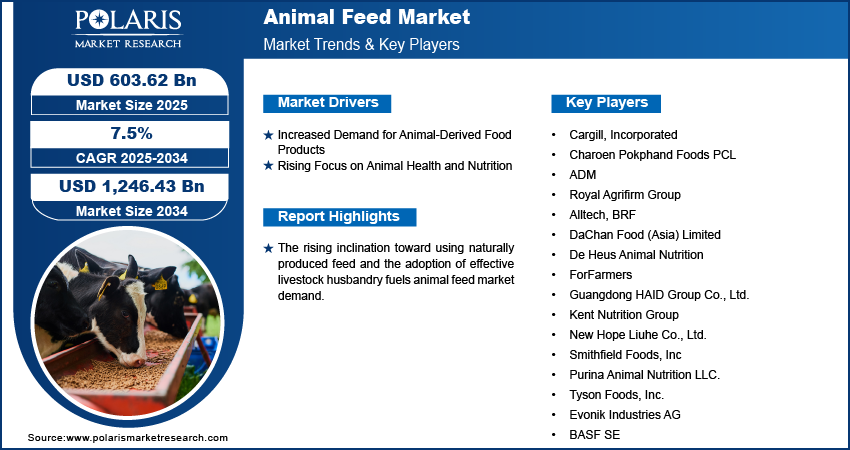

The global animal feed market is experiencing steady growth as demand for livestock products such as meat, dairy, and eggs continues to increase. Valued at USD 557.67 billion in 2024, the market is projected to grow significantly, reaching USD 1,246.43 billion by 2034. This growth reflects the rising need for animal nutrition driven by factors such as population growth, dietary shifts, and evolving consumer demands. Over the period from 2025 to 2034, the market is expected to exhibit a compound annual growth rate (CAGR) of 7.5%, underscoring the increasing importance of animal feed in global food production systems.

Animal feed plays a crucial role in the agricultural and livestock industries, as it directly impacts the health, productivity, and quality of farm animals. The global animal feed market includes a variety of products, such as cereals, grains, proteins, and specialty additives that promote growth, immunity, and overall health of animals. With the continued rise in global meat consumption, particularly in emerging economies, the demand for high-quality animal feed is expected to increase, providing substantial growth opportunities for feed manufacturers and suppliers.

The market encompasses multiple segments, including poultry feed, cattle feed, aquaculture feed, pet food, and other specialty feeds. Animal feed products are formulated to meet the specific nutritional requirements of each species, optimizing their growth and health while ensuring the efficient production of meat, eggs, milk, and other animal-based products.

Drivers of Market Growth

Several factors are driving the expansion of the animal feed market:

- Increasing Global Population and Urbanization: The global population is projected to reach nearly 9.7 billion by 2050, significantly increasing the demand for food, particularly protein-rich products such as meat, dairy, and eggs. With rising incomes in developing countries, urbanization is driving greater meat consumption, further boosting the need for animal feed. As urban areas expand and disposable incomes rise, more consumers are expected to include animal-based proteins in their diets, thus driving the demand for livestock and, consequently, animal feed.

- Growing Demand for Animal-Based Protein: With changing dietary patterns, particularly in emerging economies such as China, India, and Brazil, there has been a notable increase in the consumption of animal-based protein. Poultry, pork, and beef remain primary sources of protein for many populations. To meet the growing demand for animal products, farmers need to optimize the growth and health of their livestock, which leads to an increased requirement for nutritionally balanced animal feed.

- Advancements in Animal Feed Formulation and Nutrition: Innovations in feed formulation have made it possible to create more specialized, nutritionally optimized products for various types of livestock. These advancements not only ensure better health and productivity of animals but also contribute to the overall sustainability of the agricultural sector. Nutritional enhancements, such as additives that improve digestion, immune function, and growth rates, have become a significant driver of market growth. This innovation allows for more efficient production, reducing waste and improving feed conversion ratios.

- Rising Awareness of Animal Health and Welfare: There is increasing awareness around the health and welfare of farm animals, and this has led to more farmers and producers focusing on the quality of feed they provide. Quality nutrition is essential for disease prevention, overall health, and better productivity. Consequently, there is a rising demand for high-quality, nutrient-dense animal feed that promotes the well-being of livestock. As animal health becomes a priority, this trend is driving market growth.

- Government Support and Initiatives: Many governments around the world are implementing regulations and policies to support the growth of the animal feed industry. These include subsidies for feed production, safety standards for feed quality, and investment in agricultural infrastructure. Government policies promoting sustainable farming practices and food security are also contributing to the expansion of the market, particularly in emerging economies where agriculture plays a vital role in economic development.

