Increased focus on health, eco-friendly rides, and affordability are the key reasons more people are riding bicycles these days. Although the purpose of the bicycle has evolved over time, from a wooden bicycle in the nineteenth century to a foldable bicycle in the twenty-first century, it continues to tempt consumers and is a preferred mode of transportation for many.

In the previous few years, the global bicycle market has seen a rapid transformation. Incentives and infrastructure to assist bicycle commuting are being aggressively implemented by governments in a number of developed countries. App-based dock-less bicycle sharing systems have emerged as a result of recent technology developments in mobile apps and Global Positioning System (GPS), which are projected to fuel future demand.

For more insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=7015

The readability score of the Bicycle Subscription Market Demand report is good as it offers chapter-wise layout with each section divided into a smaller section.

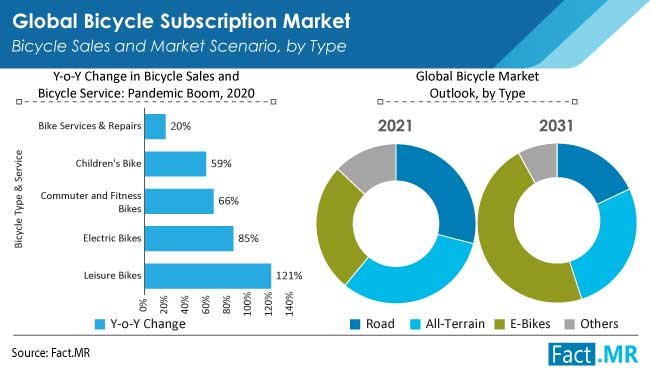

The report encompasses graphs and tables to show the entire assembling. Pictorial demonstration of the definite and estimated values of key segments is visually appealing to readers.

This Bicycle Subscription market outlook report explicates on vital dynamics such as the drivers, restraints and opportunities for key players and competitive analysis of Bicycle Subscription along with key stakeholders as well as emerging players associated with the manufacturing of product.

Competitive Landscape:

- In March 2021, Zoomo raises around US$ 12 Mn from funding from a new investor group and also a few existing to expand into new regions and further modify and advance its e-bike platform for enterprises. Similarly in August 2020, US$ 11 Mn through series A funding was raised totalling around US$ 26 Mn in the last 2 years.

- VanMoof, an Amsterdam-based firm, raised US$ 128 Mn in a Series C fundraising round in 2021. Electric bikes, which are highly popular in various countries, are designed and sold by the firm. In comparison to the company’s Series B, the Series C is a significant step forward. VanMoof raised US$ 40 Mn in a Series B funding last year.

- Bike Club has decided to raise more funding to expand its service. By early 2022, the company wants to double the number of bikes to between 50,000 and 60,000. It has secured US$ 8.8 Mn in debt financing from Triple Point, a U.K. investment business, to fund the next phase of its long-term expansion aspirations.

- In January 2021, MyByk, a public bicycle-sharing company, through pre-series A received US$ 1 Mn from Avon Cycle and other investors. It now intends to incorporate public transit into its services and smartphone app. In order to shift to a Mobility as a Service (MaaS) platform, MyByk is looking for state governments to for collaboration.

- In 2020, Yulu, an electric vehicle micro mobility service provider, announced a fresh capital of US$ 4 Mn in equity finance, led by Rocketship, a U.S.-based venture capital firm, and current investors. The new investment in the midst of the COVID-19 problem validates the new-age mobility firms’ growth potential. The new investment will be utilised to strengthen its mobility platform, develop innovative solutions, and enable quick growth.

- Dance announced the closing of US$ 17.7 Mn Series A funding round in October 2020, led by HV Holtzbrinck Ventures, one of Europe’s largest venture capital firms. Dance is a prominent player and has developed a network that does not need users to own a pricey bike and provides a rentable bicycle or e-bike in their locality.

Prominent companies operating in this market include:

- Bike Club

- BiXi

- Brompton Subscription

- Buzzbike

- Cowboy

- Dance

- Dash

- GetHenry

- Hurrecane

- MOBY BIKES LTD.

- MyByk

- Revel

- Swapfiets

- Yulu

- Zoomo

For in-depth competitive analysis, Buy Now:

https://www.factmr.com/checkout/7015

How will be insights and market estimations provided in the Fact.MR report on the Demand of Bicycle Subscription make a difference?

- The study takes a closer look at the major economic turmoil, with a focus on the recent COVID-19 pandemic disruptions

- The assessment of key growth dynamics highlights the attractiveness of new automation technologies and offers readers insight on the prospect of these during the forecast period

- The study tries to offer a balance perspective of the opportunities in mature and the most lackluster markets

- Provides scrutiny of the industry trends that have shaped recent government policies

- Provides an account of major breakthroughs in all segments that might change the course of the market considerably

- Provides an incisive analysis of socio-political milieu in which the key markets operate, and how will that influence the lucrativeness of the overall Bicycle Subscription Market

- Analyzes how collaborations and partnerships among players from different industries shape the key growth dynamics in the near future

- Evaluates the role of various stages of funding on new growth avenues in key regional markets

Contact:

US Sales Office :

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

E-Mail: sales@factmr.com