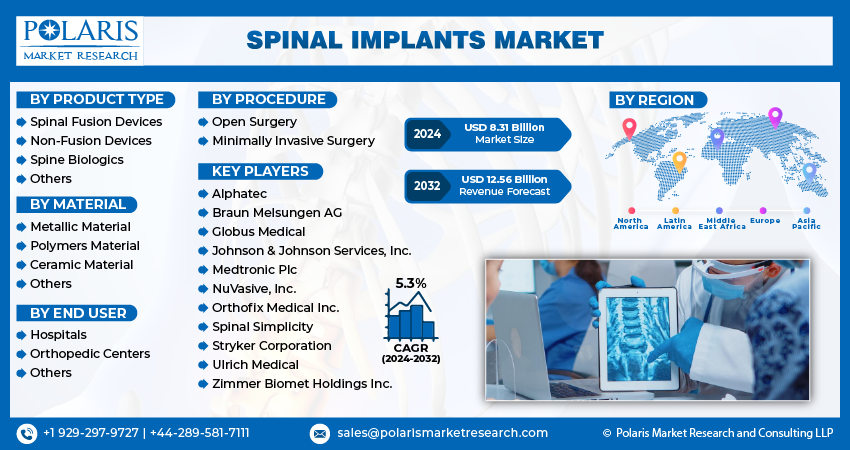

The global spinal implants market is experiencing steady growth, fueled by an aging population, increasing prevalence of spinal disorders, and advancements in implant technology. Valued at USD 7.92 billion in 2023, the market is projected to reach USD 12.56 billion by 2032, exhibiting a CAGR of 5.3% during the forecast period.

Market Overview:

Spinal implants are medical devices used to stabilize, correct deformities, and promote fusion in the spine. They encompass a range of products, including spinal fusion implants (like plates, screws, rods, and cages), non-fusion devices (like artificial discs), and bone grafts.

Some of the major players operating in the global market include:

- Alphatec

- Braun Melsungen AG

- Globus Medical

- Johnson & Johnson Services, Inc.

- Medtronic Plc

- NuVasive, Inc.

- Orthofix Medical Inc.

- Spinal Simplicity

- Stryker Corporation

- Ulrich Medical

- Zimmer Biomet Holdings Inc.

Key Drivers of Market Growth:

- Aging Population: The global aging population is a significant driver, as older adults are more susceptible to degenerative spinal conditions like osteoarthritis, spinal stenosis, and degenerative disc disease.

- Increasing Prevalence of Spinal Disorders: The rising prevalence of spinal disorders, such as scoliosis, herniated discs, and spinal fractures, is fueling the demand for spinal implants.

- Technological Advancements: Continuous advancements in implant technology, including the development of minimally invasive surgical techniques, biocompatible materials, and innovative implant designs, are improving patient outcomes and driving market growth.

Recent Developments:

- Orthofix Medical’s 7D Flash Launch: The U.S. commercial launch of 7D Flash, a spine surgery navigation system, represents a significant advancement in surgical technology. Navigation systems improve surgical precision and can lead to better patient outcomes.

- Spinal Simplicity’s Minuteman G5 Implant Launch: The Minuteman G5 implant offers a minimally invasive option for interspinous-interlaminar fusion, potentially reducing recovery time and improving patient satisfaction. Minimally invasive procedures are a growing trend in spine surgery.

- NuVasive’s Cohere TLIF-O Implant Launch: The Cohere TLIF-O implant, made from porous PEEK (polyetheretherketone), is designed for transforaminal lumbar interbody fusion (TLIF) procedures. Porous PEEK can promote bone ingrowth and fusion, potentially leading to better long-term outcomes.

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐥 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬:

Spinal Implants Market, Product Type Outlook (Revenue – USD Billion, 2019-2032)

- Spinal Fusion Devices

- Thoracic Fusion & Lumbar Fusion Devices

- Cervical Fusion Devices

- Expandable Fusion Cages

- Others

- Non-Fusion Devices

- Dynamic Stabilization Devices

- Artificial Discs

- Annulus Repair Devices

- Nuclear Disc Prostheses

- Others

- Spine Biologics

- Others

Spinal Implants Market, Material Outlook (Revenue – USD Billion, 2019-2032)

- Metallic Material

- Polymers Material

- Ceramic Material

- Others

Spinal Implants Market, Procedure Outlook (Revenue – USD Billion, 2019-2032)

- Open Surgery

- Minimally Invasive Surgery

Spinal Implants Market, End User Outlook (Revenue – USD Billion, 2019-2032)

- Hospitals

- Orthopedic Centers

- Others

The research study includes segmental analysis that divides the market into distinct groups or segments based on common characteristics. With market segmentation, businesses can identify specific customer groups that are more likely to be interested in specific products or services. Also, it enables these businesses to focus their marketing efforts and resources more efficiently, leading to higher conversion rates and improved return on investment. Furthermore, segmentation analysis helps companies develop personalized products or services, which can result in increased customer loyalty and improved customer satisfaction.

