Huntsman is expected to strengthen its agrochemical products brands such as TERMIX tank mix adjuvants, TERSPERSE dispersants

Key Companies & Market Share Insights

The market for agricultural adjuvants is highly competitive due to the presence of a large number of tier I, tier II, and local players. Manufacturers in the market offer a wide range of agricultural adjuvants including activity and utility adjuvants, for various applications such as herbicides, insecticides, and fungicides, among others. Competition among players is based on numerous parameters including quality, product offerings, innovation, sustainability, eco-friendly products offerings, corporate reputation, and price.

New product launches, innovation, geographical expansion, distribution network expansion, joint ventures, mergers & acquisitions are some of the key strategies being adopted by the players to strengthen their position in the market and gain a higher market share. For instance, in May 2020, Clariant AG launched its new formulation NBP. It is a new polar aprotic solvent for use in agricultural adjuvants Genagen formulations. Some of the prominent players in the agricultural adjuvants market include: Clariant AG, Solvay, Corteva Agriscience, The Dow Chemical Company, Huntsman International LLC., Evonik Industries AG, Ingevity, Nufarm Limited, Croda International PLC, BASF SE, Miller Chemical & Fertilizer, Helena Chemical Company, WinField United, Wilbur-Ellis Company LLC, Stepan Company LLC.

Buy Full Report: www.grandviewresearch.com/industry-analysis/agricultural-adjuvants-market