The latest research report by Polaris Market Research provides a thorough analysis of a rapidly growing market. It covers all the key market aspects, including Test and Measurement Equipments Market share, size, drivers, trends, and major developments. Also, it offers market forecasts at the national, regional, and global levels. An in-depth analysis of market segments, along with an examination of the market performance across major regions and sub-regions, has been included in the study. The report provides insights into strategic developments to help stakeholders devise effective operating strategies.

The report includes a thorough value chain analysis to help readers gain crucial information on the outbound and inbound market logistics. Additionally, a thorough examination of key market participants addressing diverse consumer needs has been provided in the study. It further covers the emerging market trends and opportunities market participants can capitalize on. Pictorial representations, including charts, tables, and graphs, have been provided to help readers comprehend the key stats and other data easily.

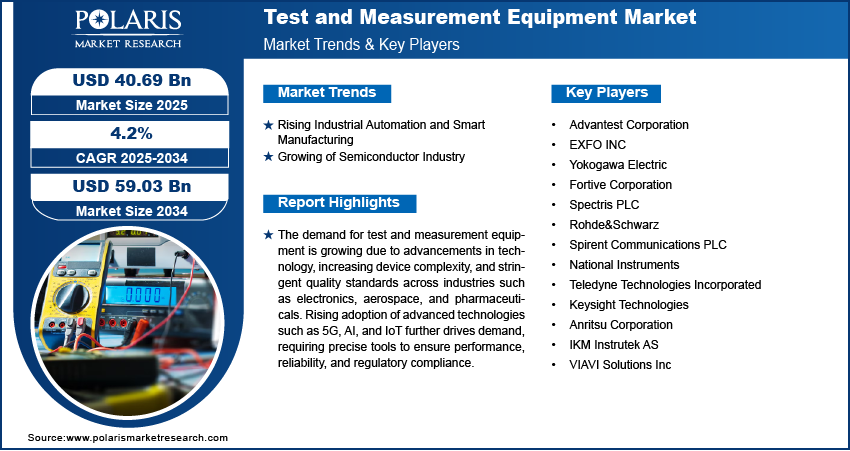

Global Test and Measurement Equipments Market size and share is currently valued at USD 39.08 billion in 2024 and is anticipated to generate an estimated revenue of USD 59.03 billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 4.2% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 – 2034

Market Dynamics:

This section of the research report sheds light on the evolution of the market, covering how market participants are responding to technological shifts. The impact of the shifting market landscape and globalization has been provided in the study. Also, all the key factors driving Test and Measurement Equipments market growth have been covered.

The report covers major market trends and opportunities market participants can capitalize on. Additionally, it presents crucial information on market restraints and challenges and how businesses can navigate them. Furthermore, an analysis of technological advancements and regulatory shifts and their impact on market demand has been included in the study.

Browse Full Insights:

https://www.polarismarketresearch.com/industry-analysis/test-and-measurement-equipment-market

A few of the key players operating in the market are:

- Advantest Corporation

- EXFO INC

- Yokogawa Electric

- Fortive Corporation

- Spectris PLC

- Rohde&Schwarz

- Spirent Communications PLC

- National Instruments

- Teledyne Technologies Incorporated

- Keysight Technologies

- Anritsu Corporation

- IKM Instrutek AS

- VIAVI Solutions Inc.

Test and Measurement Equipment Industry Developments:

- June 2024 – Advantest Launches WEL2100 for High-Precision Particle Measurement: Advantest Corporation introduced the WEL2100, a new addition to its nanoSCOUTER particle measuring equipment. Utilizing a nanopore sensor and microcurrent measurement technology, this instrument enables high-speed, precise measurement of particles such as lipid nanoparticles, viruses, and exosomes. The proprietary APT-Pore device ensures accurate size distribution measurement for particles under 30 nm. With an advanced pressure application mechanism, the WEL2100 is designed for pharmaceutical and biotechnology R&D, with potential applications in medicine and other scientific fields.

- March 2024 – GW Instek Introduces MPO-2000 Series Programmable Oscilloscopes: GW Instek launched the MPO-2000 series programmable oscilloscopes, incorporating Python programming for enhanced test and measurement automation. Available in Basic and Professional versions, the series integrates five instruments in one—an oscilloscope, spectrum analyzer, arbitrary waveform generator, digital multimeter, and programmable DC power supply. With Python scripting capabilities, it enables single and multi-instrument testing without requiring a personal computer. The MPO-2000 series is designed to improve convenience and efficiency in testing applications, particularly in education, production testing, and quality control.

- January 2023 – ABB Enhances L&W Bending Tester with New Features: ABB launched an upgraded version of its L&W Bending Tester, introducing new features to improve operator-independent bending resistance and stiffness measurements. The enhanced standalone benchtop instrument now features a large touchscreen with a user-friendly interface and improved post-processing for easier use and calibration. Additionally, it integrates with ABB’s L&W Lab Management System (LMS), connecting to the Quality Data Management module within the Manufacturing Execution System (MES). These advancements aim to enhance productivity and cost efficiency, addressing key challenges in bending property measurement.

