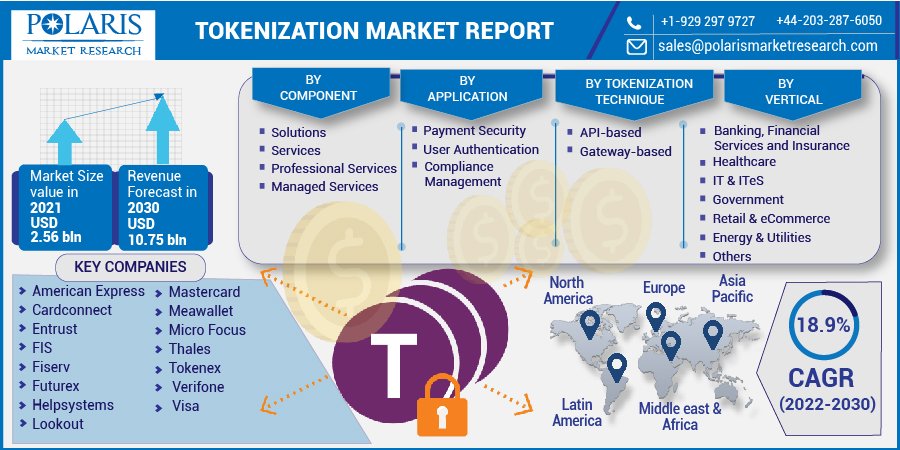

The tokenization market is experiencing rapid growth, fueled by the increasing demand for enhanced data security and privacy in various sectors. Tokenization, the process of converting sensitive data into a non-sensitive equivalent (a token), is gaining traction across industries due to its ability to secure payment data, protect personal information, and prevent cyberattacks. The tokenization market is expected to grow to $10.75 billion by 2030, with a compound annual growth rate (CAGR) of 18.9% from 2022 to 2030.

Introduction: What is Tokenization?

Tokenization is a security process that replaces sensitive data with a unique identifier or “token” that has no meaningful value outside of a specific environment. This process is particularly important for industries dealing with highly sensitive data, such as finance, healthcare, and e-commerce, as it significantly reduces the risk of data breaches and fraud. The original data is stored securely in a centralized system, and the token serves as a reference to retrieve the data when necessary.

The rise of cyber threats, data breaches, and regulatory requirements surrounding data protection are driving the adoption of tokenization across various industries. Tokenization can be used to protect credit card information, personally identifiable information (PII), medical records, and other types of sensitive data from malicious access.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/tokenization-market

Market Drivers: Why the Tokenization Market is Growing

- Increasing Cybersecurity Threats: With the rising frequency and sophistication of cyberattacks, especially data breaches and fraud, organizations are seeking secure alternatives to protect sensitive information. Tokenization is widely regarded as an effective way to prevent unauthorized access to critical data, making it a top choice for businesses in various sectors.

- Data Privacy Regulations: Stringent data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe, the California Consumer Privacy Act (CCPA), and the Health Insurance Portability and Accountability Act (HIPAA), have increased the demand for data protection solutions. Tokenization helps organizations comply with these regulations by minimizing the exposure of sensitive data and reducing the risk of non-compliance penalties.

- Growth of Digital Payments and E-Commerce: As digital payments and online transactions become more common, businesses are looking for ways to secure customer payment information. Tokenization has become an essential solution for securing payment card data, reducing the risk of fraud, and enhancing consumer trust in digital payment systems.

- Increased Adoption of Cloud-Based Solutions: The growing adoption of cloud computing has led to an increase in the need for secure data storage and processing solutions. Tokenization provides an additional layer of protection for sensitive data in cloud environments, making it an attractive solution for businesses migrating to the cloud.

- Shift to Contactless and Mobile Payments: The rapid adoption of mobile and contactless payment technologies has further fueled the demand for tokenization. As consumers increasingly rely on smartphones and wearable devices for payments, businesses need secure ways to handle payment information. Tokenization ensures that sensitive payment data is protected while enabling a seamless payment experience.

- Rising Demand for Blockchain Technology: The adoption of blockchain technology in industries such as finance, healthcare, and supply chain management is contributing to the growth of the tokenization market. Blockchain technology relies on secure data management, and tokenization can play a key role in securing digital assets on blockchain platforms.

Market Segmentation: Key Areas in Tokenization Solutions

The tokenization market is segmented based on deployment model, application, industry vertical, and region.

- Deployment Model:

- On-Premise: On-premise tokenization solutions are deployed within an organization’s data center, providing full control over the tokenization process. This model is typically preferred by large organizations with the resources to manage and secure their own infrastructure.

- Cloud-Based: Cloud-based tokenization solutions are gaining popularity due to their scalability, flexibility, and cost-effectiveness. These solutions allow businesses to securely tokenize data without the need for on-site hardware, making them an attractive option for smaller organizations or those without dedicated IT infrastructure.

- Application:

- Payment Card Tokenization: Payment card tokenization is one of the most widely used applications of tokenization. By replacing sensitive payment card details with unique tokens, businesses can reduce the risk of credit card fraud and enhance security for digital payments and transactions.

