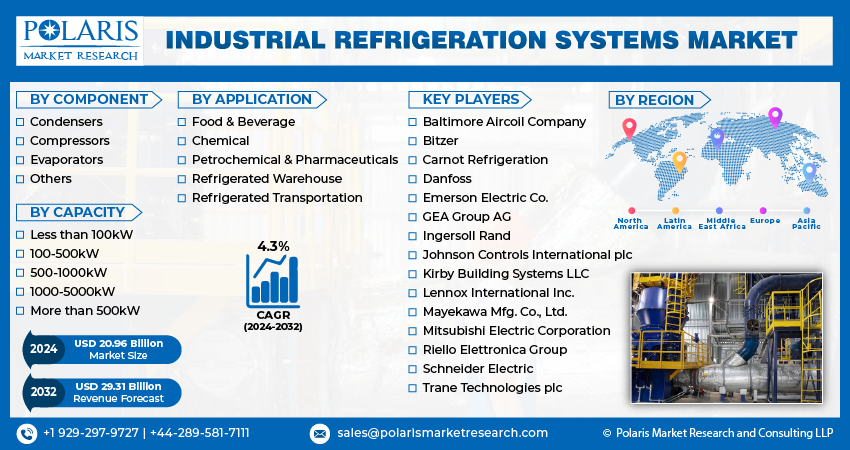

The industrial refrigeration systems market is poised for significant growth in the coming years, driven by increasing demand across various sectors. Valued at USD 20.12 billion in 2023, the market is projected to reach USD 29.31 billion by 2032, exhibiting a CAGR of 4.3% during the forecast period.

Some of the major players operating in the global market include:

- Baltimore Aircoil Company

- Bitzer

- Carnot Refrigeration

- Danfoss

- Emerson Electric Co.

- GEA Group AG

- Ingersoll Rand

- Johnson Controls International plc

- Kirby Building Systems LLC

- Lennox International Inc.

- Mayekawa Mfg. Co., Ltd.

- Mitsubishi Electric Corporation

- Riello Elettronica Group

- Schneider Electric

- Trane Technologies plc

Market Drivers:

- Stringent Environmental Regulations: The growing emphasis on environmental sustainability is driving the demand for energy-efficient and eco-friendly refrigeration systems. Stringent regulations aimed at reducing greenhouse gas emissions are compelling businesses to adopt technologies with lower Global Warming Potential (GWP).

- Rising Demand for Cold Chain Logistics: The expansion of global trade and e-commerce has fueled the demand for efficient cold chain logistics to ensure the safe transportation and storage of perishable goods.

- Growth in Food and Beverage Industry: The increasing global population and rising demand for processed and frozen foods are driving the growth of the food and beverage industry, which is a major consumer of industrial refrigeration systems.

- Technological Advancements: Ongoing advancements in refrigeration technologies, such as the development of more efficient compressors, heat exchangers, and controls, are improving the performance and energy efficiency of industrial refrigeration systems.

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐥 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬:

Industrial Refrigeration Systems Market, Component Outlook (Revenue – USD Billion, 2019-2032)

- Condensers

- Compressors

- Evaporators

- Others

Industrial Refrigeration Systems Market, Capacity Outlook (Revenue – USD Billion, 2019-2032)

- Less than 100kW

- 100-500kW

- 500-1000kW

- 1000-5000kW

- More than 500kW

Industrial Refrigeration Systems Market, Application Outlook (Revenue – USD Billion, 2019-2032)

- Food & Beverage

- Chemical

- Petrochemical & Pharmaceuticals

- Refrigerated Warehouse

- Refrigerated Transportation

The Industrial Refrigeration Systems Market segmentation divides the market into several segments. The industry segmentation is primarily based on product type, application, end-use, and geographic factors. Besides, the research study covers several sub-segments of the market. An in-depth examination of each market segment and sub-segment has been provided, covering the industry size, growth prospects, industry drivers, and challenges. The detailed market segmentation helps stakeholders identify the diverse needs of different consumer groups in the market. Also, it pinpoints opportunities for targeted marketing and product development strategies.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

Recent Developments:

- Johnson Controls’ Acquisition of M&M Carnot: In June 2023, Johnson Controls acquired M&M Carnot, a leading supplier of natural refrigeration solutions with extremely low GWP. This acquisition strengthens Johnson Controls’ position in the market and reinforces its commitment to providing sustainable refrigeration solutions to its customers.

