The global operating room integration market size is anticipated to reach USD 4.4 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 11.3% from 2022 to 2030. Increasing redevelopment projects and the adoption of advanced healthcare IT solutions in hospitals is a major factor boosting the market growth. Operating Rooms (OR) are increasingly becoming complex and congested due to the requirement of devices during surgeries such as surgical lights, operating tables, and surgical displays. Integrated Operating Rooms (I-ORs) are becoming a solution for this complexity in ORs.

Operating Room Integration Market Highlights

- OR integrated services are expected to witness the fastest growth rate in coming years owing to the growing demand from ambulatory surgical centers and hospitals

- The documentation management systems segment dominated the market in 2021 owing to the associated benefits such as data management with minimal errors

- Demand for fully integrated solutions to automated surgical workflows is growing in accordance with the requirements to access all the necessary information on a single platform. This helps in expediting the surgical procedure and eliminates the need for various devices arranged all over in the operating room

- The orthopedic surgery segment is anticipated to show a lucrative CAGR owing to its growing demand. There is an increase in the number of cases of orthopedic conditions, including osteoarthritis, osteoporosis, rheumatoid arthritis, and ligamentous knee injuries

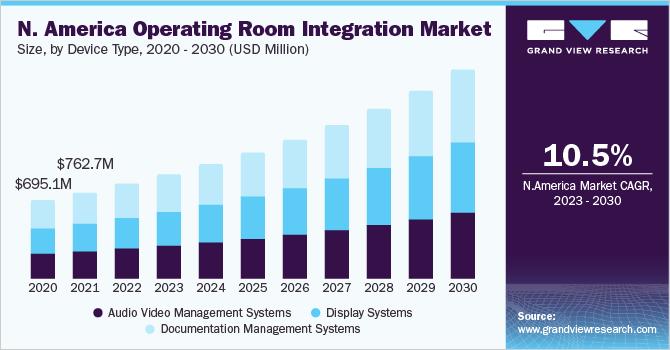

- North America dominated the market as of 2021, which is attributable to supportive government initiatives promoting the adoption of surgical automation, telemedicine, and other advanced technologies to support the use of integrated solutions in operating rooms

- Market players are involved in extensive research for the development of cost-efficient and technologically advanced OR integration solutions. Subsequently, the introduction of such solutions is expected to provide the market with lucrative growth opportunities.

- In April 2021, Barco proclaimed its partnership with Sigma – Jones | AV LLP to deliver best-in-class digital experiences in healthcare for its next-gen operating room video integration solution Nexxis

Gain deeper insights on the market and receive your free copy with TOC now @: Operating Room Integration Market Report

Though digitization was now high on the agendas of most companies, the COVID-19 pandemic speeded up the paradigm shift towards digitization in 2020. Besides, the trend toward digital ORs was also quickened up by the pandemic. Thus, the COVID-19 crisis created new opportunities to innovate and new ways to create value in the evolving healthcare world. For instance, in March 2021, Olympus has introduced EASYSUITE, a next-generation OR integration solution, in the EMEA area. EASYSUITE features video management and routing, medical content management, procedure recording, and virtual collaboration. As a result, with the introduction of EASYSUITE, the company promoted digitalization in surgery and boosted its position in the EMEA territory.

The use of video communication solutions has increased during COVID-19, in response to restrictions on travel, to lower the risk of cross-infection and ensure continuous education of surgeons in training. According to a June 2020 article published in Wiley Online Library, Microsoft Teams and Zoom were used for live surgical training teleconferencing at the National University of Malaysia to comply with government protocols during the COVID-19 pandemic. The teleconferencing solution enabled webinar lectures, surgery case-based discussions, viva voce examination, and journal critique exercises. In such unprecedented conditions, teleconferences, online learning, and webinars can be advantageous for surgical education and assessments.

The modern operating room provides consolidated data and offers access to audio and video and controls for all surgical devices at the central command station, allowing the surgeon to achieve various tasks efficiently without the prerequisite to move near the OR. Other advantages of OR integration are it minimizes manpower, maximizes OR efficiency takes less surgical time procedure, and manages patient surgical records.