Growth and Trends in the Animal Feed Market

- Shift Toward Sustainable Feed Ingredients: With the growing emphasis on sustainability, there is a noticeable shift toward the use of alternative, environmentally friendly feed ingredients. Traditional animal feed sources such as soy, corn, and wheat are resource-intensive to grow and have a significant environmental footprint. In response, there has been an increasing focus on the development of sustainable feed ingredients, including insect-based protein, algae, and plant-based protein alternatives. These ingredients are seen as more sustainable alternatives that require fewer resources to produce, helping to meet the growing demand for animal feed while reducing environmental impact.

- Integration of Technology and Automation in Feed Production: As the demand for animal feed grows, the need for more efficient and scalable production methods is also rising. Automation and advanced technologies, such as artificial intelligence (AI), machine learning, and IoT (Internet of Things), are increasingly being used in feed production and formulation. These technologies enable better control over the quality and consistency of feed products while optimizing the production process. Moreover, digitalization in the agriculture sector has led to the development of data-driven solutions for monitoring animal health and feed consumption, improving feed efficiency, and reducing waste.

- Pet Food Market Expansion: In addition to traditional animal feed for livestock, the global pet food market is also contributing to the growth of the animal feed sector. As pet ownership increases worldwide, particularly in urban areas, the demand for high-quality pet food has surged. Pet owners are seeking nutritious, specialized, and even organic food options for their pets, which is expanding the variety of products offered by the animal feed industry. This trend is likely to continue as pets are increasingly viewed as family members, and their nutritional needs are given more attention.

- Focus on Functional Feeds: Functional feeds are gaining popularity, particularly for livestock such as poultry, cattle, and aquaculture species. These are feeds that contain ingredients designed to offer additional health benefits, such as improved digestion, enhanced immune function, or disease prevention. The use of probiotics, prebiotics, enzymes, and other bioactive compounds in feed formulations is becoming more common, catering to the growing demand for holistic and preventive health measures in livestock management.

Challenges in the Animal Feed Market

- Volatility in Raw Material Prices: The prices of key ingredients used in animal feed, such as grains, soybean meal, and fishmeal, are subject to market fluctuations, which can impact the cost of feed production. Factors such as climate change, trade restrictions, and supply chain disruptions can lead to price volatility, creating uncertainty in the market. This is particularly challenging for feed manufacturers and farmers who rely on stable feed prices to maintain profitability. Rising feed costs can also negatively affect the price of meat and dairy products, influencing consumer prices.

- Regulatory and Safety Concerns: Animal feed production is subject to strict regulations and safety standards in many countries. Ensuring that animal feed is free from contaminants such as pathogens, heavy metals, and toxins is critical to protecting animal health and, ultimately, human health. Compliance with these regulations can be costly and challenging, particularly for smaller feed manufacturers. Furthermore, stricter regulations on antibiotic use in animal feed are pushing for the development of more natural, antibiotic-free alternatives, which requires additional investment in research and product development.

- Environmental Sustainability: While there is growing interest in sustainable feed ingredients, the animal feed industry still faces significant environmental challenges. The production of traditional feed ingredients such as soy and corn can lead to deforestation, habitat destruction, and water scarcity. Feed manufacturers are under increasing pressure to find sustainable and eco-friendly alternatives to reduce the environmental footprint of feed production. Balancing the need for high-quality feed with the imperative of sustainability remains a challenge for the industry.

- Animal Disease Outbreaks: The animal feed market is susceptible to disruptions caused by outbreaks of animal diseases such as avian influenza, foot-and-mouth disease, and African swine fever. These diseases can lead to mass culling of livestock, which impacts the demand for feed. Disease outbreaks also raise concerns about the safety of animal feed and the risk of disease transmission, prompting tighter regulations and increased scrutiny on feed ingredients and sourcing.

Opportunities in the Animal Feed Market

- Growing Demand in Emerging Markets: The animal feed market has significant growth potential in emerging economies, particularly in Asia-Pacific, Africa, and Latin America. As these regions experience urbanization, increased incomes, and dietary shifts toward more animal-based proteins, the demand for animal feed is set to rise. These markets represent substantial opportunities for feed manufacturers to expand their operations and reach new customers.

