Market Overview

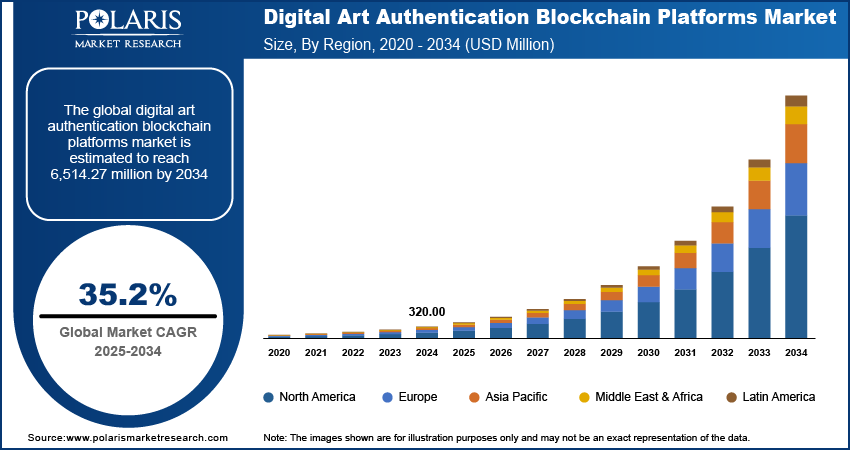

The fusion of blockchain technology with the art world has sparked a revolutionary shift in how digital art is authenticated, bought, sold, and collected. As of 2024, the global digital art authentication blockchain platforms market was valued at USD 320.00 million. With the rapid advancement of digital ownership and increased demand for verifiable provenance, this market is expected to grow significantly, reaching USD 431.23 million in 2025 and soaring to USD 6,514.27 million by 2034, showcasing a Compound Annual Growth Rate (CAGR) of 35.2% between 2025 and 2034.

Digital art authentication platforms that leverage blockchain technology provide decentralized, immutable, and transparent systems for proving the originality and ownership of digital artwork. This innovation addresses long-standing issues in the art world, including fraud, forgery, and provenance tracking, especially in a time where NFTs and digital collectibles have become mainstream.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

Market Growth Drivers

- Surge in Digital Art and NFT Popularity

The rise of NFTs (non-fungible tokens) has propelled digital art into the spotlight. Artists, collectors, and investors are increasingly interested in securing digital works via blockchain, with platforms offering tokenization and verifiable ownership as key services.

- Increased Focus on Provenance and Authenticity

In a digital world where copying and piracy are rampant, the need for certifying digital art’s origin and legitimacy has become critical. Blockchain provides an immutable ledger that records every transaction and change in ownership, creating a transparent provenance trail.

- Expanding Use Cases Beyond Art

While digital art remains a primary focus, blockchain authentication platforms are expanding into other creative and intellectual property sectors, such as music, photography, virtual fashion, and even metaverse assets. This diversification is fueling further market expansion.

- Artist Empowerment and Direct Monetization

Blockchain platforms empower artists by allowing direct sales and royalties on secondary market transactions, often coded into smart contracts. This model reduces reliance on intermediaries and ensures artists are fairly compensated over time.

- Growing Institutional and Investor Interest

Art as an asset class is becoming increasingly popular among institutional investors. Authentication through blockchain provides the transparency and trust needed for high-value digital art investments, thereby attracting more capital to the space.

Key Trends in the Market

- Integration of AI for Art Analysis

Some platforms are combining artificial intelligence with blockchain to further verify originality through pattern recognition, style analysis, and creator behavior tracking, reducing the risk of AI-generated fakes or art theft.

- Development of Cross-Chain Interoperability

As NFTs are minted on various blockchains like Ethereum, Solana, and Tezos, platforms are working on solutions to ensure seamless authentication and provenance across chains.

- Regulatory Movement

Governments and legal bodies are beginning to recognize digital assets, with discussions around intellectual property rights, taxation, and fraud protection coming to the fore. Legal clarity will further stabilize the market.

- Rise of Fractional Ownership

Blockchain makes it easier to divide ownership of high-value digital art into fractional shares, allowing multiple investors to co-own a piece. This democratizes access and liquidity in the art investment market.

