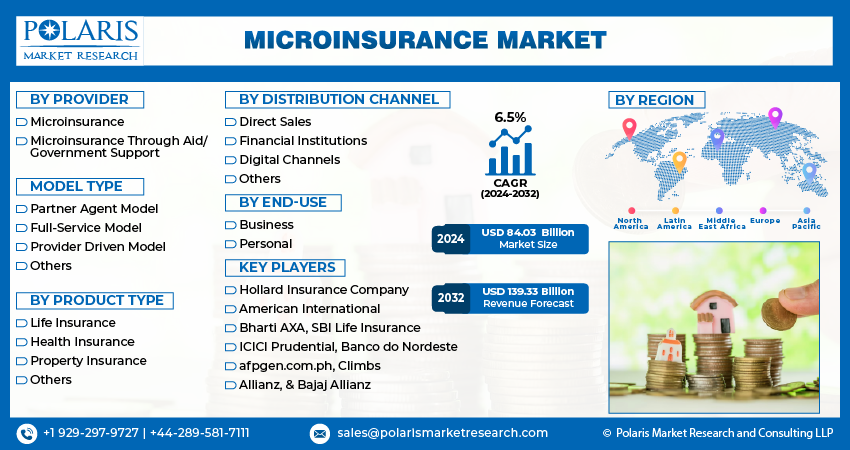

The global microinsurance market size is expected to reach USD 139.33 billion by 2032, is expected to grow at a CAGR of 6.5% during the forecast period.

Microinsurance, a subset of the broader insurance industry, focuses on providing affordable and accessible insurance products to low-income individuals and communities. These products are designed to address specific risks such as health issues, natural disasters, crop failure, and other unforeseen events. The microinsurance market bridges the gap between conventional insurance providers and underserved populations by tailoring products that align with their financial capabilities and needs.

Globally, the microinsurance market has witnessed significant growth, particularly in emerging economies across Asia, Africa, and Latin America. These regions account for a substantial portion of the market due to their high population density and vulnerability to economic shocks. Financial inclusion initiatives and the proliferation of mobile technology have further fueled the expansion of microinsurance solutions, making them more accessible and user-friendly.

𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭:

https://www.polarismarketresearch.com/industry-analysis/microinsurance-market/request-for-sample

Competitive Insight

The global players include

- Hollard Insurance Company,

- American International,

- Bharti AXA,

- SBI Life Insurance,

- ICICI Prudential,

- Banco do Nordeste,

- com.ph,

- Climbs, Allianz, &

- Bajaj Allianz.

- Market’s Growth Drivers

Several factors contribute to the robust growth of the microinsurance market:

1 Increased Financial Inclusion

Governments and non-governmental organizations (NGOs) across the globe are promoting financial inclusion, making basic financial services available to marginalized communities. Microinsurance forms a vital component of this initiative by providing financial security to underserved populations.

2 Advancements in Technology

The rise of digital platforms and mobile technology has significantly lowered operational costs and enhanced the reach of microinsurance products. Mobile-based insurance services allow users to enroll, pay premiums, and file claims conveniently, thereby increasing adoption rates.

3 Growing Awareness

Public awareness campaigns and partnerships between insurers and community organizations have educated potential beneficiaries about the importance of risk mitigation and the benefits of microinsurance. This growing awareness has been a key catalyst for market growth.

4 Supportive Regulatory Frameworks

Regulatory bodies in developing countries have introduced policies and incentives to encourage the growth of the microinsurance sector. These frameworks often include subsidies, tax benefits, and streamlined licensing processes for insurers.

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐥 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬:

The research study includes segmental analysis that divides the market into distinct groups or segments based on common characteristics. With market segmentation, businesses can identify specific customer groups that are more likely to be interested in specific products or services. Also, it enables these businesses to focus their marketing efforts and resources more efficiently, leading to higher conversion rates and improved return on investment. Furthermore, segmentation analysis helps companies develop personalized products or services, which can result in increased customer loyalty and improved customer satisfaction.

Microinsurance Market, Product Type Outlook (Revenue, USD Billion, 2019-2032)

- Life Insurance

- Health Insurance

- Property Insurance

- Others

Microinsurance Market, Provider Outlook (Revenue, USD Billion, 2019-2032)

- Microinsurance (Commercially Viable)

- Microinsurance Through Aid/Government Support

Microinsurance Market, Model Type Outlook (Revenue, USD Billion, 2019-2032)

- Partner Agent Model

- Full-Service Model

- Provider Driven Model

- Others

Microinsurance Market, End-Use Outlook (Revenue, USD Billion, 2019-2032)

- Business

- Personal

Microinsurance Market, Distribution Channel Outlook (Revenue, USD Billion, 2019-2032)

- Direct Sales

- Financial Institutions

- Digital Channels

- Others

- Key Trends

The microinsurance market is evolving rapidly, driven by several key trends:

1 Bundled Insurance Products

Insurers are increasingly offering bundled microinsurance products that combine coverage for health, agriculture, and life. These comprehensive solutions provide better value to customers and address multiple risks simultaneously.

2 Parametric Insurance

Parametric insurance products, which trigger payouts based on predefined parameters (e.g., rainfall levels or temperature thresholds), are gaining popularity. These solutions offer faster claims processing and reduced administrative costs.

3 Public-Private Partnerships (PPPs)

Collaborations between governments, private insurers, and NGOs are emerging as a prominent trend. PPPs help pool resources and expertise to deliver scalable and sustainable microinsurance solutions.

4 Customized Insurance Plans

Insurers are leveraging data analytics to design personalized microinsurance plans that cater to the unique needs of different demographic groups, such as farmers, small business owners, and women.

- Research Scope

Research into the microinsurance market encompasses several dimensions:

1 Market Segmentation

The market is segmented based on product type (health, life, agriculture, property), delivery channels (agents, brokers, mobile platforms), and geographic regions. Understanding these segments helps identify growth opportunities and tailor strategies accordingly.

2 Consumer Behavior Analysis

Studying the preferences, challenges, and expectations of microinsurance customers provides valuable insights for product development and marketing strategies.

3 Impact Assessment

Research focuses on evaluating the socio-economic impact of microinsurance programs, particularly in terms of poverty alleviation and improved resilience against economic shocks.

4 Technological Innovations

Exploring the role of technology, such as blockchain, artificial intelligence, and IoT, in enhancing microinsurance offerings and operational efficiency is a key area of study.

Recent Developments

In October 2021, MicroEnsure entered into a strategic partnership with Chamasure, a Kenyan insurance platform. This collaboration aims to deliver micro-insurance services to underserved communities.

More Trending Latest Reports By Polaris Market Research:

Enterprise Content Management Market