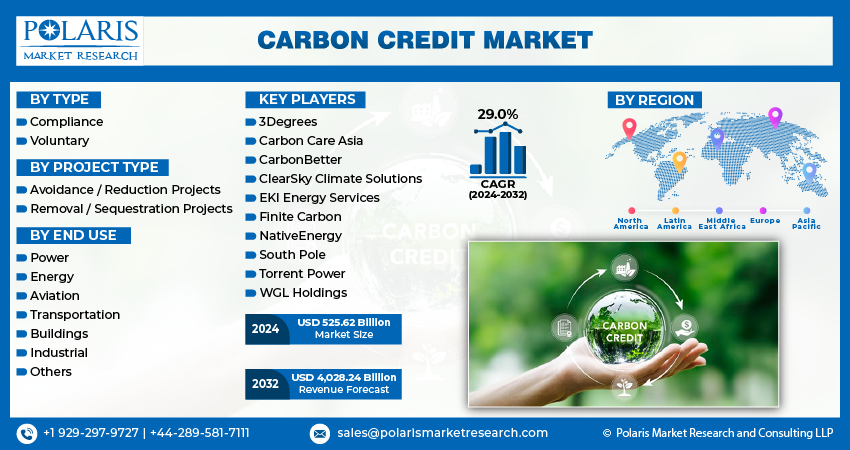

According to the research report, the global Carbon Credit Market was valued at USD 408.05 billion in 2023 and is expected to reach USD 4,028.24 billion by 2032, to grow at a CAGR of 29.00% during the forecast period.

Market Overview:

The carbon credit market plays a pivotal role in global efforts to combat climate change by incentivizing businesses and governments to reduce their carbon footprint. A carbon credit represents one metric ton of carbon dioxide (CO₂) or equivalent greenhouse gas (GHG) emissions that an organization is permitted to emit. Companies that reduce emissions below their allocated limit can sell excess credits, while those exceeding their limits must purchase credits to comply with regulations.

The carbon credit market is divided into:

- Compliance Market – Mandated by government regulations where businesses must offset emissions to meet legal requirements.

- Voluntary Market – Where businesses and individuals voluntarily purchase credits to offset their carbon footprint as part of corporate social responsibility (CSR) or sustainability commitments.

With increasing global focus on carbon neutrality and net-zero goals, the carbon credit market has gained significant momentum, offering financial incentives for emission reduction projects, including renewable energy, afforestation, energy efficiency, and carbon capture initiatives.

What’s Driving Market Forward?

Emergence of New Carbon Offset Projects: The market is driven by the surfacing of contemporary carbon offset projects covering several industries. A growing aggregate of projects involves meticulous validation, verification, and certification to sanction that the credits created are reliable and showcase real, gaugeable discharge curtailments.

Improving ESG Performance: Corporations are growingly describing their ecological, social, and governance performance. Authenticated carbon credits improve the integrity of their green assertion. This, in turn, is having a favorable impact on carbon credit validation verification and certification market sales.

Certification of Ecological Influence: There is a growing demand for carbon credit VV&C as firms look to profess and attest their ecological influences. Artificial Intelligence, satellite imagery, and blockchain technologies improve the dependability, transparency, and productivity of carbon offset projects by inspecting extensive datasets.

Major Key Players:

- SGS Société Générale de Surveillance SA.

- TÜV SÜD

- Verra

- The ERM International Group Limited

- SustainCERT

- CarbonCheck

- AENOR

- Bureau Veritas

- Gold Standard

- ACR

- DNV GL

- SCS Global Services

- Intertek Group Plc

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/carbon-credit-market

Recent Developments:

- In March 2023, the Integrity Council for Voluntary Carbon introduced the “Core Carbon Principles and Program-Level Assessment Framework” for carbon credits. This initiative aims to establish a standardized threshold for carbon emissions, ensuring greater transparency and credibility in carbon credit programs while promoting sustainable development.

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐥 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬:

The research study includes segmental analysis that divides the market into distinct groups or segments based on common characteristics. With market segmentation, businesses can identify specific customer groups that are more likely to be interested in specific products or services. Also, it enables these businesses to focus their marketing efforts and resources more efficiently, leading to higher conversion rates and improved return on investment. Furthermore, segmentation analysis helps companies develop personalized products or services, which can result in increased customer loyalty and improved customer satisfaction.

Carbon Credit Market, Project Type Outlook (Revenue – USD Billion, 2019-2032)

- Avoidance / Reduction Projects

- Removal / Sequestration Projects

- Nature-based

- Technology-based

Carbon Credit Market, Type Outlook (Revenue – USD Billion, 2019-2032)

- Compliance

- Voluntary

Carbon Credit Market, End Use Outlook (Revenue – USD Billion, 2019-2032)

- Power

- Energy

- Aviation

- Transportation

- Buildings

- Industrial

- Others

The carbon credit market is poised for significant expansion as more countries and businesses adopt carbon neutrality goals. The integration of technology, standardization of credit quality, and regulatory advancements will drive further growth in both compliance and voluntary markets.

As global decarbonization efforts accelerate, industries will increasingly rely on carbon credits as part of their transition strategies, fostering investments in clean energy, carbon capture, and reforestation projects. Additionally, innovations such as direct air capture and carbon removal credits will shape the future of the market, creating new opportunities for sustainable development.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐌𝐨𝐫𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Wireless Audio Devices Market Size