Market Overview

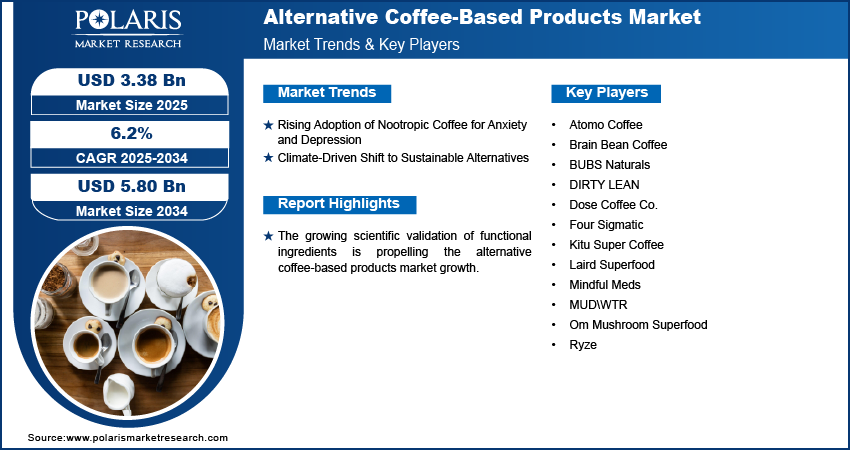

The global Alternative Coffee-Based Products Market has experienced notable growth in recent years, driven by evolving consumer preferences and rising awareness about sustainable and healthy lifestyle choices. Valued at USD 3.19 billion in 2024, this dynamic market is projected to increase to USD 3.38 billion in 2025 and reach approximately USD 5.80 billion by 2034, expanding at a CAGR of 6.2% during the forecast period.

Alternative coffee products refer to beverages and food items that use substitutes for traditional coffee beans, such as chicory root, dandelion, mushroom, barley, rye, figs, and other naturally caffeine-free or low-caffeine ingredients. These products are gaining popularity for their health benefits, environmental sustainability, and appeal to niche consumer segments like vegans, health-conscious individuals, and those with caffeine sensitivities.

The shift away from conventional coffee stems from concerns about the environmental impact of coffee farming, caffeine-related health issues, and a broader movement towards plant-based and functional beverages. These factors collectively contribute to the steady expansion of the alternative coffee industry across global markets.

Market’s Growth Drivers

1. Rising Health Awareness and Functional Benefits

One of the primary drivers of the alternative coffee-based products market is the increasing consumer focus on health and wellness. As more individuals seek to reduce their caffeine intake due to issues such as anxiety, insomnia, and heart health, alternative coffee solutions offer a beneficial compromise. Ingredients like chicory, mushrooms (e.g., lion’s mane, reishi), and adaptogenic herbs are being used not only for flavor but also for their purported cognitive and digestive health benefits.

2. Increasing Demand for Plant-Based and Vegan Products

The plant-based revolution has touched nearly every food and beverage category, and coffee alternatives are no exception. Veganism and vegetarianism are no longer niche lifestyles but are now embraced by a large portion of the population. Consumers are increasingly turning to plant-derived substitutes that align with their ethical and dietary beliefs, giving alternative coffee a strong foothold in this expanding demographic.

3. Environmental and Ethical Considerations

Coffee cultivation, especially in large-scale operations, is associated with deforestation, water usage, and the exploitation of labor in some producing countries. Conscious consumers are opting for alternatives that offer a smaller environmental footprint and are often produced more ethically. Ingredients like chicory root, for instance, can be grown in temperate climates and harvested with fewer resources, making them a more sustainable option.

4. Innovation and Product Diversification

The market has witnessed a surge in innovative product development. From ready-to-drink beverages to instant powders, pods, and specialty blends, manufacturers are capitalizing on consumer interest with novel formulations. Brands are exploring unique ingredient combinations and functional benefits to differentiate themselves in a competitive space. This innovation is driving consumer trial and long-term adoption.

5. E-commerce Expansion and Marketing Strategies

The rise of digital retail has enabled alternative coffee brands to reach a global audience. Direct-to-consumer models, online subscriptions, and influencer marketing are reshaping how these products are discovered and consumed. Small and emerging brands have successfully carved out loyal communities online by emphasizing transparency, storytelling, and sustainability.