- Eco-friendly Blockchain Solutions

Given environmental concerns around energy-intensive blockchains like Ethereum, there’s a push toward more sustainable networks (e.g., Proof-of-Stake models) to support ethical and environmentally conscious art platforms.

Research Scope

The market research for digital art authentication blockchain platforms spans across:

- Historical data (2020–2024)

- Forecast period (2025–2034)

- Technological landscape

- Competitive dynamics

- Consumer behavior and adoption patterns

- Regulatory frameworks

- Investment trends

The study includes insights into platform architecture, token standards (ERC-721, ERC-1155, etc.), smart contract innovation, and data storage methodologies for high-value digital assets.

Market Segmentation

To better understand the nuances of this rapidly growing market, it can be segmented in several key ways:

- By Component

- Platform/Software Solutions: Systems used to mint, register, and authenticate digital artworks.

- Services: Consulting, integration, maintenance, legal assistance, and customer support for artists and collectors.

- By Application

- Art Galleries & Museums: Use authentication platforms to digitize and preserve works.

- Individual Artists: Use platforms to mint, authenticate, and sell NFTs directly to consumers.

- Collectors & Investors: Use platforms to verify ownership and provenance before acquiring digital works.

- Marketplaces: Integrate with authentication platforms to ensure the legitimacy of NFTs sold on their platforms.

- By Blockchain Type

- Public Blockchains: Open networks like Ethereum and Solana used for transparent authentication.

- Private/Consortium Blockchains: Used by galleries or institutions requiring more controlled environments.

- By End User

- Independent Artists

- Art Dealers

- Auction Houses

- Art Institutions

- Crypto Enthusiasts & Investors

Key Players in the Market

Several companies and platforms are at the forefront of this growing sector:

- Verisart – One of the first platforms to combine blockchain with art certification.

- Ascribe – Focuses on digital ownership and rights management.

- Artory – Specializes in data integrity for physical and digital art provenance.

- Codex Protocol – Offers a decentralized title registry for art and collectibles.

- OpenSea & Rarible – Major NFT marketplaces integrating authentication mechanisms.

Startups and newer players are emerging with AI-enhanced verification tools, carbon-neutral minting, and greater artist-centric services, intensifying competition and innovation.

Challenges and Barriers

- Environmental Concerns

Proof-of-Work blockchain systems consume large amounts of energy, which has raised sustainability questions about the long-term use of certain platforms in digital art.

- Lack of Standardization

The absence of universal standards for authentication, metadata, and royalties can lead to fragmented practices and interoperability issues.

- Legal and Copyright Complexities

With many jurisdictions lacking clear digital property laws, ownership disputes, copyright infringement, and the enforcement of royalties remain contentious issues.

- Security Risks

While blockchain is secure, the platforms themselves (e.g., smart contracts, wallets, and storage solutions) can be vulnerable to hacking, phishing, and smart contract bugs.

Outlook and Future Opportunities

The future of the digital art authentication market is promising. As blockchain matures and integrates more seamlessly into both the traditional and digital art worlds, the platforms supporting authentication will likely evolve into core components of the art ecosystem.

Key future opportunities include:

- Enterprise and institutional adoption of authentication tools by galleries, museums, and universities.

- Partnerships with luxury brands and media companies to authenticate collectibles, merchandise, and virtual experiences.

- Integration with AI-generated art tools to trace and verify AI-created works.

- Expansion into the metaverse, where owning verified digital assets will become a fundamental part of identity and experience.

Conclusion

The global digital art authentication blockchain platforms market is undergoing a transformative phase, driven by digital innovation, user demand for security and transparency, and the mainstreaming of NFTs. With an expected CAGR of 35.2% between 2025 and 2034, the market presents massive potential for platforms that can balance innovation, trust, and accessibility.

As artists seek autonomy, collectors demand security, and institutions embrace digital transformation, blockchain-powered authentication platforms are poised to become the bedrock of the digital art economy.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐌𝐨𝐫𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

AI-Powered Enterprise Automation Market

Asia Pacific Radiopharmaceuticals Market

Joint Replacement Devices Market

High Protein Bakery Products Market

Livestock Identification Market

Grain Oriented Electrical Steel Market

𝐁𝐫𝐨𝐰𝐬𝐞 𝐌𝐨𝐫𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐀𝐫𝐭𝐢𝐜𝐥𝐞𝐬: