Market Overview:

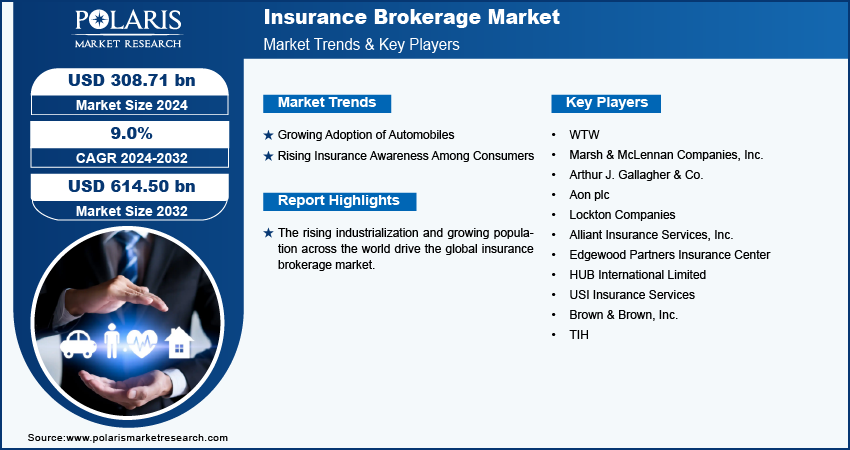

The global insurance brokerage market size is expected to reach USD 614.50 billion by 2032, exhibiting a CAGR of 9.0% during 2024–2032.

An insurance broker is essential for economic development and serves as a link between policyholders and insurers. Insurance broker provides their clients with expert guidance and advice on insurance products. Brokers offer insurance products such as medical insurance, property & casualty insurance, and health insurance. Insurance brokers collaborate closely with their clients to meet their needs regarding coverage.

Growth Drivers and Opportunities:

- Insurance brokers assist individuals and businesses in understanding the many auto insurance choices and finding policies that align with their needs. The increasing use of cars is driving the growth of the market.

- Brokers offer specialised guidance on various insurance products, assisting clients in comprehending their choices and choosing policies that meet their requirements. Increased consumer knowledge about insurance is fueling growth in the market.

Key Players:

In this extremely competitive market, major rivals constantly innovate and differentiate their products in an effort to take the lead in the market. Here is the list of the leading companies operating in the insurance brokerage market:

- WTW

- Marsh & McLennan Companies, Inc.

- Arthur J. Gallagher & Co.

- Aon plc

- Lockton Companies

- Alliant Insurance Services, Inc.

- Edgewood Partners Insurance Center

- HUB International Limited

- USI Insurance Services

- Brown & Brown, Inc.

- TIH

Segmentation Overview:

The insurance brokerage market is mainly segmented based on insurance, brokerage, end user, and region. Based on insurance analysis, in 2023, the property & casualty insurance segment held the larger market share because of the increasing awareness of risk management and the growing complexity of risk situations. The rising incidence of natural disasters has significantly increased the need for extensive property insurance.

Furthermore, according to the end user analysis, in 2023, the individual segment accounted for the larger market share due to the rising awareness of the importance of personal financial stability and an increasing focus on future planning.

Insurance Brokerage Market, Insurance Outlook (Revenue – USD Billion, 2019-2032)

- Life Insurance

- Property & Casualty Insurance

Insurance Brokerage Market, Brokerage Outlook (Revenue – USD Billion, 2019-2032)

- Retail

- Wholesale

Insurance Brokerage Market, End User Outlook (Revenue – USD Billion, 2019-2032)

- Individual

- Corporate