The pharmaceutical membrane filtration market involves the use of membrane filtration technologies to separate or filter pharmaceutical products, such as drugs, vaccines, and biologics, from unwanted particles, microorganisms, or impurities. This filtration process is crucial in ensuring the purity, safety, and quality of pharmaceutical products. Membrane filtration is a key component in various stages of pharmaceutical manufacturing, including raw material processing, product formulation, and final product purification.

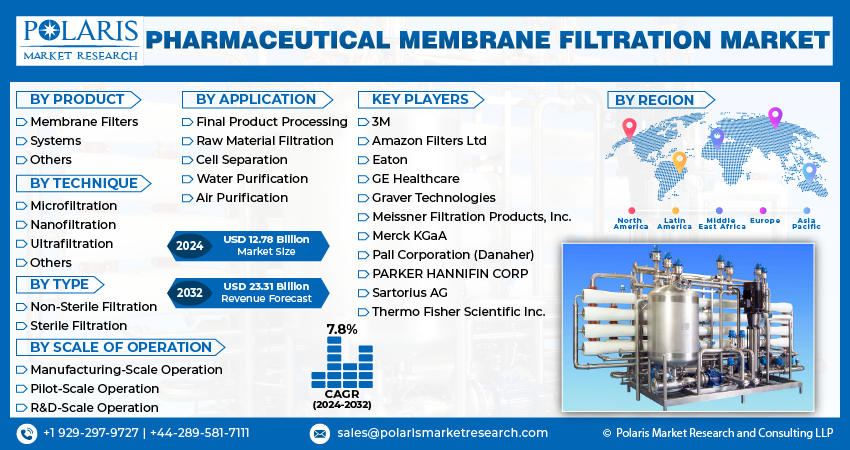

The global Pharmaceutical Membrane Filtration market size is expected to reach USD 23.31 Billion by 2032, exhibiting the CAGR of 7.8% during the forecast period.

Market Growth Drivers

- Rising Demand for Biologics and Biosimilars

The growing focus on biologics and biosimilars is one of the key drivers of the pharmaceutical membrane filtration market. Membrane filtration technologies are widely used in the production of biologics and biosimilars, particularly for protein separation, concentration, and purification. With the rise in the global demand for biologic therapies, the need for efficient and high-quality filtration technologies is expected to increase. - Increasing Adoption of Single-Use Technologies

The adoption of single-use technologies in pharmaceutical manufacturing is driving the demand for membrane filtration systems. Single-use systems offer several benefits, including cost-effectiveness, reduced risk of cross-contamination, and improved operational flexibility. These advantages make single-use filtration systems ideal for small-scale production and batch processing, particularly in the production of biologics. - Regulatory Pressure for High-Quality Standards

Regulatory agencies, such as the U.S. FDA and the European Medicines Agency (EMA), have stringent requirements regarding the purity and safety of pharmaceutical products. Membrane filtration plays a critical role in ensuring that pharmaceutical products meet these high standards by removing contaminants, endotoxins, and particles. Regulatory pressure is thus a significant driver for the adoption of membrane filtration technologies in the pharmaceutical industry.

Some of the major players operating in the global market include:

- 3M

- Amazon Filters Ltd

- Eaton

- GE Healthcare

- Graver Technologies

- Meissner Filtration Products, Inc.

- Merck KGaA

- Pall Corporation (Danaher)

- PARKER HANNIFIN CORP

- Sartorius AG

Key Trends

- Miniaturization and Automation of Filtration Systems

The trend towards miniaturization and automation in pharmaceutical manufacturing is influencing the design of membrane filtration systems. Small-scale filtration systems that can be automated for precision and efficiency are becoming increasingly popular, especially in the production of smaller batches of high-value drugs. Automation helps reduce labor costs, increase throughput, and minimize human errors in the filtration process. - Shift Towards Sustainable Filtration Solutions

As environmental concerns continue to rise, there is a growing emphasis on sustainability within the pharmaceutical industry. Filtration companies are developing membranes that require less water, energy, and chemicals, reducing the overall environmental impact of the filtration process. Membranes with higher fouling resistance and longer lifespan also contribute to reducing waste and resource consumption. - Integration with Process Analytical Technologies (PAT)

The integration of membrane filtration systems with Process Analytical Technologies (PAT) allows for real-time monitoring of filtration processes. This trend is expected to gain momentum as pharmaceutical companies aim for higher process control, better consistency, and enhanced product quality. Real-time monitoring ensures that the filtration process is optimal and that product specifications are met consistently.