- Healthcare Data Tokenization: Tokenization is increasingly being used in the healthcare sector to protect sensitive patient data, such as medical records and personally identifiable information (PII). Tokenization helps healthcare providers comply with regulations like HIPAA while ensuring that patient data remains secure.

- Enterprise Data Tokenization: Tokenization is also used to protect sensitive enterprise data, including employee records, financial data, and intellectual property. By tokenizing this information, businesses can reduce the risk of data breaches and unauthorized access.

- Digital Asset Tokenization: Digital asset tokenization involves converting assets such as real estate, art, and commodities into digital tokens. These tokens can be traded on blockchain platforms, enabling fractional ownership and improving liquidity in traditionally illiquid markets.

- Industry Vertical:

- Financial Services: The financial services industry is the largest adopter of tokenization, driven by the need to protect payment card information, personal banking data, and investment records. Tokenization helps financial institutions prevent fraud, reduce chargebacks, and comply with regulatory requirements such as PCI DSS (Payment Card Industry Data Security Standard).

- Healthcare: Healthcare providers and organizations dealing with sensitive patient data are increasingly using tokenization to safeguard medical records, insurance details, and other personal health information. Tokenization helps healthcare organizations meet privacy regulations while ensuring the security of patient data.

- Retail and E-Commerce: Retailers and e-commerce businesses are adopting tokenization to protect customer payment information and prevent credit card fraud. By tokenizing payment card data, these businesses can offer a more secure and seamless payment experience for customers.

- Government and Defense: Government agencies and defense organizations are utilizing tokenization to secure sensitive data related to national security, citizen records, and classified information. Tokenization helps protect this data from cyber threats and unauthorized access.

- Energy and Utilities: Energy and utility companies are increasingly adopting tokenization to protect critical infrastructure data, including smart grid information, operational data, and customer billing details. Tokenization helps ensure the security and resilience of energy systems.

- Region:

- North America: North America holds the largest market share in the tokenization market, driven by the presence of major financial institutions, e-commerce platforms, and tech companies. The region’s strong regulatory environment and widespread adoption of digital payments also contribute to the market’s growth.

- Europe: Europe is another key market for tokenization, particularly due to stringent data privacy regulations such as GDPR. The region’s focus on securing personal data and protecting consumer privacy is driving the adoption of tokenization in various industries, including healthcare and financial services.

- Asia-Pacific: The Asia-Pacific region is expected to experience the highest growth in the tokenization market, fueled by the growing adoption of digital payments, mobile wallets, and cloud computing. Countries like China, India, and Japan are witnessing increased demand for tokenization solutions to protect payment information and enhance cybersecurity.

- Latin America and Middle East & Africa: Both regions are gradually adopting tokenization solutions, with a focus on protecting payment data and securing financial transactions. The rise of e-commerce and mobile payment adoption in these regions is contributing to the demand for tokenization.

Challenges in the Tokenization Market

Despite the growth potential, the tokenization market faces several challenges:

- Integration Complexity: Integrating tokenization solutions with existing legacy systems can be complex, particularly for organizations with outdated infrastructure. Ensuring seamless integration and interoperability between tokenization platforms and other security technologies is a key challenge for businesses.

- Cost of Implementation: While tokenization can reduce the risk of data breaches and fraud, the initial cost of implementation may be high for some organizations, particularly small and medium-sized enterprises (SMEs). This can hinder the widespread adoption of tokenization in certain sectors.

- Lack of Awareness: Although tokenization is gaining traction, many organizations are still unaware of its benefits or may underestimate the risks of not implementing such solutions. Educating businesses about the advantages of tokenization and the threats it mitigates will be crucial for market expansion.

- Regulatory Uncertainty: The evolving regulatory landscape surrounding data protection and privacy laws poses a challenge for businesses adopting tokenization. Organizations must ensure that their tokenization solutions comply with a variety of regulations, which can vary by region and industry.

Key Market Players: Leading Companies in the Tokenization Market

Several companies are leading the tokenization market by providing innovative solutions for data protection. Key players include:

- American Express

- Cardconnect

- Entrust

- FIS

- Fiserv

- Futurex

- Helpsystems

- Lookout

- Mastercard

- Meawallet

- Micro Focus

- Thales

- Tokenex

- Verifone

- and Visa

Future Outlook: What Lies Ahead for the Tokenization Market

The tokenization market is poised for significant growth as businesses and organizations across industries continue to prioritize data security and compliance with privacy regulations. With the rise of digital payments, cloud adoption, and blockchain technology, the demand for tokenization solutions is expected to increase, especially in sectors such as finance, healthcare, and retail.

In the coming years, advancements in artificial intelligence (AI) and machine learning (ML) will further enhance tokenization platforms by enabling real-time threat detection and risk management. These innovations, along with the ongoing development of regulatory frameworks, will help businesses optimize their data protection strategies and drive the growth of the tokenization market.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐌𝐨𝐫𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Hospital Electronic Health Records Market

Point-Of-Sale (Pos) Terminals Market

Identity & Access Management (Iam) Market