- Innovation in Feed Ingredients and Formulations: The development of new, innovative feed ingredients and formulations presents a major opportunity for the industry. Ingredients such as insect protein, algae, and alternative plant-based proteins can provide more sustainable, cost-effective, and nutritionally balanced feed solutions. Research into functional feed additives that enhance animal health, improve feed efficiency, and reduce environmental impact is also a key area of opportunity.

- Expansion of Value-Added Products: As consumer preferences shift toward higher-quality and more specialized animal products, there is a growing demand for value-added feed products that improve the productivity and health of livestock. This includes premium feed formulations designed for specific species or breeds, as well as functional ingredients that promote disease resistance, growth enhancement, and reproductive health.

- Strategic Partnerships and Acquisitions: In a rapidly growing market, there are ample opportunities for strategic partnerships, joint ventures, and acquisitions. Collaboration between feed manufacturers, agricultural technology companies, and research institutions can accelerate innovation in feed formulations and manufacturing processes. Partnerships can also help companies expand their product portfolios, enter new markets, and enhance supply chain efficiency.

Top Companies:

Understanding key players and their initiatives provides valuable insights into the competitive landscape and emerging opportunities in the market. Here are the top companies in the market:

- Cargill, Incorporated

- Charoen Pokphand Foods PCL

- ADM

- Royal Agrifirm Group

- Alltech

- BRF

- DaChan Food (Asia) Limited

- De Heus Animal Nutrition

- ForFarmers

- Guangdong HAID Group Co., Ltd.

- Kent Nutrition Group

- New Hope Liuhe Co., Ltd.

- Smithfield Foods, Inc

- Purina Animal Nutrition LLC.

- Tyson Foods, Inc.

- Evonik Industries AG

- BASF SE

Report Scope

Animal Feed Market, Livestock Outlook (Revenue – USD Billion, 2020-2034)

- Cattle

- Poultry

- Swine

- Aquaculture

- Others

Animal Feed Market, Form Outlook (Revenue – USD Billion, 2020-2034)

- Mash

- Pellets

- Crumbles

- Others

Animal Feed Market, Composition Outlook (Revenue – USD Billion, 2020-2034)

- Cereal-Based Feed

- Soy-Based Feed

- Fish-Based Feed

- Oilseed-Based Feed

- Other Animal-Based Feed

Animal Feed Market, Type Outlook (Revenue – USD Billion, 2020-2034)

- Antibiotic

- Antioxidants

- Amino acids

- Feed enzymes

- Feed Acidifiers

- Vitamin

- Others

Animal Feed Market, Regional Outlook (Revenue – USD Billion, 2020-2034)

- North America

- Livestock Outlook

- Cattle

- Poultry

- Swine

- Aquaculture

- Others

- Form Outlook

- Mash

- Pellets

- Crumbles

- Others

- Composition Outlook

- Cereal-Based Feed

- Soy-Based Feed

- Fish-Based Feed

- Oilseed-Based Feed

- Other Animal-Based Feed

- Type Outlook

- Antibiotic

- Antioxidants

- Amino acids

- Feed enzymes

- Feed Acidifiers

- Vitamin

- Others

- Livestock Outlook

- Europe

- Livestock Outlook

- Cattle

- Poultry

- Swine

- Aquaculture

- Others

- Form Outlook

- Mash

- Pellets

- Crumbles

- Others

- Composition Outlook

- Cereal-Based Feed

- Soy-Based Feed

- Fish-Based Feed

- Oilseed-Based Feed

- Other Animal-Based Feed

- Type Outlook

- Antibiotic

- Antioxidants

- Amino acids

- Feed enzymes

- Feed Acidifiers

- Vitamin

- Others

- Livestock Outlook

𝐂𝐥𝐢𝐜𝐤 𝐡𝐞𝐫𝐞 𝐭𝐨 𝐀𝐜𝐜𝐞𝐬𝐬 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭:

https://www.polarismarketresearch.com/industry-analysis/animal-feed-market

The global animal feed market, valued at USD 557.67 billion in 2024, is expected to experience steady growth. By 2025, the market is projected to reach USD 603.62 billion and further expand to USD 1,246.43 billion by 2034. This represents a compound annual growth rate (CAGR) of 7.5% from 2025 to 2034.

Animal feed is essential for providing the nutrients required by animals for their growth, health, and productivity. The feed is typically made from a variety of ingredients, such as grains, protein meals, fats, and minerals, and is tailored to the specific needs of different animals. Different types of feed are formulated for particular species and purposes: for example, poultry feed is designed to support egg production and growth in chickens and other poultry, while cattle feed is high in fiber to promote proper digestion in cows and other ruminants.