Market Overview:

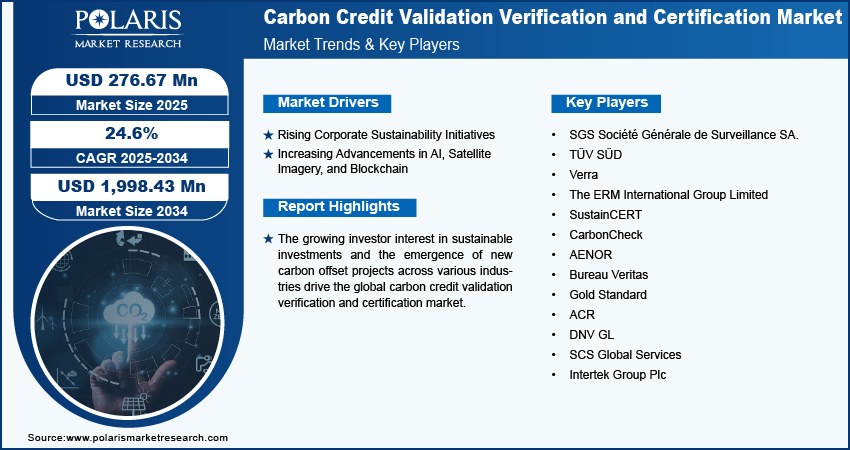

The global carbon credit validation verification and certification market size is expected to reach USD 1,998.43 million by 2034, exhibiting a CAGR of 24.6% during 2025–2034.

The carbon mechanism mandates the Validation Verification of Carbon Credits to ensure compliance with required standards and proper following of methodologies. Carbon Mechanisms have associated Validation and Verification Bodies (VVB) that provide accreditation to projects being evaluated. The certification of carbon credits is crucial for maintaining the environmental integrity of efforts to reduce emissions. Independent certification organizations evaluate and confirm the methodologies, additionality, and permanence of emissions reductions for projects.

Growth Drivers and Opportunities:

- Businesses are more frequently disclosing their performance in environmental, social, and governance (ESG) aspects. The growing corporate sustainability efforts are driving the expansion of the carbon credit validation, verification, and certification market.

- The demand for carbon credit VV&C has risen as companies aim to verify and authorize their ecological effects. Rising innovations in these technologies enhance the worldwide market for carbon credit validation, verification, and certification.

Download Free Sample PDF Copy of the Report:

Key Players:

The market is marked by fierce competition, and the leading companies rely on innovative technology, superior goods, and a strong brand identity to boost sales. Here is the list of the leading companies operating in the carbon credit validation verification and certification market:

- SGS Société Générale de Surveillance SA.

- TÜV SÜD

- Verra

- The ERM International Group Limited

- SustainCERT

- CarbonCheck

- AENOR

- Bureau Veritas

- Gold Standard

- ACR

- DNV GL

- SCS Global Services

- Intertek Group Plc

Key Trends:

1. Rise in Voluntary Carbon Market Participation

The voluntary carbon market, where companies or individuals can voluntarily offset their emissions, has seen significant growth in recent years. Many companies are opting for voluntary carbon credits to meet internal environmental goals ahead of regulatory requirements. This trend is pushing the need for higher-quality validation, verification, and certification processes to ensure that the credits are credible and effective in mitigating emissions.

2. Standardization of Carbon Certification Protocols

As the market matures, there is a growing trend toward the standardization of certification protocols to simplify the carbon credit trading process and improve market transparency. Various certification bodies are working to harmonize their standards, which will reduce confusion and improve the overall credibility of carbon credits.

3. Increased Focus on Nature-Based Solutions (NBS)

There is an increasing focus on nature-based solutions, such as afforestation, reforestation, and soil carbon sequestration, as carbon offset strategies. These solutions are becoming an essential part of carbon offset portfolios and require robust validation, verification, and certification to ensure their carbon storage claims are legitimate.

4. Blockchain for Carbon Credit Transparency

Blockchain technology is increasingly being explored to enhance transparency and traceability in the carbon credit market. Blockchain can provide a secure, tamper-proof record of carbon credit transactions, which improves trust in the market and reduces the risk of fraud or double counting.

5. Regulatory Harmonization and Carbon Markets Integration

As carbon credit markets grow, there is an ongoing effort to integrate regional and national carbon markets into a global trading system. Efforts to harmonize regulations, standards, and verification processes across borders will drive efficiency and increase liquidity in the market, fostering a more robust and widespread carbon credit system.

Challenges:

While the market for carbon credit validation, verification, and certification is growing, it faces several challenges:

1. Market Fragmentation and Complexity

The carbon credit market remains fragmented, with varying standards, certification bodies, and methodologies for carbon offset projects. This complexity can confuse buyers and investors, hindering the market’s growth.

2. Credibility Concerns

Issues surrounding the legitimacy and transparency of carbon offset projects have raised concerns about the effectiveness of carbon credits. Projects must prove that they achieve genuine emissions reductions (i.e., they are “additional”) and are not simply generating credits without real-world impact.

3. Scalability of Carbon Offset Projects

The scalability of certain carbon offset projects, particularly nature-based solutions like reforestation, may be limited by land availability, financing constraints, and long-term viability. Ensuring the scalability of these projects is essential for meeting global emission reduction targets.

4. Regulatory Risks

As governments around the world evolve their climate policies, there may be regulatory uncertainties surrounding the use of carbon credits for compliance or voluntary offsetting. Changes in carbon pricing policies or emission reduction targets could influence demand for carbon credits.

Segmentation Overview:

Carbon Credit Validation Verification and Certification Market, Type Outlook (Revenue – USD Million, 2020-2034)

- Compliance

- Voluntary

Carbon Credit Validation Verification and Certification Market, Service Outlook (Revenue – USD Million, 2020-2034)

- Validation

- Verification

- Certification

Carbon Credit Validation Verification and Certification Market, Sector Outlook (Revenue – USD Million, 2020-2034)

- Agriculture & Forestry

- Energy & Utilities

- Industrial

- Transportation

- Others

The carbon credit validation verification and certification market is mainly segmented based on the service, type, sector, and region. Based on the service analysis, in 2024, the verification segment held the largest market share because of the growing demand for openness and responsibility in carbon offset programs.

Furthermore, according to the type analysis, in 2024, the voluntary segment led the global market owing to the change in corporate sustainability approaches. Numerous companies are actively engaging in environmental initiatives that exceed regulatory mandates.