The global factoring services market size is expected to reach USD 7,005.90 billion by 2030 and is set to expand at 9.2% CAGR from 2023 to 2030, according to a new report by Grand View Research, Inc. The remarkable growth can be attributed to the rise in open account trading and cross-border business, and the expansion of the manufacturing industry in Asian countries such as China and India is expected to boost the growth of this market.

Factoring Services Market Report Highlights

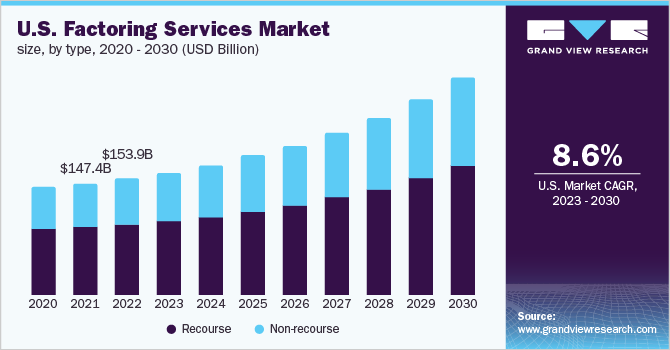

- The non-recourse segment is expected to grow considerably during the forecast period with a CAGR of 9.6%, as the non-recourse service providers perform thorough credit evaluations and offer credit protection against bad debts

- The bank segment accounts for the highest market share in 2022 and throughout the forecast period. The growing cross-border transactions and adoption of mobile-based payment channels are anticipated to propel the segment growth over the forecast period

- The healthcare segment is anticipated to grow with a considerable CAGR of 10.9% over the forecast period. Slow payment is a common problem across the healthcare industry which hinders expansion and makes it tough to cover expenses

Gain deeper insights on the market and receive your free copy with TOC now @: Factoring Services Market Report

Factoring service is a type of finance in which a business would sell its accounts receivable (invoices) to a third party to meet its short-term liquidity needs and factor would pay the amount due on the invoices minus its commission or fees. Factoring allows a company to sell off its receivables at one time rather than having to wait on collecting from customers. The receivables are sold at a discount, meaning that the factoring company may pay the company with the receivables 80% or 90%, depending on the agreement, of the value of the receivables. The main components are financing, risk coverage, and receivables credit management and the major types are maturity factoring, finance factoring, discount factoring, and undisclosed factoring.

The need of startups and Small & Medium Enterprises (SMEs) for an alternative source of finance propels the demand in this market. Additionally, the implementation of technological advancements such as blockchain and distributed ledger will improve the overall supply chain process by reducing operational costs and enhancing security across the system.

A rise in demand for factoring services can be seen due to its ability to offer immense flexibility via customization depending upon the client’s requirement. This is in contrast to conventional financial products such as bank loans. The factoring services are based on the current value of the sales ledger and not on historic management information. Factoring does not increase liability, as it is a transaction of sale and not a loan.

A few factors, including archaic regulations, foreign currency restrictions, continued usage of stamp duty tax, and traditional laws restricting the right of assignment, might slow down the growth for a short period. However, several service providers are in the process to deploy the latest technologies to overcome such problems. The factoring services providers such as Eurobank, Société Générale S.A., REV Capital, and Tradewind Finance are adopting various business strategies to improve their services portfolio to attract potential business clients.

For instance, in April 2022, Eurobank Factors, a subsidiary of Eurobank, unveiled new improvements to its factoring and launched new digital reverse factoring services. The bank’s new digital reverse factoring services are aimed at assisting clients to improve their cash flow ratios and to provide loyalty schemes on lenient terms. The new services would aid the bank in expanding its customer base for factoring services in the EMEA region.

Factoring Services Market Insights By Region

Europe accounted for the major market share owing to the growing focus of transport companies on export business factoring. Emerging start-ups continue to line up for factoring services from countries such as the U.K., Germany, Italy, Romania, and Sweden. Many service providers in this region remain focused on automating the process by utilizing advanced technologies such as blockchain, which provides advanced data security and smart contract functionality. It is one of the crucial factors supporting the factoring services industry growth in the region. The Asia Pacific region is expected to witness considerable growth owing to the expansion of the manufacturing sector in economies such as India and other Southeast Asian countries. Their economies are rapidly shifting from agrarian to manufacturing and export-oriented economies, supporting the growth of factoring services in the region. The Asia Pacific region is home to a large number of developing economies, such as China, Thailand, India, and the Philippines, which are getting investments from developed markets that are saturated and exploring new opportunities in the region.

Competitive Analysis By Major Companies

Market players are focusing on strategic partnerships, mergers & acquisitions. Companies continue to actively engage with existing and new clients, to increase their respective market share. They are also aggressively investing in advanced technologies such as distributed ledger and blockchain activities to gain a competitive edge in the factoring services market. Some prominent players in the global factoring services market include:

- Barclays Bank PLC

- BNP Paribas

- China Construction Bank Corporation

- Deutsche Factoring Bank

- Eurobank

- Hitachi Capital (UK) PLC

For More Details or Sample Copy please visit link @: https://www.grandviewresearch.com/industry-analysis/factoring-services-market/request/rs5

Factoring Services Market Segmentation

Grand View Research has segmented the global factoring services market based on category, type, financial institution, end-use, and region.

- Factoring Services Category Outlook (Revenue, USD Billion, 2018 – 2030)

- Factoring Services Type Outlook (Revenue, USD Billion, 2018 – 2030)

- Factoring Services Financial Institution Outlook (Revenue, USD Billion, 2018 – 2030)

- Factoring Services End-use Outlook (Revenue, USD Billion, 2018 – 2030)

- Factoring Services Regional Outlook (Revenue, USD Million, 2018 – 2030)

- List of Key Players in the Factoring Services Market

Research Methodology

We employ a comprehensive and iterative research methodology focused on minimizing deviance in order to provide the most accurate estimates and forecasts possible. We utilize a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. Our market estimates and forecasts are derived through simulation models. A unique model is created and customized for each study. Gathered information for market dynamics, technology landscape, application development, and pricing trends are fed into the model and analyzed simultaneously.

For Customized reports or Special Pricing please visit @: https://www.grandviewresearch.com/special-pricing/451061/rfsp2

About Grand View Research

Grand View Research provides syndicated as well as customized research reports and consulting services on 46 industries across 25 major countries worldwide. This U.S. based market research and consulting company is registered in California and headquartered in San Francisco. Comprising over 425 analysts and consultants, the company adds 1200+ market research reports to its extensive database each year. Supported by an interactive market intelligence platform, the team at Grand View Research guides Fortune 500 companies and prominent academic institutes in comprehending the global and regional business environment and carefully identifying future opportunities.

Contact:

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll-Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Web: https://www.grandviewresearch.com