Market Trends:

- Minimally Invasive Surgery (MIS): The increasing adoption of MIS techniques in spine surgery is driving the demand for implants designed for these procedures. MIS offers benefits such as smaller incisions, less blood loss, and faster recovery times.

- Biocompatible Materials: The use of biocompatible materials, such as titanium and PEEK, is increasing, as these materials are less likely to cause adverse reactions in patients.

- Focus on Non-Fusion Devices: The market for non-fusion devices, such as artificial discs, is growing as these devices offer the potential to preserve spinal motion and reduce the risk of adjacent segment degeneration.

Market Opportunities:

- Emerging Markets: The growing access to healthcare in emerging markets presents significant growth opportunities for the spinal implants market.

- Geriatric Population: The increasing elderly population represents a substantial market for spinal implants to treat age-related spinal conditions.

- Technological Innovation: Continued innovation in implant design, materials, and surgical techniques offers significant growth potential.

Challenges:

- High Cost: The high cost of some spinal implants can be a barrier to access, particularly in developing countries.

- Regulatory Issues: The spinal implant market is subject to strict regulatory requirements, which can be challenging for companies to navigate.

- Clinical Evidence: Strong clinical evidence is needed to demonstrate the safety and effectiveness of new spinal implants.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/spinal-implants-market

Table of Contents:

- Research Methodology

3.1. Overview

3.1.1. Data Mining

3.2. Data Sources

3.2.1. Primary Sources

3.2.2. Secondary Sources

4. Global Spinal Implants Market Insights

4.1. Spinal Implants – Industry Snapshot

4.2. Spinal Implants Market Dynamics

4.2.1. Drivers and Opportunities

4.2.1.1. The increasing prevalence of spinal disorders in both young as well as senior populations drives market growth

4.2.1.2. The advancements in technologies, such as minimally invasive surgery, drives the market growth

4.2.2. Restraints and Challenges

4.2.2.1. The high cost of procedures and risk of complications hinders market growth

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Suppliers (Moderate)

4.3.2. Threats of New Entrants: (Low)

4.3.3. Bargaining Power of Buyers (Moderate)

4.3.4. Threat of Substitute (Moderate)

4.3.5. Rivalry among existing firms (High)

4.4. PESTLE Analysis

4.5. Spinal Implants Industry Trends

4.6. Value Chain Analysis

4.7. COVID-19 Impact Analysis

5. Global Spinal Implants Market, by Product Type

5.1. Key Findings

5.2. Introduction

5.2.1. Global Spinal Implants Market, by Product Type, 2019-2032 (USD Billion)

5.3. Spinal Fusion Devices

5.3.1. Global Spinal Implants Market, by Spinal Fusion Devices, by Region, 2019-2032 (USD Billion)

5.3.2. Thoracic Fusion & Lumbar Fusion Devices

5.3.2.1. Global Spinal Implants Market, by Thoracic Fusion & Lumbar Fusion Devices, by Region, 2019-2032 (USD Billion)

5.3.3. Cervical Fusion Devices

5.3.3.1. Global Spinal Implants Market, by Cervical Fusion Devices, by Region, 2019-2032 (USD Billion)

5.3.4. Expandable Fusion Cages

5.3.4.1. Global Spinal Implants Market, by Expandable Fusion Cages, by Region, 2019-2032 (USD Billion)

5.3.5. Others

5.3.5.1. Global Spinal Implants Market, by Others, by Region, 2019-2032 (USD Billion)

5.4. Non-Fusion Devices

5.4.1. Global Spinal Implants Market, by Non-Fusion Devices, by Region, 2019-2032 (USD Billion)

5.4.2. Dynamic Stabilization Devices

5.4.2.1. Global Spinal Implants Market, by Dynamic Stabilization Devices, by Region, 2019-2032 (USD Billion)

5.4.3. Artificial Discs

5.4.3.1. Global Spinal Implants Market, by Artificial Discs, by Region, 2019-2032 (USD Billion)

5.4.4. Annulus Repair Devices

5.4.4.1. Global Spinal Implants Market, by Annulus Repair Devices, by Region, 2019-2032 (USD Billion)

5.4.5. Nuclear Disc Prostheses

5.4.5.1. Global Spinal Implants Market, by Nuclear Disc Prostheses, by Region, 2019-2032 (USD Billion)

5.4.6. Others

5.4.6.1. Global Spinal Implants Market, by Others, by Region, 2019-2032 (USD Billion)

5.5. Spine Biologics

5.5.1. Global Spinal Implants Market, by Spine Biologics, by Region, 2019-2032 (USD Billion)

5.6. Others

5.6.1. Global Spinal Implants Market, by Others, by Region, 2019-2032 (USD Billion)

Conclusion:

The spinal implants market is expected to continue its steady growth, driven by the factors mentioned above. Technological advancements, an aging population, and the increasing prevalence of spinal disorders are all contributing to market expansion. Addressing the challenges related to cost, regulation, and the need for robust clinical evidence will be crucial for ensuring that patients have access to safe and effective spinal implants.

More Trending Latest Reports By Polaris Market Research: