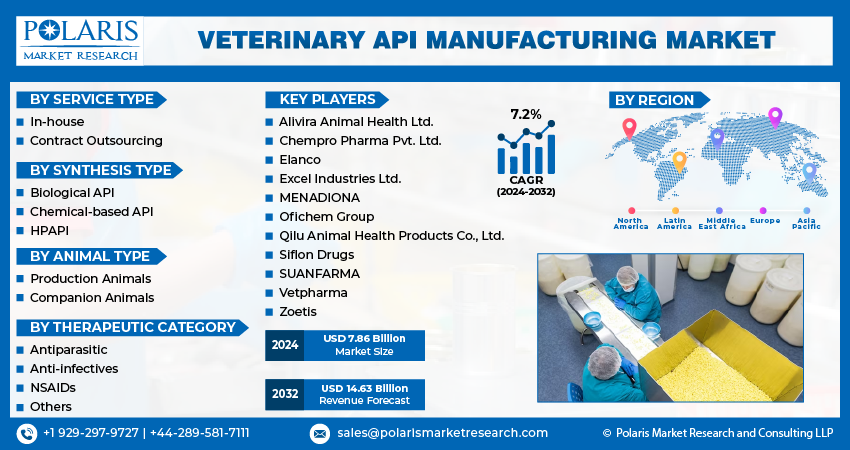

The global veterinary active pharmaceutical ingredients (API) manufacturing market is poised for significant growth in the coming years. According to recent reports, this market is expected to reach a size of USD 14.63 billion by 2032, growing at a robust compound annual growth rate (CAGR) of 7.2%. This growth reflects the increasing demand for quality veterinary medicines across various regions, driven by factors such as a rising global pet population, the need for more effective animal health treatments, and advancements in the field of veterinary pharmaceuticals. This article explores the various drivers, growth trends, challenges, and opportunities in the veterinary API manufacturing market.

Download Free Sample PDF Copy of the Report:

Understanding Veterinary Active Pharmaceutical Ingredients (APIs)

Veterinary APIs are crucial compounds used in the production of pharmaceutical products designed for animal health. These APIs are used to treat, prevent, or manage diseases and conditions in various animals, including livestock, pets, and wildlife. From antibiotics and vaccines to antiparasitics and anti-inflammatory drugs, veterinary APIs play an essential role in the health and productivity of animals. The increasing demand for high-quality animal health products is driving the growth of the veterinary API manufacturing market.

Market Drivers

- Growing Animal Health Awareness

The increasing awareness of animal health and the importance of veterinary care is one of the key drivers of the veterinary API manufacturing market. Pet ownership is on the rise worldwide, particularly in emerging markets. With a larger number of pet owners becoming more conscientious about the well-being of their pets, there is a heightened demand for veterinary pharmaceuticals to treat illnesses and improve the overall health of animals. - Increasing Incidence of Animal Diseases

The rise in animal diseases, both infectious and chronic, is significantly contributing to the growth of the veterinary API manufacturing market. With the global rise of zoonotic diseases and new viral strains, veterinarians require more effective APIs to treat and prevent these diseases. Moreover, with industrial-scale farming operations and concentrated animal feeding operations (CAFOs) becoming more common, there is an increased need for antibiotics, vaccines, and other therapeutic drugs. - Expanding Livestock Industry

The expanding livestock industry is a significant driver of the veterinary API market. As global demand for meat and dairy products increases, the need for animal husbandry practices that support animal health is growing. This drives the demand for veterinary drugs to maintain the health and productivity of livestock, including cattle, poultry, and swine. Furthermore, the growth of aquaculture and the increasing number of animals being raised for consumption add to the demand for veterinary APIs. - Technological Advancements in Animal Pharmaceuticals

Technological innovation in the veterinary pharmaceutical industry is another key driver. The development of more targeted and effective treatments for animals is leading to the creation of novel APIs. Biotechnology, genomics, and bioinformatics have paved the way for the development of new API formulations, which can address a wider range of diseases and conditions in animals. This technological evolution ensures that veterinary pharmaceutical manufacturers continue to meet the rising demands of the market.

Market Growth Trends

- Focus on Sustainable and Eco-Friendly Practices

As environmental awareness grows, there is an increasing focus on sustainable and eco-friendly practices in veterinary API manufacturing. Consumers and regulators are demanding more environmentally responsible production methods. This has prompted manufacturers to adopt greener technologies, such as biodegradable formulations, reduced use of hazardous chemicals, and energy-efficient production processes. - Shift Toward Generic Drugs

With the expiration of patents for many veterinary pharmaceuticals, the market is witnessing a shift toward generic veterinary APIs. Generic drugs are often more affordable than their branded counterparts, which makes them increasingly popular in cost-sensitive markets, particularly in developing countries. This trend is expected to continue as more veterinary products lose patent protection. - Growing Preference for Preventive Care

Another notable trend in the veterinary API market is the growing preference for preventive care rather than treatment-focused approaches. Vaccines, parasiticides, and other preventative treatments are becoming increasingly popular as pet owners and farmers focus on proactive measures to ensure the health of their animals. This trend is driving the demand for APIs that are used in vaccines and other preventive health products. - Advancements in Personalized Veterinary Medicine

Personalized medicine, which tailors treatments to individual animals based on their genetic makeup and health history, is also gaining traction in the veterinary space. This has led to increased demand for APIs that are specific to the needs of individual animals. Veterinarians are increasingly using genetic information to select the most effective treatments for their patients, leading to greater precision in drug formulation.

Challenges in Veterinary API Manufacturing

- Regulatory Challenges

The veterinary API manufacturing industry faces stringent regulatory requirements, particularly when it comes to ensuring the safety and efficacy of veterinary drugs. Different regions have varying standards and regulations, which can complicate the approval process for new veterinary APIs. Manufacturers must invest considerable resources to ensure compliance with local and international regulations, which can be a barrier to market entry, particularly for smaller companies. - Supply Chain Disruptions

The global supply chain has been severely disrupted in recent years due to factors such as the COVID-19 pandemic and geopolitical tensions. This has impacted the availability of raw materials used in veterinary API manufacturing. Any disruptions in the supply of critical ingredients can delay production timelines and lead to shortages of essential veterinary medicines. As a result, manufacturers must explore strategies to diversify their supply chains and reduce the risk of disruptions. - Intense Competition and Pricing Pressure

The veterinary API manufacturing market is highly competitive, with numerous players competing for market share. As the market continues to grow, manufacturers are under pressure to reduce costs while maintaining high-quality standards. Price competition, particularly in the generic drug segment, can negatively impact profit margins, forcing companies to innovate in order to remain competitive. - Limited R&D Investment for Non-Livestock Animals

While much of the focus in veterinary API research and development has been on livestock animals, there is a notable lack of investment in products designed for non-livestock animals, particularly exotic pets. This creates a gap in the market, as pet owners of non-traditional pets (e.g., reptiles, birds) often struggle to find appropriate veterinary medicines.

Opportunities in the Veterinary API Market

- Emerging Markets

Emerging markets, particularly in Asia-Pacific, Latin America, and Africa, represent a significant growth opportunity for veterinary API manufacturers. The rising disposable income in these regions, coupled with an increase in pet ownership and improved agricultural practices, is driving the demand for veterinary drugs. Manufacturers who can penetrate these markets early can capitalize on the growing demand for animal health products. - Increase in Pet Insurance

The rise in pet ownership, combined with the growing trend of pet insurance, creates a new market for veterinary drugs. Pet owners who have insurance coverage are more likely to seek out treatments for their animals, which will drive the demand for high-quality veterinary APIs. The growth of the pet insurance market will contribute to the overall growth of the veterinary pharmaceutical market. - Partnerships and Collaborations

Veterinary API manufacturers can benefit from strategic partnerships and collaborations with research institutions, veterinary clinics, and pharmaceutical companies. These partnerships can help foster innovation, provide access to new technologies, and expand market reach. Collaborations with regulatory bodies can also help streamline the approval process for new veterinary drugs. - Biologics and Immunotherapies

The development of biologics and immunotherapies represents an exciting opportunity in the veterinary API market. As the field of veterinary medicine evolves, biologics—such as monoclonal antibodies, gene therapies, and cell-based treatments—are gaining traction as alternative solutions to traditional pharmaceutical approaches. These novel treatments are expected to drive the demand for specialized veterinary APIs in the coming years.

Top Companies:

Understanding key players and their initiatives provides valuable insights into the competitive landscape and emerging opportunities in the market. Here are the top companies in the market:

- Alivira Animal Health Ltd.

- Chempro Pharma Pvt. Ltd.

- Elanco

- Excel Industries Ltd.

- MENADIONA

- Ofichem Group

- Qilu Animal Health Products Co., Ltd.

- Siflon Drugs

- SUANFARMA

- Vetpharma

- Zoetis

Country-Wise Insights:

- North America

- S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Australia

- Rest of APAC

- Latin America

- Argentina

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- Israel

- South Africa

- Rest of MEA

The veterinary active pharmaceutical ingredients manufacturing market is set to experience strong growth in the coming decade. Driven by increasing awareness of animal health, a rising incidence of animal diseases, and advancements in veterinary medicines, the market is poised to reach USD 14.63 billion by 2032. However, manufacturers must navigate challenges such as regulatory hurdles, supply chain disruptions, and intense competition. By capitalizing on emerging markets, investing in R&D, and exploring new treatment modalities, companies can position themselves to succeed in this dynamic and expanding market.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐌𝐨𝐫𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Tumor-induced Osteomalacia Market:

https://www.polarismarketresearch.com/industry-analysis/tumor-induced-osteomalacia-market

Contrast Media Injectors Market:

https://www.polarismarketresearch.com/industry-analysis/contrast-media-injectors-market

Viral Sensitizers Market:

https://www.polarismarketresearch.com/industry-analysis/viral-sensitizers-market

Blastic Plasmacytoid Dendritic Cell Neoplasm Market:

Artificial Tendons and Ligaments Market:

https://www.polarismarketresearch.com/industry-analysis/artificial-tendons-and-ligaments-market