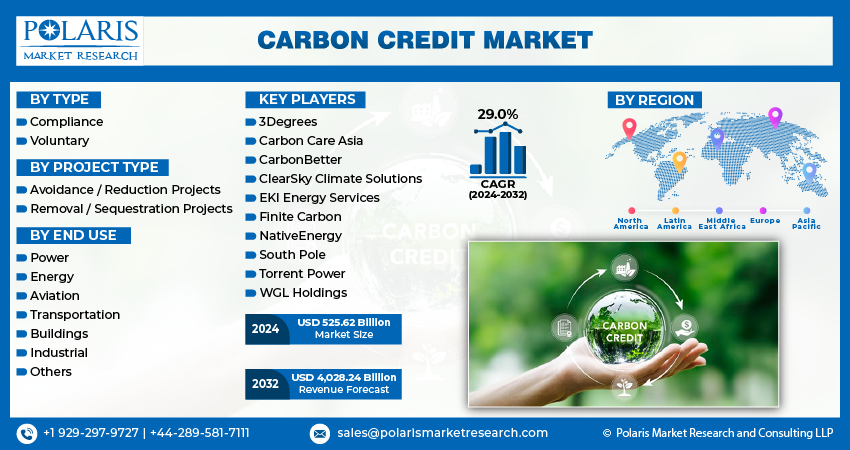

According to the research report, the global Carbon Credit Market was valued at USD 408.05 billion in 2023 and is expected to reach USD 4,028.24 billion by 2032, to grow at a CAGR of 29.00% during the forecast period.

Market Overview:

The carbon credit market has emerged as a pivotal tool in global efforts to mitigate climate change by reducing greenhouse gas (GHG) emissions. A carbon credit represents a tradable certificate or permit granting the holder the right to emit one metric ton of carbon dioxide or its equivalent (CO₂e). These credits are part of cap-and-trade programs or voluntary markets, enabling organizations to offset their emissions by investing in renewable energy, reforestation, or other environmentally sustainable projects. As governments, corporations, and individuals strive to achieve net-zero emissions, the carbon credit market plays an essential role in supporting climate action and promoting sustainable development.

Key Trends in the Carbon Credit Market:

- Integration of Blockchain Technology:

Blockchain is being utilized to enhance transparency, traceability, and efficiency in carbon credit transactions, addressing issues like double counting and fraud. - Expansion of Nature-Based Solutions:

Projects focused on reforestation, afforestation, and soil carbon sequestration are gaining prominence, offering high-quality carbon credits while providing co-benefits such as biodiversity conservation and community development. - Corporate Participation in Voluntary Markets:

Increasing participation of corporations in voluntary carbon credit markets demonstrates their commitment to sustainability, with many investing in credits to enhance their environmental credentials. - Development of High-Integrity Carbon Credits:

Efforts are underway to standardize and ensure the integrity of carbon credits, including certification schemes that verify the quality and impact of offset projects.

𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭:

https://www.polarismarketresearch.com/industry-analysis/carbon-credit-market/request-for-sample

Major Key Players:

- Natural Fibre Company

- Alpaca Direct

- Plymouth Yarn Company

- Mary Maxim

- Alpaca Owners Association

- Lion Brand Yarn

- Berroco

- Cascade Yarns

- Malabrigo Yarn

- and Fil Katia

Recent Developments:

- Integrity Council for Voluntary Carbon Establishes Core Carbon Principles (March 2023)

In March 2023, the Integrity Council for Voluntary Carbon unveiled the “Core Carbon Principles and Program-level Assessment Framework” for carbon credits. This framework is designed to create a standardized threshold for carbon emissions, ensuring that carbon credits align with sustainable development goals. By providing clear guidelines, the initiative aims to enhance transparency, credibility, and the overall impact of carbon credit programs in combating climate change.

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐥 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

The Carbon Credit Market segmentation divides the market into several segments. The industry segmentation is primarily based on product type, application, end-use, and geographic factors. Besides, the research study covers several sub-segments of the market. An in-depth examination of each market segment and sub-segment has been provided, covering the industry size, growth prospects, industry drivers, and challenges. The detailed market segmentation helps stakeholders identify the diverse needs of different consumer groups in the market. Also, it pinpoints opportunities for targeted marketing and product development strategies.

Carbon Credit Market, Project Type Outlook (Revenue – USD Billion, 2019-2032)

- Avoidance / Reduction Projects

- Removal / Sequestration Projects

- Nature-based

- Technology-based

Carbon Credit Market, Type Outlook (Revenue – USD Billion, 2019-2032)

- Compliance

- Voluntary

Carbon Credit Market, End Use Outlook (Revenue – USD Billion, 2019-2032)

- Power

- Energy

- Aviation

- Transportation

- Buildings

- Industrial

- Others

The carbon credit market is playing an increasingly important role in global efforts to combat climate change and transition to a low-carbon economy. Key drivers such as stringent regulations, corporate net-zero commitments, and the growth of renewable energy projects are propelling the market forward. Emerging trends like blockchain integration, nature-based solutions, and corporate participation highlight the innovation and collaboration shaping the market’s evolution. As the urgency to address climate change intensifies, the carbon credit market will remain a vital mechanism for promoting sustainability and reducing global emissions.

Related Report:

U.S. Postal Automation Systems Market Share

North America MRO Distribution Market Growth