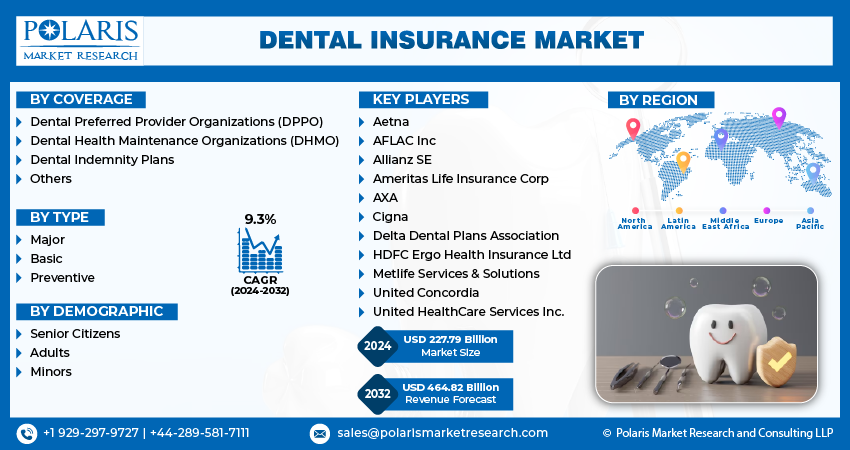

The global dental insurance market is experiencing substantial growth, driven by increasing awareness of oral health’s importance, rising disposable incomes, and growing access to dental care. Projected to reach USD 464.82 billion by 2032, the market is expected to expand at a robust CAGR of 9.3% during the forecast period.

Market Overview:

Dental insurance plans help individuals and families cover the costs associated with dental care, including preventative checkups, fillings, cleanings, and more complex procedures like crowns, implants, and orthodontics. The market consists of various plan types, including dental preferred provider organizations (PPOs), dental health maintenance organizations (DHMOs), and indemnity plans.

Some of the major players operating in the global market include:

- Aetna

- AFLAC Inc

- Allianz SE

- Ameritas Life Insurance Corp

- AXA

- Cigna

- Delta Dental Plans Association

- HDFC Ergo Health Insurance Ltd

- Metlife Services & Solutions

- United Concordia

- United HealthCare Services Inc.

Key Drivers of Market Growth:

- Growing Awareness of Oral Health: Increased public awareness of the link between oral health and overall well-being is driving demand for dental insurance. People are increasingly recognizing the importance of preventative dental care.

- Rising Disposable Incomes: Rising disposable incomes in many regions are enabling individuals and families to afford dental insurance plans, contributing to market growth.

- Aging Population: The aging global population is more susceptible to dental problems, such as gum disease and tooth loss, increasing the need for dental care and consequently, dental insurance.

- Technological Advancements: Advancements in dental technology, like implants and cosmetic dentistry, while offering better solutions, often come with higher costs, making dental insurance more attractive.

Recent Developments:

- PNB MetLife’s Dental Health Insurance Plan: The introduction of this plan in India addresses the growing need for accessible dental coverage in this region. It caters to outpatient costs and other dental expenses, making dental care more affordable.

- Bupa & YuLife Partnership: This collaboration integrates dental insurance with life insurance policies, offering a convenient bundled option for employers and employees. Such partnerships can expand the reach of dental coverage.

- Ameritas’ Lifetime Deductible Option: This innovative approach to deductibles simplifies the insurance process for members and enhances the value proposition of group dental plans, potentially attracting more subscribers.

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐥 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬:

Dental Insurance Market, Coverage Outlook (Revenue – USD Billion, 2019-2032)

- Dental Preferred Provider Organizations (DPPO)

- Dental Health Maintenance Organizations (DHMO)

- Dental Indemnity Plans

- Others

Dental Insurance Market, Type Outlook (Revenue – USD Billion, 2019-2032)

- Major

- Basic

- Preventive

Dental Insurance Market, Demographic Outlook (Revenue – USD Billion, 2019-2032)

- Senior Citizens

- Adults

- Minors

The research study includes segmental analysis that divides the market into distinct groups or segments based on common characteristics. With market segmentation, businesses can identify specific customer groups that are more likely to be interested in specific products or services. Also, it enables these businesses to focus their marketing efforts and resources more efficiently, leading to higher conversion rates and improved return on investment. Furthermore, segmentation analysis helps companies develop personalized products or services, which can result in increased customer loyalty and improved customer satisfaction.

