Market Overview:

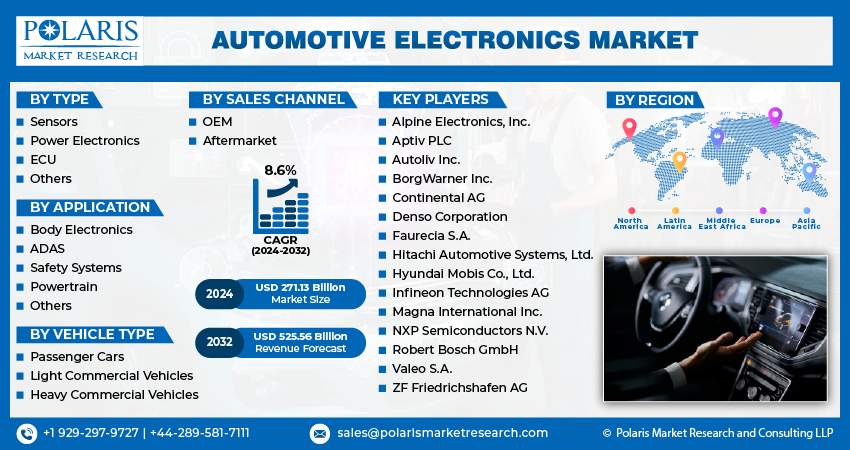

The global Automotive Electronics market size is expected to reach USD 525.56 billion by 2032, exhibiting a CAGR of 8.6% during the forecast period. Automotive electronics encompass a range of systems, including advanced driver-assistance systems (ADAS), infotainment, power management, and connectivity solutions, that are integral to modern vehicles. The rising adoption of electric vehicles (EVs), increasing demand for connected and autonomous driving technologies, and the push for sustainability are propelling the growth of this market.

Market Growth Drivers

- Rising Demand for Electric Vehicles (EVs): The global transition toward sustainable transportation is fueling demand for electronic systems in EVs, such as battery management systems and inverters.

- Advanced Safety Regulations: Stringent government regulations mandating safety features like ADAS and electronic stability control systems are driving market growth.

- Consumer Demand for Connectivity: Increasing consumer expectations for smart and connected features in vehicles, including navigation, entertainment, and telematics, are accelerating the adoption of automotive electronics.

Key Trends

- Integration of Artificial Intelligence (AI): AI is powering advanced systems like predictive maintenance, autonomous driving, and intelligent in-cabin experiences.

- Adoption of 5G Technology: The rollout of 5G networks is enabling faster, more reliable vehicle-to-everything (V2X) communication.

- Focus on Sustainability: Automakers are incorporating energy-efficient electronic systems to meet environmental standards and consumer preferences.

- Expansion of Over-the-Air (OTA) Updates: Software-based systems in vehicles are increasingly being updated remotely, reducing maintenance costs and improving performance.

- Electrification of Powertrains: Innovations in electronic powertrains are pivotal for the efficiency and performance of electric and hybrid vehicles.

Automotive Electronics Market Report Highlights:

- The sensors segment is anticipated to see substantial growth during the forecast period, driven by their key role in enhancing safety, improving fuel efficiency, and controlling emissions.

- The ADAS segment is poised for significant growth, owing to its vital contribution in improving vehicle safety, reducing accidents, and creating a more efficient driving experience.

- The passenger cars segment is expected to maintain a strong revenue share throughout the forecast period, driven by the increasing demand for advanced infotainment systems, in-car connectivity, and climate control technologies.

Download Free Sample PDF Copy of the Report:

Key Companies:

- Alpine Electronics, Inc.

- Aptiv PLC

- Autoliv Inc.

- BorgWarner Inc.

- Continental AG

- Denso Corporation

- Faurecia S.A.

- Hitachi Automotive Systems, Ltd.

- Hyundai Mobis Co., Ltd.

- Infineon Technologies AG

- Magna International Inc.

- NXP Semiconductors N.V.

- Robert Bosch GmbH

- Valeo S.A.

- ZF Friedrichshafen AG

Segmental overviews:

The Automotive Electronics Market is rapidly evolving, driven by the growing demand for advanced, energy-efficient vehicle systems. These technologies integrate critical components such as Advanced Driver Assistance Systems (ADAS), infotainment, battery management, and vehicle connectivity solutions. They offer enhanced control, safety, and optimization of vehicle operations, transforming the automotive industry towards more sustainable and intelligent mobility solutions.

Automotive Electronics Market, Type Outlook (Revenue – USD Billion, 2019-2032)

- Sensors

- Power Electronics

- ECU

- Others

Automotive Electronics Market, Application Outlook (Revenue – USD Billion, 2019-2032)

- Body Electronics

- ADAS

- Safety Systems

- Powertrain

- Others

Automotive Electronics Market, Vehicle Type Outlook (Revenue – USD Billion, 2019-2032)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Recent Developments in the Automotive Electronics Market:

- November 2023: Renesas Electronics Corporation unveiled its strategy for the next generation of system-on-chips (SoCs) and microcontrollers (MCUs), aimed at diverse applications in the automotive digital domain. The company also introduced its fifth-generation R-Car SoC, designed for high-performance automotive applications, featuring advanced chipset integration technology within the package.

- January 2023: HARMAN launched new products, including the Sound and Vibration Sensor and External Microphone, to enhance the in-car audio experience. These innovative products offer a range of applications to improve safety and user engagement, further advancing the integration of advanced electronics in automotive environments.

Stringent emission standards and fuel efficiency mandates drive the automotive electronics market. Globally, efforts to combat climate change enforce strict regulations, compelling automakers to adopt advanced electronic systems like engine control units, sensors, and electronic fuel injection. The rise in electric and hybrid vehicles, influenced by environmental concerns and incentives, fuels demand for sophisticated electronic components such as battery management systems.