Table of Contents Test and Measurement Equipments Market:

Global Test and Measurement Equipment Market, by Product Type

5.1. Key Findings

5.2. Introduction

5.2.1. Global Test and Measurement Equipment Market, by Product Type, 2020 – 2034 (USD billion)

5.3. General-Purpose Test Equipment

5.3.1. Global Test and Measurement Equipment Market, by General-Purpose Test Equipment, by Region, 2020 – 2034 (USD billion)

5.3.2. Oscilloscopes

5.3.3. Global Test and Measurement Equipment Market, by Oscilloscopes, by Region, 2020 – 2034 (USD billion)

5.3.4. Signal Generator

5.3.5. Global Test and Measurement Equipment Market, by Signal Generator, by Region, 2020 – 2034 (USD billion)

5.3.6. Logic Analyzer

5.3.7. Global Test and Measurement Equipment Market, by Logic Analyzer, by Region, 2020 – 2034 (USD billion)

5.3.8. Multimeter

5.3.9. Global Test and Measurement Equipment Market, by Multimeter, by Region, 2020 – 2034 (USD billion)

5.3.10. Spectrum Analyzer

5.3.11. Global Test and Measurement Equipment Market, by Spectrum Analyzer, by Region, 2020 – 2034 (USD billion)

5.3.12. BERT Solutions

5.3.13. Global Test and Measurement Equipment Market, by BERT Solutions, by Region, 2020 – 2034 (USD billion)

5.3.14. Network Analyzer

5.3.15. Global Test and Measurement Equipment Market, by Network Analyzer, by Region, 2020 – 2034 (USD billion)

5.3.16. Electronic Counters

5.3.17. Global Test and Measurement Equipment Market, by Electronic Counters, by Region, 2020 – 2034 (USD billion)

5.3.18. Others

5.3.19. Global Test and Measurement Equipment Market, by Others, by Region, 2020 – 2034 (USD billion)

5.4. Mechanical Test Equipment

5.4.1. Global Test and Measurement Equipment Market, by Mechanical Test Equipment, by Region, 2020 – 2034 (USD billion)

5.4.2. Non-Destructive Test Equipment

5.4.3. Global Test and Measurement Equipment Market, by Non-Destructive Test Equipment, by Region, 2020 – 2034 (USD billion)

5.4.4. Machine Vision Inspection Systems

5.4.5. Global Test and Measurement Equipment Market, by Machine Vision Inspection Systems, by Region, 2020 – 2034 (USD billion)

5.4.6. Machine Condition Monitoring Systems

5.4.7. Global Test and Measurement Equipment Market, by Machine Condition Monitoring Systems, by Region, 2020 – 2034 (USD billion)

6. Global Test and Measurement Equipment Market, by Service Type

6.1. Key Findings

6.2. Introduction

6.2.1. Global Test and Measurement Equipment Market, by Service Type, 2020 – 2034 (USD billion)

6.3. Calibration Service

6.3.1. Global Test and Measurement Equipment Market, by Calibration Service, by Region, 2020 – 2034 (USD billion)

6.4. After Sales

6.4.1. Global Test and Measurement Equipment Market, by After Sales, by Region, 2020 – 2034 (USD billion)

6.5. Other Services

6.5.1. Global Test and Measurement Equipment Market, by Other Services, by Region, 2020 – 2034 (USD billion)

7. Global Test and Measurement Equipment Market, by End-Use Industry

7.1. Key Findings

7.2. Introduction

7.2.1. Global Test and Measurement Equipment Market, by End-Use Industry, 2020 – 2034 (USD billion)

7.3. Electronic & Semiconductor Industry

7.3.1. Global Test and Measurement Equipment Market, by Electronic & Semiconductor Industry, by Region, 2020 – 2034 (USD billion)

7.3.1.1.

7.4. Automotive Industry

7.4.1. Global Test and Measurement Equipment Market, by Automotive Industry, by Region, 2020 – 2034 (USD billion)

7.5. Telecommunication & Data Centers

7.5.1. Global Test and Measurement Equipment Market, by Telecommunication & Data Centers, by Region, 2020 – 2034 (USD billion)

7.6. Aerospace & Defense

7.6.1. Global Test and Measurement Equipment Market, by Aerospace & Defense, by Region, 2020 – 2034 (USD billion)

7.7. Medical Technology Industry

7.7.1. Global Test and Measurement Equipment Market, by Medical Technology Industry, by Region, 2020 – 2034 (USD billion)

7.8. Other Industries

7.8.1. Global Test and Measurement Equipment Market, by other industries, by Region, 2020 – 2034 (USD billion)

Top Features of Test and Measurement Equipments Market Report:

- In-depth market analysis covering all the key market aspects

• Historical, current, and projected market size in terms of value and volume

• Detailed market segmentation covering all the major market segments

• Thorough examination of major market developments

• Assessment of the product offerings of market players and their operating strategies

• Includes classification of potential new clients or partners in the target demographic

Key Questions Answered in Report:

- What are the key market growth drivers?

• What are the market projections considering production value and capacity?

• What will be the impact of strategic developments on market growth?

• Who are the Test and Measurement Equipmentsmarket key players?

• What are the major market trends that can be used to maximize revenue?

• Which research methodologies have been used while prepearing the research report?

• Who could benefit from the research report?

More Trending Latest Reports By Polaris Market Research:

Automotive Battery Thermal Management System Market