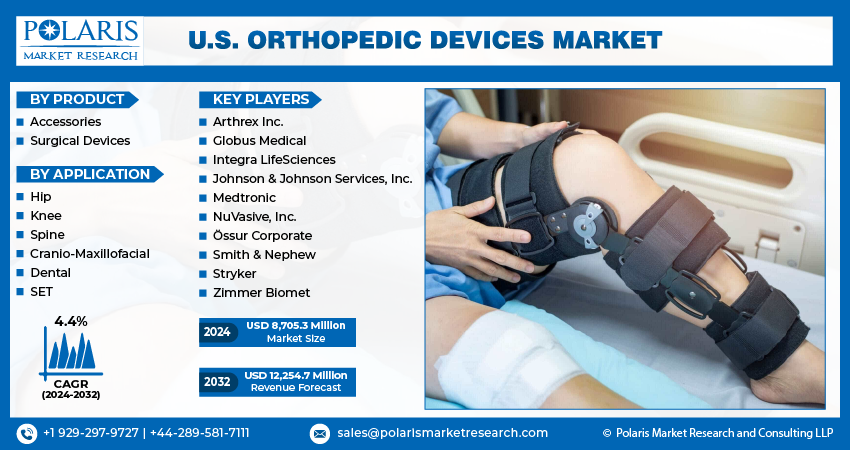

The U.S. orthopedic devices market size is expected to reach USD 12,254.7 Million by 2032, exhibiting a CAGR of 4.4% during the forecast period.

The U.S. orthopedic devices market is a critical segment of the healthcare industry, encompassing a wide range of products designed to diagnose, prevent, and treat musculoskeletal disorders. From joint reconstruction to trauma fixation devices, the market serves a growing need for advanced orthopedic solutions.

Importance of Orthopedic Devices in Healthcare

Orthopedic devices play a vital role in improving patients’ mobility and quality of life. They address conditions ranging from arthritis to fractures, making them indispensable in both emergency and planned medical interventions.

Download Free Sample PDF Copy of the Report:

Market’s Growth Drivers

Aging Population and Rising Prevalence of Bone Disorders

With an aging population in the U.S., the prevalence of conditions like osteoporosis and arthritis is on the rise. This demographic shift is a significant driver of demand for orthopedic devices, particularly joint replacement implants.

Technological Advancements in Orthopedic Devices

Cutting-edge technologies, such as robotic-assisted surgeries and artificial intelligence, are revolutionizing orthopedic care. These advancements enhance precision, reduce recovery times, and improve patient outcomes.

Increasing Sports-Related Injuries

The growing popularity of sports and outdoor activities has led to an uptick in sports-related injuries. This trend boosts the demand for devices like braces, support systems, and surgical implants.

Some of the major players operating in the global market include:

- Arthrex Inc.

- Globus Medical

- Integra LifeSciences

- Johnson & Johnson Services, Inc.

- Medtronic

- NuVasive, Inc.

- Össur Corporate

- Smith & Nephew

- Stryker

- Zimmer Biomet

Key Trends Shaping the Market

Emergence of Minimally Invasive Surgical Techniques

Minimally invasive surgeries are gaining traction due to their benefits, including smaller incisions, quicker recovery, and reduced risk of complications. Orthopedic devices tailored for such procedures are increasingly in demand.

Growing Adoption of Biodegradable Implants

Biodegradable implants, which dissolve naturally over time, are becoming popular. They eliminate the need for additional surgeries and are aligned with patient-centric healthcare trends.

Advancements in 3D Printing and Customization

3D printing is enabling the production of customized orthopedic implants and prosthetics. This innovation ensures a better fit and functionality, improving patient satisfaction.

Segmentation Overview:

The research report categorizes the market into various segments and sub-segments. The primary segments covered in the study include product and appliction. The splitting of the market into various groups enables businesses to understand market preferences and trends better.

U.S. Orthopedic Devices Market, Product Outlook (Revenue – USD Million, 2019-2032)

- Accessories

- Surgical Devices

U.S. Orthopedic Devices Market, Application Outlook (Revenue – USD Million, 2019-2032)

- Hip

- Knee

- Spine

- Cranio-Maxillofacial

- Dental

- SET

Research Scope in Orthopedic Devices

Ongoing R&D for Innovative Products

Research and development in orthopedic devices focus on creating smarter, lighter, and more durable solutions. Emerging technologies like nanotechnology and AI hold immense promise.

Focus on Biocompatible Materials

Biocompatible materials, such as titanium alloys and polymers, are being developed to minimize immune responses and improve the longevity of implants.

Collaboration Between Academia and Industry

Collaborative efforts between academic institutions and industry players are fostering innovation, leading to breakthroughs in product design and application.

Future Outlook

Market Projections and Growth Potential

The U.S. orthopedic devices market is expected to grow steadily, driven by technological advancements and an increasing patient base. Estimates suggest a compound annual growth rate (CAGR) exceeding 5% over the next decade.

Challenges and Opportunities Ahead

Despite growth prospects, the market faces challenges like high device costs and stringent regulatory approvals. However, opportunities in untapped rural markets and telehealth integration can offset these barriers.

Evolving Patient-Centric Healthcare Trends

The shift towards value-based care is pushing manufacturers to develop devices that prioritize patient satisfaction, cost-efficiency, and long-term outcomes.

Recent Developments in the Orthopedic Reconstruction Market

January 2024:

Enovis Corporation completed the acquisition of LimaCorporate S.p.A., strengthening its position in the global orthopedic reconstruction market. This acquisition expands Enovis’ portfolio with a range of proven surgical solutions and technologies, ensuring its leadership in innovative orthopedic care.

July 2023:

Stryker launched the Ortho Q Guidance System, a state-of-the-art solution for advanced surgery planning and recommendations in knee and hip procedures. This system offers surgeons streamlined control directly from the sterile field, improving procedural efficiency and outcomes.

April 2023:

Enovis Corporation acquired Novastep, a subsidiary of Amplitude Surgical SA. Novastep specializes in foot and ankle solutions, including CE-marked forefoot and midfoot implants. This acquisition bolsters Enovis’ global market presence by enhancing its product offerings and leveraging Novastep’s strong international distribution network.

Orthopedic devices serve as vital tools in the management and prevention of various musculoskeletal conditions. As the prevalence of orthopedic disorders continues to rise, particularly with conditions like rheumatoid arthritis (RA), osteoarthritis, fibromyalgia, and juvenile arthritis becoming more prevalent, the demand for U.S. orthopedic devices market sees a notable surge. These devices offer innovative solutions and treatments that alleviate pain, enhance mobility, and improve overall quality of life for individuals affected by musculoskeletal issues.