Mordor Intelligence has published a new report on the United States Oil and Gas Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

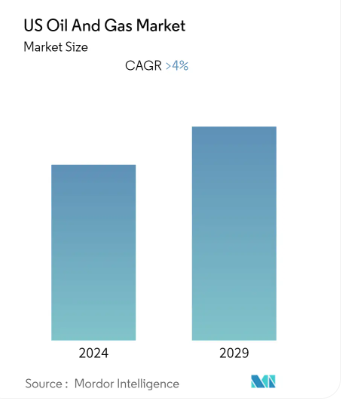

The United States oil and gas market is projected to grow at a compound annual growth rate (CAGR) of 4%, reaching new heights by 2029. This growth is driven by increased crude oil production, significant investments in the upstream sector, and advancements in drilling and extraction technologies. As a leading global producer, the U.S. remains pivotal to the global energy landscape, even as renewable energy gains traction. Oil and gas continue to dominate the energy mix, underscoring their critical role in meeting the country’s energy demands.

Key Trends

1. Upstream Sector Driving Growth

The upstream segment is expected to witness robust growth due to significant crude oil production and the development of new oil fields.

- The U.S. accounted for 18.5% of global crude oil production in 2021, producing over 16.5 million barrels per day.

- Major projects, such as the Herschel Expansion in the Gulf of Mexico and the GMT-2 project in Alaska, are increasing production capacity.

- Enhanced drilling technologies and cost-efficient production methods are further boosting the upstream segment’s growth trajectory.

2. Technological Advancements in Exploration and Production

Innovations in drilling and production technologies are transforming the oil and gas landscape:

- Hydraulic fracturing and horizontal drilling have unlocked significant reserves, particularly in the Permian Basin.

- Advanced subsea systems, as seen in BP’s Herschel Expansion, are optimizing extraction processes.

- Automation and AI-driven analytics are improving operational efficiency and reducing environmental impacts.

3. Shifting Focus Toward Sustainable Practices

Although oil and gas dominate the energy mix, there is a growing emphasis on sustainability:

- Companies are adopting carbon capture and storage (CCS) technologies to reduce emissions.

- Investments in hybrid projects that integrate geothermal and hydrocarbon production are gaining momentum.

4. Renewable Energy Investments Creating Headwinds

While the oil and gas sector thrives, the growing investment in renewable energy presents challenges:

- The U.S. added 351.67 GW of installed renewable energy capacity by 2022, with significant federal and state-level support.

- Legislation such as the America Competes Act emphasizes clean energy transitions, posing competition for traditional fossil fuels.

Get a PDF sample copy of the United States Oil and Gas Market Research Report, Visit – https://www.mordorintelligence.com/industry-reports/united-states-oil-and-gas-market

Market Segmentation

The United States Oil and Gas Market is segmented by Sector:

- Upstream:

- Focused on exploration and production activities.

- Significant developments in the Permian Basin and Gulf of Mexico.

- Midstream:

- Includes transportation, storage, and processing.

- Investments in pipeline infrastructure and LNG export terminals.

- Downstream:

- Comprises refining and distribution of petroleum products.

- Growth in petrochemical projects to meet rising demand for plastics and polymers.

Get a Customized Report Tailored to Your Requirements. – https://www.mordorintelligence.com/market-analysis/oil-and-gas

Key Players

The U.S. oil and gas market is moderately fragmented, with key players leading technological innovation and production capacity expansions. Major companies include ExxonMobil Corporation, Chevron Corporation, BP PLC, Shell PLC, and TotalEnergies SE.

- ExxonMobil Corporation: A leader in upstream exploration and production, with significant investments in the Permian Basin and offshore fields.

- Chevron Corporation: Focused on advancing drilling technology and sustainable energy integration.

- BP PLC: Known for its Gulf of Mexico operations and investments in decarbonization technologies.

- Shell PLC: Prioritizing natural gas production and LNG exports while diversifying into renewables.

- TotalEnergies SE: Expanding its U.S. footprint through innovative refining and distribution solutions.

These companies are leveraging innovation, strategic partnerships, and sustainability initiatives to maintain their market positions.

Conclusion

The United States oil and gas market remains a cornerstone of the global energy landscape, with steady growth expected through 2029. While renewable energy investments challenge the sector, advancements in drilling technology, rising production levels, and robust infrastructure development ensure the continued importance of oil and gas in the energy mix. As key players innovate and adapt to evolving market dynamics, the industry is poised to balance energy security and environmental sustainability, maintaining its critical role in powering the nation and beyond.

Industry Related Reports