Recent Developments

- AFT, a well-known company in the dry filtration sector, was purchased by The Micronics Engineered Filtration Group, a collection of filtration firms providing complete filtration solutions globally, in July 2023. It is anticipated that this strategic acquisition will greatly improve Micronics’ product line and increase its market share in the filtering sector.

- The motion and control technology business Parker Hannifin opened a new Bioscience Filtration facility in Birtley, UK, in March 2023. The purpose of this location is to increase the company’s production capacity and meet the growing demands of the food and beverage, biopharmaceutical, and pharmaceutical sectors.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/pharmaceutical-membrane-filtration-market

Research Scope

The research scope for the pharmaceutical membrane filtration market includes the following areas:

- Technology Analysis

Understanding the different types of filtration technologies used in pharmaceutical manufacturing, including microfiltration, ultrafiltration, nanofiltration, and reverse osmosis. Research in this area focuses on the efficacy, efficiency, and applications of these technologies across different pharmaceutical segments. - Membrane Materials and Innovations

Investigation into the materials used in membrane filtration, such as polymeric and ceramic membranes, and advancements in membrane coatings and surface modifications. Research in this area explores how new materials and innovations can improve filtration performance and extend the lifespan of membranes. - Application Areas

Detailed study of the various applications of membrane filtration in pharmaceutical processes, including biologic drug production, vaccines, injectable drugs, and pharmaceutical water purification. Research examines how membrane filtration improves product quality, safety, and efficiency in each of these applications.

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐥 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

The research report categorizes the market into various segments and sub-segments. The primary segments covered in the study include type, application, end use and region. The splitting of the market into various groups enables businesses to understand market preferences and trends better. Also, stakeholders can develop products/services that align with the diverse needs of consumers in the industry. Besides, the research study includes a thorough examination of all the major sub-segments in the market.

Pharmaceutical Membrane Filtration, Product Outlook (Revenue – USD Billion, 2019 – 2032)

- Membrane Filters

- Mixed Cellulose Ester & Cellulose Acetate (MCE & CA) Membrane Filters

- Nylon Membrane Filters

- Polycarbonate Track-Etched (PCTE) Membrane Filters

- Others

- Systems

- Single-Use Systems

- Reusable Systems

- Others

Pharmaceutical Membrane Filtration, Technique Outlook (Revenue – USD Billion, 2019 – 2032)

- Microfiltration

- Nanofiltration

- Ultrafiltration

- Others

Pharmaceutical Membrane Filtration, Type Outlook (Revenue – USD Billion, 2019 – 2032)

- Non-Sterile Filtration

- Sterile Filtration

Pharmaceutical Membrane Filtration, Scale of Operation Outlook (Revenue – USD Billion, 2019 – 2032)

- Manufacturing-Scale Operation

- Pilot-Scale Operation

- R&D-Scale Operation

Pharmaceutical Membrane Filtration, Application Outlook (Revenue – USD Billion, 2019 – 2032)

- Final Product Processing

- Raw Material Filtration

- Cell Separation

- Water Purification

- Air Purification

The pharmaceutical membrane filtration market is poised for significant growth as the demand for high-quality pharmaceutical products, biologics, and vaccines continues to rise. Membrane filtration technologies play a critical role in ensuring the purity, safety, and effectiveness of these products by removing contaminants, microorganisms, and impurities during the manufacturing process.

More Trending Latest Reports by Polaris Market Research:

Commercial Aircraft Aftermarket

Distribution Transformer Market