Mordor Intelligence has published a new report on the US Securities Brokerage Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

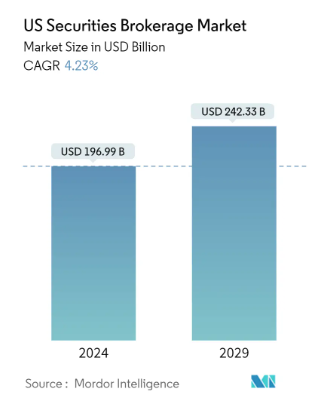

The United States securities brokerage market, valued at USD 196.99 billion in 2024, is projected to grow at a compound annual growth rate (CAGR) of 4.23%, reaching USD 242.33 billion by 2029. This growth is fueled by increased demand for digital trading platforms, an active IPO landscape, and the expansion of retail investing. With investors looking for both stability and higher returns, brokerage firms are seeing a surge in clients seeking diversified investments and accessible online services.

Key Trends in the U.S. Securities Brokerage Market

1. Increased Demand for Digital and Mobile Trading Platforms

The shift to online trading has reshaped the brokerage industry, driven by ease of access, lower transaction costs, and increased transparency. Major brokerage firms now offer digital platforms and mobile applications to attract a new generation of investors, enabling quick and efficient trades. This trend is particularly strong among millennial and Gen Z investors, who favor digital solutions and are contributing to record trading volumes. Brokerage platforms are also increasingly incorporating features like real-time analytics and automated trading, enhancing the digital user experience.

2. Surge in IPO Activity

Initial public offerings (IPOs) have become a key area of focus, with the NASDAQ and NYSE leading globally in terms of IPO proceeds. As more companies go public to access capital, investor interest in IPOs has surged, supported by increased awareness and the ease of participating in new listings through brokerage platforms. The active IPO landscape in the U.S. is bolstering growth in the securities brokerage market, particularly as individual investors become more involved in the initial trading of newly listed companies.

3. Growth in Retail Investing and Self-Directed Portfolios

Retail investing has seen exponential growth, fueled by the rise of self-directed trading platforms. Platforms like Fidelity, E-Trade, and Robinhood are attracting first-time investors seeking control over their investment decisions. The shift towards self-directed accounts has led brokerage firms to prioritize educational resources, analytics tools, and portfolio management options that cater to this new investor segment. Retail investors’ increasing interest in stock and options trading is expected to continue driving market growth.

4. Competitive Pricing and Commission-Free Trading

The move to commission-free trading by major brokers has intensified competition in the industry, making trading more accessible for a broad customer base. Firms have adapted by offering more diversified services, such as advisory options, premium analytics, and fractional share trading. This model allows investors to buy portions of high-priced stocks, thus broadening participation. As competition grows, brokerages are also exploring revenue streams from order flow and premium service subscriptions to maintain profitability.

Report Overview – https://www.mordorintelligence.com/industry-reports/us-securities-brokerage-market

Market Segmentation

The U.S. securities brokerage market is segmented by type, mode, and type of establishment.

By Type:

- Equity Brokerage: Largest segment, including traditional stock trading.

- Bond Brokerage: Focus on fixed-income investments, appealing to conservative investors.

- Derivatives and Commodities Brokerage: Covers futures, options, and commodities, providing diversification for seasoned investors.

- Other Stock Brokerage: Includes niche services like annuities and structured products.

By Mode:

- Online: The primary mode, driven by demand for convenience, cost-effectiveness, and mobile compatibility.

- Offline: Traditional mode catering to clients seeking personalized, in-person consultations, particularly for complex investment decisions.

By Type of Establishment:

- Exclusive Brokers: Focus solely on brokerage services and offer a variety of investment options.

- Banks: Provide brokerage services as part of broader financial offerings, appealing to clients who prefer one-stop banking solutions.

- Investment Firms: Offer comprehensive wealth management, often with advisory services, serving high-net-worth clients.

- Other Types: Includes firms offering specialized brokerage services, such as robo-advisors or ESG-focused investments.

Get a Customized Report Tailored to Your Requirements. – https://www.mordorintelligence.com/market-analysis/e-brokers

U.S. Securities Brokerage Market Key Players

Prominent players in the U.S. securities brokerage market include Fidelity Investments, E-Trade, Merrill Edge, Interactive Brokers, and JPMorgan Wealth Management. These companies lead in offering competitive digital platforms, diversified investment options, and strong client support. Fidelity Investments has been a leader in commission-free trading and fractional share services, appealing to retail investors. E-Trade continues to innovate with mobile trading features and educational resources, while Interactive Brokers caters to active traders with advanced analytics and low-cost trading options. Major players are also leveraging technological advancements, including AI-driven analytics and blockchain integration, to enhance trading security and efficiency.

Conclusion

The U.S. securities brokerage market is set to grow steadily over the next five years, propelled by digital transformation, increasing IPO activity, and the democratization of investing through commission-free trading. As more Americans engage in self-directed investing, brokerage firms are adapting with enhanced digital platforms, educational tools, and diverse investment options. With traditional brokerage and banking firms facing competition from fintech-driven platforms, innovation will be central to capturing market share. As technology and investor demographics evolve, the U.S. securities brokerage market is positioned for continued expansion, offering accessible, secure, and efficient trading solutions across a broad client base.

Industry Related Reports

Global Online Brokerage Industry: The report provides insights into market trends and is segmented by client type, including retail and institutional clients; by services provided, covering full-service brokers and discount brokers; by ownership structure, encompassing privately held and publicly held firms; and by geographic regions, including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

Europe E-Brokerages Market: The Report is segmented by investor type, including retail and institutional investors; by operation, covering domestic and foreign transactions; and by geography, encompassing Germany, the United Kingdom, Russia, Spain, the Netherlands, Denmark, Sweden, Finland, Norway, and the rest of Europe.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/