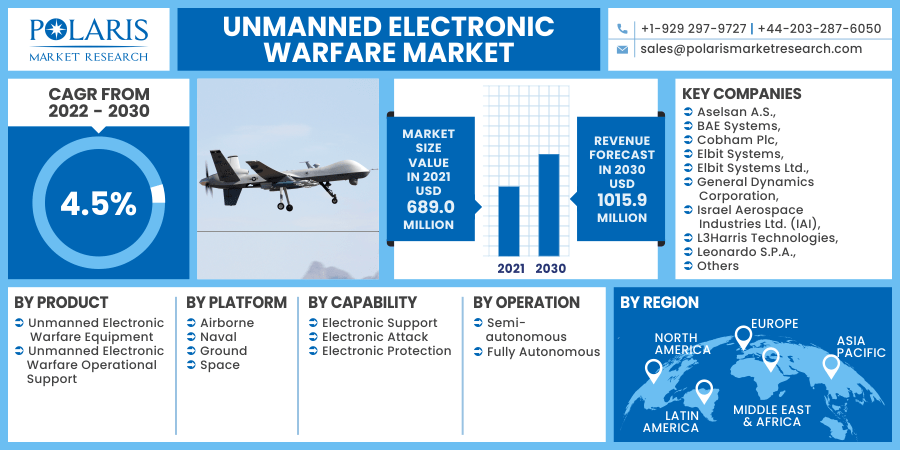

The unmanned electronic warfare (EW) market is on an upward trajectory, with the global market size projected to reach $1015.9 million by 2030. This represents a significant growth from its current valuation, driven by technological advancements and increasing defense spending globally. The market is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2022 to 2030, highlighting the growing reliance on unmanned systems in electronic warfare operations.

Introduction to Unmanned Electronic Warfare

Electronic warfare refers to the use of electromagnetic spectrum to disrupt or deny enemy forces the ability to use their own electromagnetic spectrum. This could involve jamming, spoofing, or intercepting enemy communications. The integration of unmanned systems in EW has added a new dimension to these operations, providing enhanced capabilities in terms of range, flexibility, and cost-effectiveness.

Unmanned electronic warfare systems utilize drones, robots, or autonomous platforms equipped with advanced sensors and communications tools to conduct EW missions. These systems can perform a variety of tasks, including surveillance, electronic attack, electronic protection, and support operations, without putting human lives at risk.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/unmanned-electronic-warfare-market

Market Dynamics

Drivers of Growth

- Technological Advancements

One of the key drivers of the unmanned electronic warfare market is the continuous development of advanced technology. The evolution of unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and autonomous systems is enabling EW operations that were previously unthinkable. These technologies allow for more effective countermeasures, better range, and the ability to operate in contested environments without risking human lives. - Increasing Defense Spending

The global rise in defense budgets is contributing to the demand for unmanned EW systems. Countries across the world are investing heavily in their defense sectors, with a focus on enhancing their electronic warfare capabilities. The growing need for modernized defense systems that can protect national security interests is propelling the growth of unmanned EW systems. - Global Security Threats

The increasing prevalence of cyber warfare, terrorism, and geopolitical tensions is also driving the demand for unmanned EW systems. As nations face new threats, the need for robust, adaptable, and discreet defense mechanisms is becoming more urgent. Unmanned systems can operate in hostile environments without risking personnel, providing a strategic advantage in combat situations.

Challenges

- High Initial Investment

While unmanned EW systems provide long-term operational benefits, their development and deployment require a substantial initial investment. The high cost of unmanned platforms and the technology required for EW capabilities can be a barrier to entry for many countries, especially those with limited defense budgets. - Regulatory Issues

The use of unmanned systems for military applications is subject to stringent regulations, which can hinder their widespread adoption. International agreements, such as arms control treaties and export control laws, can complicate the procurement and deployment of unmanned EW systems. These regulatory hurdles may slow down the pace of growth in the market. - Vulnerability to Countermeasures

As unmanned systems become more integrated into defense strategies, adversaries are also developing countermeasures to neutralize these systems. Cyberattacks, electronic jamming, and other counter-EW tactics are evolving, posing a significant challenge to the effectiveness of unmanned systems. Continuous innovation is necessary to stay ahead of these evolving threats.

Market Segmentation

The unmanned electronic warfare market can be segmented based on platform type, application, and region.

By Platform Type

- Unmanned Aerial Vehicles (UAVs)

UAVs are the most commonly used unmanned platforms in electronic warfare operations. They are highly effective in providing surveillance, reconnaissance, and signal intelligence. UAVs can be equipped with a variety of EW payloads, including jammers, interceptors, and electronic protection systems. - Unmanned Ground Vehicles (UGVs)

UGVs are increasingly being used for ground-based EW operations. These platforms are equipped with sensors and communication tools to detect and neutralize threats in urban or remote areas. They offer increased mobility and versatility, making them ideal for terrain-specific operations. - Unmanned Underwater Vehicles (UUVs)

While less common, UUVs are gaining attention for use in naval electronic warfare. These platforms can be deployed for underwater reconnaissance, surveillance, and communication interception, adding a new layer of capability to naval defense operations.

By Application

- Electronic Attack

Electronic attack (EA) is the use of electromagnetic energy to disrupt, degrade, or destroy the electronic systems of an adversary. Unmanned EW systems are highly effective in EA missions due to their ability to stay in the air or on the ground for extended periods. These platforms can conduct offensive EW operations, such as jamming enemy radar or communications systems. - Electronic Protection

Electronic protection (EP) involves measures to safeguard friendly electronic systems from enemy EW attacks. Unmanned EW systems can play a critical role in EP by providing early detection of incoming threats, spoofing enemy signals, or providing electronic countermeasures. - Electronic Support

Electronic support (ES) focuses on the detection and identification of enemy electronic systems. Unmanned EW platforms equipped with advanced sensors can gather intelligence and provide real-time data on enemy operations. This data can be used to inform strategic decisions and enhance situational awareness.

By Region

- North America

North America is currently the largest market for unmanned electronic warfare systems, driven by the U.S. Department of Defense’s investments in advanced military technology. The region’s defense contractors are also at the forefront of developing and deploying unmanned EW systems. - Europe

Europe is another key market for unmanned EW systems, with countries like the UK, France, and Germany investing in their defense capabilities. The growing security concerns in Eastern Europe, particularly with regard to Russia, are expected to drive the demand for unmanned EW platforms in this region. - Asia-Pacific

The Asia-Pacific region is witnessing rapid growth in defense spending, especially among countries like China, India, and Japan. These nations are increasingly focusing on enhancing their electronic warfare capabilities to safeguard their borders and interests. The market for unmanned EW systems is expected to grow significantly in this region. - Rest of the World

The rest of the world, particularly the Middle East, Africa, and Latin America, is also contributing to the growth of the unmanned EW market. Geopolitical instability in these regions is prompting governments to invest in unmanned defense technologies, including EW systems.

Competitive Landscape

The unmanned electronic warfare market is highly competitive, with numerous key players operating in the sector. Major defense contractors and technology companies are developing and deploying unmanned systems with integrated EW capabilities. Some of the leading companies in the market include:

- Northrop Grumman Corporation

Northrop Grumman is a leading player in the development of unmanned aerial systems and EW technologies. The company’s unmanned platforms are widely used by military forces around the world for a variety of EW applications. - General Atomics Aeronautical Systems, Inc.

General Atomics is known for its UAVs, which are used for surveillance and EW operations. The company is also involved in the development of advanced technologies for electronic warfare. - Boeing Defense, Space & Security

Boeing is another major player in the unmanned EW market, providing advanced UAVs and EW systems for military applications. Boeing’s unmanned platforms are used by several defense forces globally. - Thales Group

Thales is a leading provider of EW systems, offering a range of solutions for military, aerospace, and defense applications. The company is involved in the development of unmanned platforms equipped with cutting-edge EW technologies. - Lockheed Martin Corporation

Lockheed Martin is a key player in the unmanned EW market, providing UAVs, sensors, and communication systems used for electronic warfare operations. The company’s products are deployed in various defense applications worldwide.

Future Outlook

The unmanned electronic warfare market is expected to continue its growth trajectory over the next decade, driven by advancements in technology and the increasing need for effective defense systems. The integration of artificial intelligence (AI), machine learning (ML), and automation into unmanned EW platforms will further enhance their capabilities, enabling faster decision-making and more effective countermeasures.

As the nature of warfare continues to evolve, the reliance on unmanned systems for EW operations will increase, particularly in contested environments where human lives may be at risk. The market is poised to benefit from the growing demand for cost-effective, versatile, and scalable defense solutions.

Conclusion

The unmanned electronic warfare market is poised for significant growth, with a projected market size of $1015.9 million by 2030. This growth is fueled by technological advancements, increasing defense budgets, and the rising demand for advanced security solutions in the face of evolving global threats. As the market matures, the integration of unmanned systems into electronic warfare operations will play a crucial role in shaping the future of modern warfare.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐌𝐨𝐫𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Robotic Process Automation (RPA) Market

Restaurant Point-Of-Sale (Pos) Terminals Market

Mobile Point-Of-Sale (Mpos) Terminals Market

Professional Service Automation Market

Over-The-Top Devices And Services Market

Network Function Virtualization Market

Hotel Management Software Market

Indonesia, Philippines, Malaysia, and Cambodia Debt Collection Software Market