Market Overview

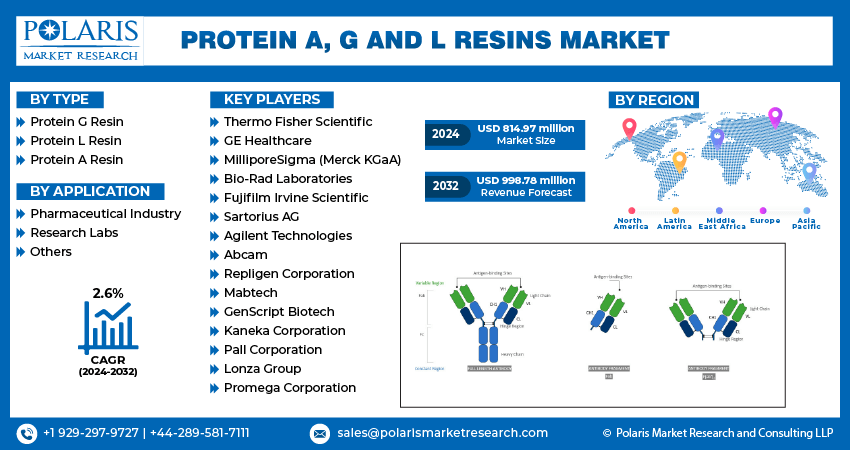

The global Protein A, G, and L Resins Market was valued at approximately USD 795.56 million in 2023 and is projected to reach USD 998.78 million by 2032, exhibiting a CAGR of 2.6% during the forecast period.

These resins are essential in affinity chromatography for purifying proteins and antibodies, each binding specifically to different classes of immunoglobulins. Their applications span research, clinical diagnostics, and industrial processes, making them indispensable in the biopharmaceutical sector.

Download Free Sample PDF Copy of the Report:

Market Growth Drivers

- Rising Demand for Monoclonal Antibodies: The surge in monoclonal antibody production, driven by their efficacy in treating various diseases, has heightened the need for efficient purification methods, thereby boosting the demand for these resins.

- Expansion of the Biopharmaceutical Industry: The industry’s growth necessitates advanced purification techniques to meet stringent regulatory standards and ensure product quality, propelling the adoption of Protein A, G, and L resins.

- Advancements in Antibody Engineering: Innovations in developing diverse antibody formats have increased the requirement for versatile purification solutions, enhancing the market for these resins.

- Emphasis on Personalized Medicine: The shift towards tailored therapeutics has intensified research and development activities, leading to a greater need for high-performance purification resins.

- Technological Progress in Bioprocessing: Continuous improvements in bioprocessing technologies have optimized purification processes, making the use of these resins more efficient and cost-effective.

List of Key Companies in Protein A, G and L Resins Market

- Thermo Fisher Scientific

- GE Healthcare

- MilliporeSigma (Merck KGaA)

- Bio-Rad Laboratories

- Fujifilm Irvine Scientific

- Sartorius AG

- Agilent Technologies

- Abcam

Key Trends

- Dominance of Protein A Resins: Protein A resins hold a significant market share due to their pivotal role in purifying monoclonal antibodies and other high-value biopharmaceuticals.

- Emergence of Protein L Resins: Protein L resins are gaining attention for their unique ability to bind a variety of antibody isotypes, making them valuable in specific applications and representing a rapidly growing market segment.

- Regional Market Leadership: North America leads the market, attributed to its robust biopharmaceutical industry and substantial investments in healthcare and biotechnology.

- Focus on High-Capacity Resins: The increasing demand for biopharmaceuticals has spurred the development of high-capacity resins, enhancing purification efficiency and reducing processing time.

- Cost-Effectiveness Strategies: Manufacturers are exploring ways to optimize resin usage, enhance durability, and improve overall cost-efficiency to remain competitive in the market.

Market Segmentation

The research report categorizes the market into various segments and sub-segments. The primary segments covered in the study include type and application. The splitting of the market into various groups enables businesses to understand market preferences and trends better.

Protein A, G and L Resins Market, Type Outlook (Revenue – USD Million, 2019-2032)

- Protein G Resin

- Protein L Resin

- Protein A Resin

Protein A, G and L Resins Market, Application Outlook (Revenue – USD Million, 2019-2032)

- Pharmaceutical Industry

- Research Labs

- Others

Protein A, G and L Resins Industry Developments

- June 2024: GE Healthcare announced the opening of a new resin manufacturing facility in Singapore. This expansion is set to increase production capacity and cater to the growing demand for Protein A, G, and L resins in the Asia-Pacific region.

- April 2024: Thermo Fisher introduced a new Protein A resin designed to enhance productivity and lower costs in monoclonal antibody production, addressing the industry’s demand for efficient and cost-effective solutions.