Mordor Intelligence has published a new report on the European ETF Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

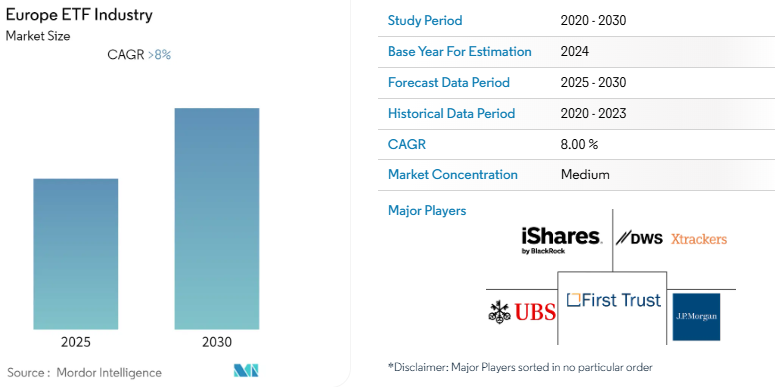

The European Exchange-Traded Fund (ETF) market is experiencing a significant expansion, with projections indicating a Compound Annual Growth Rate (CAGR) exceeding 8% during the forecast period leading up to 2030. This growth is propelled by evolving investor preferences, regulatory advancements, and the increasing adoption of innovative investment strategies.

Key Trends

Rise of Active ETFs

A notable development in the European ETF landscape is the surge in active ETF offerings. Unlike traditional passive ETFs that track specific indices, active ETFs are managed by fund managers who make strategic investment decisions to outperform the market. Major asset managers, including JPMorgan Asset Management, Fidelity International, and Janus Henderson, are expanding their active ETF portfolios to meet growing investor demand. Projections suggest that the European active ETF market could escalate from its current valuation of approximately $50 billion to over $1 trillion by 2030.

Emphasis on ESG Integration

Environmental, Social, and Governance (ESG) considerations are increasingly influencing investment decisions. In 2024, ESG-focused ETFs in Europe attracted substantial inflows, with a record €63 billion in the third quarter alone. Investors are gravitating towards ETFs that align with sustainable and responsible investment principles, reflecting a broader commitment to ethical investing.

Report Overview: https://www.mordorintelligence.com/industry-reports/europe-etf-industry

Market Segmentation

The European ETF market is diverse, encompassing various asset classes and investment strategies. Key segments include:

Equity ETFs: These funds provide exposure to a broad range of equity markets, including specific sectors and geographic regions.

Fixed Income ETFs: Offering access to government and corporate bonds, these ETFs cater to investors seeking income generation and portfolio diversification.

Commodity ETFs: These funds track the performance of commodities such as gold, oil, and agricultural products, allowing investors to hedge against inflation and diversify their holdings.

Alternative ETFs: This category includes funds that employ alternative investment strategies, such as hedge fund replication or exposure to cryptocurrencies.

Money Market ETFs: Focusing on short-term debt instruments, these ETFs are designed for investors seeking liquidity and capital preservation.

Mixed Assets ETFs: Combining multiple asset classes, these funds offer diversified exposure within a single investment vehicle.

Geographically, the market is segmented into regions including the UK, Germany, France, Italy, the Netherlands, Spain, and the rest of Europe, each exhibiting unique investment trends and preferences.

Get a Customized Report Tailored to Your Requirements. – https://www.mordorintelligence.com/market-analysis/etfs

Key Players

The European ETF market is characterized by the presence of several prominent asset management firms that have established themselves as leaders through diverse product offerings and significant market share. Notable players include:

iShares by BlackRock: As one of the largest ETF providers globally, iShares offers a comprehensive range of ETFs across various asset classes and sectors, catering to both retail and institutional investors.

Xtrackers: Operated by DWS Group, Xtrackers provides a wide array of ETFs, including those focused on equities, fixed income, and commodities, with an emphasis on innovative and sustainable investment solutions.

First Trust Europe: Known for its specialized and thematic ETFs, First Trust Europe offers products that target specific investment niches and strategies, appealing to investors seeking targeted exposure.

UBS: UBS’s ETF offerings encompass a broad spectrum of asset classes, with a focus on quality and sustainable investing, aligning with the firm’s commitment to responsible investment practices.

J.P. Morgan: J.P. Morgan’s ETF suite includes both passive and active strategies, providing investors with options to meet diverse investment objectives and risk appetites.

These firms have been instrumental in driving the growth and innovation within the European ETF market, continually expanding their product lines to meet evolving investor demands.

Conclusion

The European ETF market is on a robust growth trajectory, underpinned by the increasing popularity of active management strategies and a heightened focus on ESG considerations. As asset managers continue to innovate and expand their ETF offerings, and as investors seek cost-effective, transparent, and diversified investment solutions, the ETF market in Europe is poised for sustained expansion in the coming years.

Industry Related Reports