The global oral solid dosage (OSD) contract manufacturing market is poised for continued growth, driven by several key factors.

Market Overview

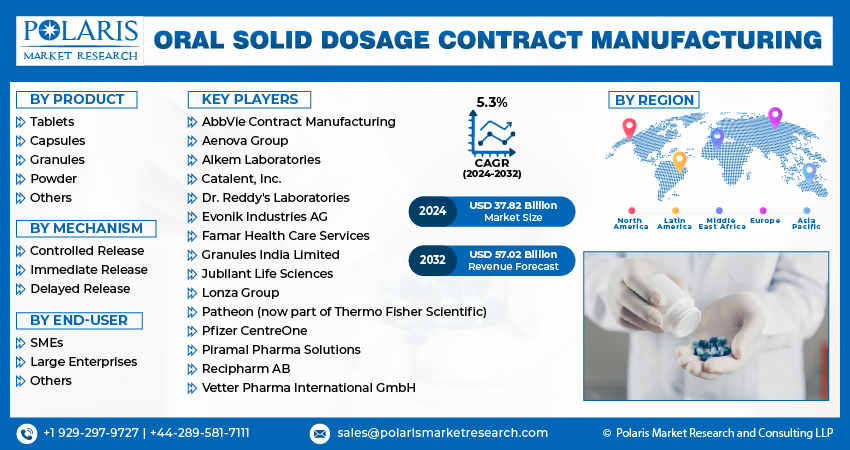

The global OSD contract manufacturing market size was valued at USD 35.98 billion in 2023 and is anticipated to grow from USD 37.82 billion in 2024 to USD 57.02 billion by 2032, exhibiting a CAGR of 5.3% during the forecast period. This growth reflects the increasing reliance of pharmaceutical companies on contract manufacturing organizations (CMOs) for the production of their oral solid dosage forms.

Some of the major players operating in the global market include:

- AbbVie Contract Manufacturing

- Aenova Group

- Alkem Laboratories

- Catalent, Inc.

- Dr. Reddy’s Laboratories

- Evonik Industries AG

- Famar Health Care Services

- Granules India Limited

- Jubilant Life Sciences

- Lonza Group

- Patheon (now part of Thermo Fisher Scientific)

- Pfizer CentreOne

- Piramal Pharma Solutions

- Recipharm AB

- Vetter Pharma International GmbH

Key Market Drivers:

- Focus on Core Competencies: Pharmaceutical companies are increasingly focusing on their core competencies, such as research and development, and outsourcing manufacturing activities to specialized CMOs.

- Cost-Effectiveness: Outsourcing manufacturing can significantly reduce costs for pharmaceutical companies, allowing them to allocate resources more effectively.

- Access to Expertise and Technology: CMOs possess specialized expertise and access to cutting-edge technologies, enabling them to produce high-quality oral solid dosage forms efficiently and cost-effectively.

- Regulatory Compliance: CMOs have in-depth knowledge of regulatory requirements and can ensure that manufacturing processes comply with stringent quality and safety standards.

𝐑𝐞𝐠𝐢𝐨𝐧𝐚𝐥 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬:

The regional analysis section sheds light on the industry trends and Oral Solid Dosage Contract Manufacturing Market dynamics across different geographic regions. It examines all the major factors shaping the market behavior globally. These include economic conditions, regulatory frameworks, and cultural influences. Besides, the impact of consumer preferences on market growth has been examined in the report. Regional analysis helps stakeholders identify market opportunities and challenges at the regional level. Also, regional analysis enables businesses to devise strategies to capitalize on specific industry trends and conditions. Along with all the major regions, an in-depth analysis of all the major sub-regions has been provided in the study.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

Recent Developments:

- Lonza Expands Drug Product Manufacturing Capabilities: In May 2023, Lonza expanded its drug product manufacturing capabilities with the establishment of a new clinical and commercial drug product manufacturing line in Visp, Switzerland. This expansion enhances Lonza’s ability to provide comprehensive drug development and manufacturing services to its clients.

- CDMO Launches First Continuous Manufacturing Line in China: In January 2023, a leading CDMO announced the launch of its first continuous manufacturing line for oral solids in China. This development signifies the growing importance of continuous manufacturing in the pharmaceutical industry and the increasing adoption of advanced manufacturing technologies.

Table of Contents:

- Global Oral Solid Dosage Contract Manufacturing Market Insights

4.1. Oral Solid Dosage Contract Manufacturing Market – End-User Snapshot

4.2. Oral Solid Dosage Contract Manufacturing Market Dynamics

4.2.1. Drivers and Opportunities

4.2.1.1. Advancements in drug delivery technology is projected to spur the product demand

4.2.1.2. Increased investments by Contract Development Manufacturing Organizations (CDMOs) is expected to drive oral solid dosage contract manufacturing market growth

4.2.2. Restraints and Challenges

4.2.2.1. Stringent regulatory compliance is likely to impede the market oral solid dosage contract manufacturing growth opportunities

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Suppliers (Moderate)

4.3.2. Threats of New Entrants: (Low)

4.3.3. Bargaining Power of Buyers (Moderate)

4.3.4. Threat of Substitute (Moderate)

4.3.5. Rivalry among existing firms (High)

4.4. PESTEL Analysis

4.5. Oral Solid Dosage Contract Manufacturing Market End-User Trends

4.6. Value Chain Analysis

4.7. COVID-19 Impact Analysis

5. Global Oral Solid Dosage Contract Manufacturing Market, by Product

5.1. Key Findings

5.2. Introduction

5.2.1. Global Oral Solid Dosage Contract Manufacturing Market, by Product, 2019-2032 (USD Billion)

5.3. Tablets

5.3.1. Global Oral Solid Dosage Contract Manufacturing Market, by Tablets, by Region, 2019-2032 (USD Billion)

5.4. Capsules

5.4.1. Global Oral Solid Dosage Contract Manufacturing Market, by Capsules, by Region, 2019-2032 (USD Billion)

5.5. Granules

5.5.1. Global Oral Solid Dosage Contract Manufacturing Market, by Granules, by Region, 2019-2032 (USD Billion)

5.6. Powder

5.6.1. Global Oral Solid Dosage Contract Manufacturing Market, by Powder, by Region, 2019-2032 (USD Billion)

5.7. Others

5.7.1. Global Oral Solid Dosage Contract Manufacturing Market, by Others, by Region, 2019-2032 (USD Billion)

Conclusion

The global oral solid dosage contract manufacturing market is poised for continued growth, driven by the increasing demand for outsourcing services, advancements in manufacturing technologies, and the growing focus on cost-effectiveness and efficiency in the pharmaceutical industry. Continued innovation and a strong focus on quality and compliance will be crucial for CMOs to maintain a competitive edge in this dynamic market.

More Trending Latest Reports By Polaris Market Research: