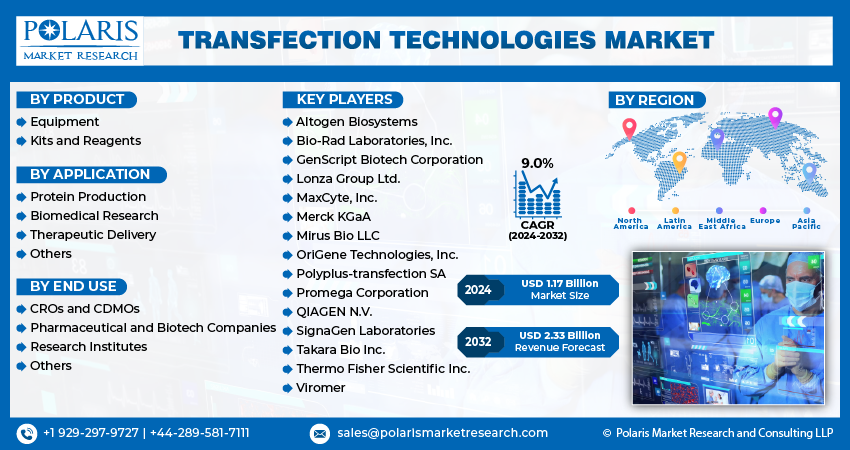

The global Transfection Technologies market size is expected to reach USD 2.33 billion by 2032, exhibiting the CAGR of 9.0% during the forecast period.

Transfection technologies have gained significant prominence in modern molecular biology, drug development, and genetic engineering. These technologies enable the delivery of nucleic acids, proteins, and other bioactive molecules into cells, making them pivotal in therapeutic and research applications. This article delves into the market overview, growth drivers, key trends, research scope, and future outlook of the transfection technologies market.

𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭:

Market Overview

Transfection technologies encompass a range of methods, including chemical, physical, and viral techniques, for introducing foreign materials into cells. The market is growing rapidly, driven by advancements in genomics, proteomics, and cellular therapy. Major applications include gene expression studies, CRISPR-mediated gene editing, vaccine development, and cancer research.

The global transfection technologies market is valued at several billion USD, with steady growth projected over the next decade. Major players include Thermo Fisher Scientific, Lonza Group, and Bio-Rad Laboratories, alongside emerging startups focusing on novel techniques.

Some of the major players operating in the global transfection technologies market include:

- Altogen Biosystems

- Bio-Rad Laboratories, Inc.

- GenScript Biotech Corporation

- Lonza Group Ltd.

- MaxCyte, Inc.

- Merck KGaA

- Mirus Bio LLC

- OriGene Technologies, Inc.

- Polyplus-transfection SA

- Promega Corporation

- QIAGEN N.V.

- SignaGen Laboratories

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

- Viromer

Market Growth Drivers

The transfection technologies market is fueled by a confluence of factors:

2.1. Increasing Prevalence of Chronic Diseases

- Rising cases of cancer, cardiovascular diseases, and genetic disorders have amplified the demand for gene therapy, wherein transfection plays a critical role.

2.2. Advancements in Genomic Research

- The rapid development of technologies like CRISPR-Cas9 and next-generation sequencing has bolstered the demand for efficient transfection methods.

2.3. Growing Biotechnology Investments

- Increased funding for biotechnology startups and research institutions globally is creating opportunities for innovation in transfection technologies.

2.4. Expansion of Cell-Based Therapeutics

- The rise in demand for CAR-T cell therapy and stem cell research necessitates reliable transfection systems for therapeutic development.

Report Segmentation

The research study includes segmental analysis that divides the market into distinct groups or segments based on common characteristics. With market segmentation, businesses can identify specific customer groups that are more likely to be interested in specific products or services. Also, it enables these businesses to focus their marketing efforts and resources more efficiently, leading to higher conversion rates and improved return on investment. Furthermore, segmentation analysis helps companies develop personalized products or services, which can result in increased customer loyalty and improved customer satisfaction.

Transfection Technologies Market, Product Outlook (Revenue – USD Billion, 2019-2032)

- Equipment

- Kits and Reagents

Transfection Technologies Market, Application Outlook (Revenue – USD Billion, 2019-2032)

- Protein Production

- Biomedical Research

- Therapeutic Delivery

- Others

Transfection Technologies Market, End Use Outlook (Revenue – USD Billion, 2019-2032)

- CROs and CDMOs

- Pharmaceutical and Biotech Companies

- Research Institutes

- Others

Key Market Trends

3.1. Adoption of Non-Viral Transfection Methods

- Non-viral methods, such as electroporation and lipid-based transfection, are gaining popularity due to their lower toxicity and reduced immunogenicity.

3.2. Emergence of Automation in Transfection

- Automation in transfection processes ensures higher reproducibility and throughput, addressing the needs of high-volume research facilities.

3.3. Integration of AI and Machine Learning

- Predictive algorithms are being utilized to optimize transfection protocols, increasing efficiency and reducing the trial-and-error approach.

3.4. Focus on Sustainable Practices

- Eco-friendly reagents and reduced energy consumption techniques are being developed to align with sustainability goals.

Research Scope

The scope of research in transfection technologies spans across multiple dimensions:

- Development of Novel Reagents: Designing reagents for enhanced transfection efficiency with minimal cytotoxicity.

- Single-Cell Transfection: Tailoring transfection methods for individual cells to enable precision in gene editing.

- Applications in Regenerative Medicine: Exploring transfection for tissue engineering and organ regeneration.

- Scalability for Industrial Use: Adapting transfection methods for large-scale biopharmaceutical manufacturing.

Future Outlook

The future of the transfection technologies market is promising, with substantial opportunities for innovation and growth:

- Personalized Medicine: As personalized treatments gain traction, transfection technologies will be central to tailoring therapies at a genetic level.

- Collaborative Efforts: Partnerships between academia, industry, and government bodies are expected to accelerate advancements in transfection.

- Emerging Markets: The expansion of biotechnology in developing regions presents untapped opportunities for market players.

- Regulatory Developments: Streamlining regulatory pathways for transfection-based products will encourage wider adoption in clinical applications.

Recent Developments:

March 2023:

Sartorius, through its French subsidiary Sartorius Stedim Biotech, signed a contract to acquire Polyplus, a company specializing in transfection agents and advanced DNA/RNA delivery reagents. The acquisition also includes Polyplus’ portfolio of GMP-grade plasmid DNA, further enhancing Sartorius’ capabilities in cell and gene therapy production.

May 2021:

Gamma Biosciences announced its plan to acquire a controlling stake in Mirus Bio, a Wisconsin-based company renowned for its innovative biomimetic lipid-polymer nanocomplexes (LPNCs). These nanocomplexes are specifically designed for nucleic acid delivery and adapt to cellular environments, supporting advancements in gene therapy and biotechnology applications.