Market Trends:

- Focus on Preventative Care: Dental insurance plans are increasingly emphasizing preventative care, such as regular checkups and cleanings, to reduce long-term dental costs.

- Digitalization: The dental insurance industry is embracing digital technologies, such as online enrollment, claims processing, and telehealth consultations, to improve efficiency and customer experience.

- Value-Based Care: There is a growing shift towards value-based care in dental insurance, where providers are reimbursed based on patient outcomes and quality of care.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/dental-insurance-market

Market Opportunities:

- Emerging Markets: The growing middle class and increasing access to healthcare in emerging markets present significant growth opportunities for dental insurance providers.

- Specialized Plans: Developing specialized dental insurance plans for specific demographics, such as seniors or children, can cater to unique needs and drive market growth.

- Integration with Health Insurance: Integrating dental insurance with overall health insurance plans can offer comprehensive coverage and improve patient outcomes.

Challenges:

- Cost of Premiums: The cost of dental insurance premiums can be a barrier for some individuals and families, particularly those with limited incomes.

- Coverage Limitations: Some dental insurance plans have limitations on coverage, such as annual maximums or waiting periods for certain procedures, which can restrict access to necessary care.

- Provider Networks: Access to a wide network of dental providers is crucial for attracting and retaining dental insurance members.

Table of Contents:

- Global Dental Insurance Market Insights

4.1. Dental Insurance Market – Demographic Snapshot

4.2. Dental Insurance Market Dynamics

4.2.1. Drivers and Opportunities

4.2.1.1. Increasing dental health issues.

4.2.1.2. Rising dental care awareness

4.2.2. Restraints and Challenges

4.2.2.1. Limited Coverage and High Deductibles

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Suppliers (Moderate)

4.3.2. Threats of New Entrants: (Low)

4.3.3. Bargaining Power of Buyers (Moderate)

4.3.4. Threat of Substitute (Moderate)

4.3.5. Rivalry among existing firms (High)

4.4. PESTEL Analysis

4.5. Dental Insurance Market Demographic Trends

4.6. Value Chain Analysis

4.7. COVID-19 Impact Analysis

5. Global Dental Insurance Market, by Coverage

5.1. Key Findings

5.2. Introduction

5.2.1. Global Dental Insurance Market, by Coverage, 2019-2032 (USD Billion)

5.3. Dental Preferred Provider Organizations (DPPO)

5.3.1. Global Dental Insurance Market, by Dental Preferred Provider Organizations (DPPO), by Region, 2019-2032 (USD Billion)

5.4. Dental Health Maintenance Organizations (DHMO)

5.4.1. Global Dental Insurance Market, by Dental Health Maintenance Organizations (DHMO), by Region, 2019-2032 (USD Billion)

5.5. Dental Indemnity Plans

5.5.1. Global Dental Insurance Market, by Dental Indemnity Plans, by Region, 2019-2032 (USD Billion)

5.6. Others

5.6.1. Global Dental Insurance Market, by Others, by Region, 2019-2032 (USD Billion)

6. Global Dental Insurance Market, by Type

6.1. Key Findings

6.2. Introduction

6.2.1. Global Dental Insurance Market, by Type, 2019-2032 (USD Billion)

6.3. Major

6.3.1. Global Dental Insurance Market, by Major, by Region, 2019-2032 (USD Billion)

6.4. Basic

6.4.1. Global Dental Insurance Market, by Basic, by Region, 2019-2032 (USD Billion)

6.5. Preventive

6.5.1. Global Dental Insurance Market, by Preventive, by Region, 2019-2032 (USD Billion)

Conclusion:

The dental insurance market is expected to continue its strong growth trajectory, driven by increasing awareness of oral health, rising disposable incomes, and an aging population. Addressing the challenges related to cost, coverage limitations, and provider networks will be critical for ensuring that dental insurance provides accessible and affordable care to a wider population. The market will likely be shaped by further innovation in plan design, digital technologies, and a greater focus on preventative care.

More Trending Latest Reports By Polaris Market Research:

Next Generation Emergency Response System Market

Treatment Planning Systems And Advanced Image Processing Market