Browse Full Insights:

https://www.polarismarketresearch.com/industry-analysis/alternative-coffee-based-products-market

Key Trends Shaping the Market

1. Caffeine-Free and Low-Caffeine Preferences

Consumers are becoming more mindful of their caffeine intake, leading to increased interest in zero- or low-caffeine alternatives. Products using ingredients like dandelion root, barley, and carob offer a roasted flavor profile similar to coffee but without the stimulant effects.

2. Mushroom-Based Coffee Alternatives

Mushroom-infused coffee substitutes, especially those featuring lion’s mane, chaga, and reishi, are gaining attention for their adaptogenic and nootropic properties. These ingredients are marketed as helping to improve focus, reduce stress, and support immune health.

3. Hybrid Products and Cross-Category Innovations

Hybrid products that blend alternative coffee ingredients with superfoods, collagen, or protein powders are gaining traction. These drinks serve dual purposes: energizing consumers while also delivering functional health benefits, such as anti-aging or metabolic support.

4. Cold Brews and Ready-to-Drink Formats

Convenience continues to be a major factor in consumer buying decisions. As a result, alternative coffee products are increasingly available in grab-and-go bottles and cans. Cold brews, lattes, and pre-mixed blends made with oat, almond, or coconut milk are especially popular among younger consumers.

5. Local and Artisan Branding

Smaller, craft-style producers are gaining consumer trust through unique branding, artisan quality, and local sourcing. Consumers are attracted to storytelling and community-oriented branding, especially when the product aligns with their personal values.

Research Scope

The research surrounding the alternative coffee-based products market includes an extensive analysis of market size, growth trajectory, consumer preferences, and the competitive landscape. Key areas of focus include:

-

Ingredient Innovation: The continuous development of new blends and functional formulations.

-

Consumer Behavior: Patterns, preferences, and motivators among diverse demographic groups.

-

Distribution Channels: The effectiveness of online versus offline channels in driving sales.

-

Geographical Penetration: Market performance across developed and developing regions.

-

Regulatory Frameworks: Impact of food labeling, organic certification, and health claims on product development and marketing.

Research also evaluates the impact of macroeconomic factors such as global supply chains, climate change, and the rising cost of conventional coffee beans, which are accelerating the demand for more sustainable options.

Market Segmentation

The global alternative coffee-based products market can be segmented based on several key factors:

1. By Product Type

-

Beverages: Instant coffee substitutes, ground blends, pods, RTD drinks

-

Food Products: Coffee-flavored snacks, energy bars, cereals

-

Supplements: Coffee-alternative powders with functional ingredients

2. By Ingredient

-

Chicory Root

-

Mushrooms (Reishi, Lion’s Mane, Chaga)

-

Dandelion Root

-

Barley and Rye

-

Carob and Fig

-

Herbal Blends

3. By Form

-

Powder

-

Liquid

-

Capsules or Pods

-

Ready-to-Drink (RTD)

4. By Distribution Channel

-

Online Retailers

-

Supermarkets and Hypermarkets

-

Specialty Stores

-

Health Food Stores

-

Cafés and Coffee Shops

5. By Region

-

North America: Leading due to health-conscious consumers and a strong wellness culture.

-

Europe: High demand driven by sustainability concerns and innovative product offerings.

-

Asia-Pacific: Rapidly growing market due to increasing western influence and rising disposable incomes.

-

Latin America & Middle East: Emerging regions where urbanization and dietary diversification are driving adoption.

Conclusion

The global alternative coffee-based products market is brewing with opportunity. As health consciousness, environmental responsibility, and functional nutrition continue to shape consumer habits, alternative coffee products are no longer fringe innovations but mainstream alternatives. The combination of health benefits, ethical sourcing, and evolving flavors is creating a robust foundation for long-term growth.

Looking ahead, companies in this space will need to maintain a strong focus on transparency, ingredient innovation, and consumer education to retain market share and stay competitive. With a favorable growth outlook and increasing consumer curiosity, the alternative coffee wave is well on its way to reshaping the global beverage industry.