Most of the Minimally Invasive Surgeries (MIS) procedures such as TAVR, and EVAR, laparoscopic procedures are performed in hybrid integrated OR. Surging patient preference for MIS is boosting the market growth. MIS includes robotic surgery; laparoscopic surgeries that have a wide range of applications in the medical sector. In addition, hospitals have shifted their preference towards advanced MIS procedures for diagnosing chronic diseases. The preference is due to the benefits that this procedure provides such as lower postoperative complication rates along with reduced hospital stay, less pain and offers fast recovery time. It also provides a high accuracy rate as compared to traditional open surgery. The aforementioned factors are anticipated to boost the demand for I-ORs over the forecast period.

Operating Room Integration Market Insights By Demographics

North America dominated the market and accounted for the largest revenue share of over 45.0%. Dominance can be attributed to the increasing demand for surgical automation. Major factors attributed to the market growth are the rise in demand for efficient healthcare services, an increase in the need to reduce healthcare expenditure, and effective EHR implementation by healthcare organizations. In the Asia Pacific, the market for operating room integration is anticipated to witness the highest CAGR over the forecast period. The market is driven by a rising pool of patient populations suffering from chronic disorders that require surgical interventions, increasing demand for sophisticated medical devices in hospitals, a rising number of MIS procedures, and rapidly improving healthcare infrastructure.

Competitive Analysis By Major Players

The industry is fragmented with a large number of players operating in this sector. The key players are focusing on implementing new strategies such as regional expansion, mergers, and acquisitions, improving their application portfolio through innovation, partnerships, and distribution agreements to increase their revenue share and mark their presence in the market. The competitors operating in the market are focusing on other strategies such as mergers and acquisitions, collaborative agreements to mark their presence in the market. For instance, In January 2020, Brainlab declared its acquisition of Vision Tree Software. Vision tree Optimal Care (VTOC) platform, which provides EHR, research, and registry platform. The acquisition will provide an opportunity to capture data by point-of-care electronic forms and use inefficient workflows. The strategies like these implemented by the leader in this vertical are further propelling the market growth. Some of the prominent players in the operating room integration market include:

- Braiblab AG

- Barco

- Dragerwerk AG & Co. KGaA

- Steris Plc.

- KARL STORZ SE & CO. KG

- Olympus

- Care Syntax

For Any Questions or Inquire please visit @: https://www.grandviewresearch.com/industry-analysis/operating-room-integration-market/request/rs5

Operating Room Integration Market Segmentation

Grand View Research has segmented the global operating room integration market by component, device type, application, end use, and region:

- Operating Room Integration Component Outlook (Revenue, USD Million, 2017 – 2030)

- Operating Room Integration Device Type Outlook (Revenue, USD Million, 2017 – 2030)

- Operating Room Integration Application Outlook (Revenue, USD Million, 2017 – 2030)

- Operating Room Integration End-Use Outlook (Revenue, USD Million, 2017 – 2030)

- Operating Room Integration Regional Outlook (Revenue, USD Million, 2017 – 2030)

- List of Key Players of Operating Room Integration Market

Research Methodology

We employ a comprehensive and iterative research methodology focused on minimizing deviance in order to provide the most accurate estimates and forecasts possible. We utilize a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. Our market estimates and forecasts are derived through simulation models. A unique model is created and customized for each study. Gathered information for market dynamics, technology landscape, application development, and pricing trends are fed into the model and analyzed simultaneously.

For Customized reports or Special Pricing please visit @: https://www.grandviewresearch.com/special-pricing/7098/rfsp2

About Grand View Research

Grand View Research provides syndicated as well as customized research reports and consulting services on 46 industries across 25 major countries worldwide. This U.S. based market research and consulting company is registered in California and headquartered in San Francisco. Comprising over 425 analysts and consultants, the company adds 1200+ market research reports to its extensive database each year. Supported by an interactive market intelligence platform, the team at Grand View Research guides Fortune 500 companies and prominent academic institutes in comprehending the global and regional business environment and carefully identifying future opportunities.

Contact:

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll-Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com