- Tecumseh Products Company’s Expansion of TC Series: In March 2023, Tecumseh Products Company expanded its TC Series compressor platform to include models featuring Propane R-290 refrigerant, specifically designed for the Indian market. This move aligns with the growing demand for environmentally friendly refrigerants in emerging markets.

Market Opportunities:

- Natural Refrigerants: The increasing adoption of natural refrigerants, such as carbon dioxide (CO2) and hydrocarbons, presents significant opportunities for market growth. These refrigerants have low GWP and offer a more sustainable alternative to traditional refrigerants.

- Internet of Things (IoT) Integration: The integration of IoT technologies can enhance the efficiency and performance of industrial refrigeration systems by enabling real-time monitoring, predictive maintenance, and remote diagnostics.

- Energy-Efficient Solutions: The development and adoption of energy-efficient technologies, such as variable speed drives and advanced controls, can help businesses reduce energy consumption and operating costs.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/industrial-refrigeration-systems-market

Challenges:

- High Initial Investment: The initial investment cost of high-efficiency and eco-friendly refrigeration systems can be significant, which may deter some businesses from adopting these technologies.

- Skilled Workforce: The installation, maintenance, and operation of advanced refrigeration systems require skilled technicians and engineers.

- Regulatory Compliance: Navigating the complex regulatory landscape surrounding refrigerants and energy efficiency can be challenging for businesses.

Table of Contents:

-

-

- Secondary Sources

-

- Global Industrial Refrigeration Systems Market Insights

- Industrial Refrigeration Systems Market – Application Snapshot

- Industrial Refrigeration Systems Market Dynamics

- Drivers and Opportunities

- Stringent regulatory standards is projected to spur the product demand.

- Increasing consumer demand for quality and safety is expected to drive industrial refrigeration systems market growth.

- Restraints and Challenges

- High initial cost is likely to impede the market industrial refrigeration systems growth opportunities.

- Drivers and Opportunities

- Porter’s Five Forces Analysis

- Bargaining Power of Suppliers (Moderate)

- Threats of New Entrants: (Low)

- Bargaining Power of Buyers (Moderate)

- Threat of Substitute (Moderate)

- Rivalry among existing firms (High)

- PESTEL Analysis

- Industrial Refrigeration Systems Market Application Trends

- Value Chain Analysis

- COVID-19 Impact Analysis

- Global Industrial Refrigeration Systems Market, by Component

- Key Findings

- Introduction

- Global Industrial Refrigeration Systems Market, by Component, 2019-2032 (USD Billion)

- Condensers

- Global Industrial Refrigeration Systems Market, by Condensers, by Region, 2019-2032 (USD Billion)

- Compressors

- Global Industrial Refrigeration Systems Market, by Compressors, by Region, 2019-2032 (USD Billion)

- Evaporators

- Global Industrial Refrigeration Systems Market, by Evaporators, by Region, 2019-2032 (USD Billion)

- Others

- Global Industrial Refrigeration Systems Market, by Others, by Region, 2019-2032 (USD Billion)

- Global Industrial Refrigeration Systems Market, by Capacity

- Key Findings

- Introduction

- Global Industrial Refrigeration Systems Market, by Capacity, 2019-2032 (USD Billion)

- Less than 100kW

- Global Industrial Refrigeration Systems Market, by Less than 100kW, by Region, 2019-2032 (USD Billion)

- 100-500kW

- Global Industrial Refrigeration Systems Market, by 100-500kW, by Region, 2019-2032 (USD Billion)

- 500-1000kW

- Global Industrial Refrigeration Systems Market, by 500-1000kW, by Region, 2019-2032 (USD Billion)

- 1000-5000kW

- Global Industrial Refrigeration Systems Market, by 1000-5000kW, by Region, 2019-2032 (USD Billion)

- More than 500kW

- Global Industrial Refrigeration Systems Market, by More than 500kW, by Region, 2019-2032 (USD Billion)

Conclusion:

The industrial refrigeration systems market is poised for continued growth, driven by a combination of factors, including increasing demand, technological advancements, and a growing focus on sustainability. By embracing innovative technologies, addressing the challenges associated with implementation and maintenance, and staying abreast of evolving regulations, businesses can capitalize on the significant opportunities presented by this dynamic market.