Quick Commerce Market Overlook

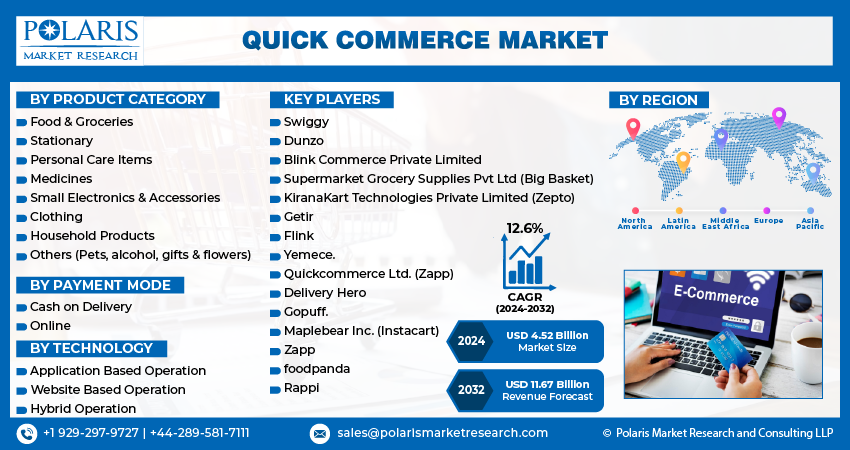

The global quick commerce market was valued at USD 4.02 billion in 2023 and is expected to grow at a CAGR of 12.6% during the forecast period.

Market Overview

The Quick Commerce (Q-commerce) market is experiencing rapid growth as it responds to the evolving demands of today’s consumer base. Q-commerce, which refers to ultra-fast delivery of products, typically within an hour or less, has emerged as a major trend in the retail industry. This market is primarily fueled by the need for instant gratification among consumers and the increasing adoption of mobile technologies and e-commerce platforms. As more consumers prioritize convenience and speed, businesses are enhancing their delivery infrastructure and adopting innovative technologies to meet these demands.

Quick commerce encompasses a range of products, including groceries, pharmaceuticals, fashion, electronics, and other daily essentials, delivered at lightning speeds. This contrasts with traditional e-commerce, where delivery times typically span a few days. The rise of hyperlocal delivery services, coupled with the rapid growth of urbanization, has played a significant role in the market’s expansion.

Key features that define Q-commerce include rapid delivery, real-time order tracking, a broad product range, and a seamless customer experience. The demand for instant delivery services is reshaping the retail landscape, prompting major players in the industry to invest in technological solutions and distribution networks. As this sector continues to grow, Q-commerce is expected to become an integral part of consumer shopping behavior.

Key Market Growth Drivers

Several factors are driving the growth of the quick commerce market. These key growth drivers are helping to expand the reach of Q-commerce services globally:

- Consumer Demand for Instant Gratification

The primary driver of Q-commerce is the rising demand for fast and efficient delivery services. As more people lead fast-paced lifestyles, the need for quick and seamless access to products is at an all-time high. Consumers are increasingly opting for the convenience of online shopping but expect faster delivery times. Q-commerce addresses this need by providing deliveries within 30 to 60 minutes, offering a solution to the delay and frustration often associated with traditional delivery methods.

- Technological Advancements in Logistics and Delivery Systems

Advances in logistics technology are significantly improving the efficiency of the quick commerce market. Innovations such as automation in warehouses, advanced route optimization algorithms, and the use of drones and autonomous vehicles are streamlining the delivery process. These technologies reduce the time required to fulfill an order and improve the accuracy of deliveries, enhancing the overall customer experience.

Moreover, mobile apps and real-time tracking systems allow consumers to place orders and track deliveries instantly, adding a level of convenience and transparency that was previously unattainable. The growth of the internet of things (IoT) and artificial intelligence (AI) is further transforming the logistics landscape, making it possible to handle increasing demand more efficiently.

- Increased Smartphone and Internet Penetration

As smartphone penetration continues to increase globally, so does the accessibility of Q-commerce platforms. Consumers can now easily place orders for groceries, pharmaceuticals, and other essentials with a few taps on their smartphones. This ease of access is helping to drive market growth, particularly in urban areas where consumers are more inclined to use digital services for convenience. Moreover, the expansion of the internet across rural and underserved regions is contributing to the rapid growth of quick commerce, making it possible for businesses to reach a wider consumer base.

- Changing Consumer Shopping Habits

The COVID-19 pandemic has accelerated the shift from physical retail to online shopping, leading to a significant increase in demand for quick delivery services. Consumers are now more accustomed to ordering products online and expect them to be delivered quickly. The trend toward e-commerce and the desire for increased convenience have made Q-commerce an attractive option for customers who need products urgently but want to avoid long delivery times.

- Investment in Infrastructure by Q-Commerce Platforms

Investment in logistics infrastructure by Q-commerce platforms is another crucial factor contributing to market growth. Companies are establishing a network of warehouses in key locations to ensure rapid delivery and greater order fulfillment capacity. These warehouses, strategically located within urban areas, allow for quick dispatch and shorter delivery distances, reducing delivery time.

Browse Full Insights:

https://www.polarismarketresearch.com/industry-analysis/quick-commerce-market

Market Challenges

Despite its impressive growth, the quick commerce market faces several challenges that companies must navigate to remain competitive:

- High Operational Costs

One of the biggest challenges for Q-commerce businesses is managing operational costs. Rapid delivery models demand a significant investment in logistics, including inventory management, delivery personnel, and last-mile infrastructure. This can result in higher operational costs for businesses, which may impact profitability, especially when operating in highly competitive markets where profit margins are thin.

- Supply Chain and Inventory Management Issues

Quick commerce companies rely on efficient inventory management to ensure the timely delivery of products. However, maintaining a dynamic inventory across multiple locations to meet fluctuating consumer demand can be difficult. Stockouts or delayed shipments due to logistical inefficiencies can lead to frustrated customers, which can harm the brand’s reputation and consumer trust. Furthermore, the management of perishable goods, such as groceries, requires highly efficient supply chains to prevent spoilage and waste.

- Intense Competition

The growing demand for Q-commerce services has attracted many players to the market, resulting in intense competition. The presence of both established e-commerce giants (like Amazon and Walmart) and new entrants has made it challenging for companies to differentiate themselves and retain customers. Additionally, many new startups in the sector are under pressure to maintain high-quality services while balancing the high costs associated with fast deliveries.

- Regulatory and Delivery Constraints

As Q-commerce platforms expand, they must also navigate regulatory and compliance challenges. Different countries and regions have varying rules governing the delivery of goods, taxes, and consumer protection laws, which can pose operational challenges for global Q-commerce businesses. Additionally, concerns related to traffic congestion, delivery vehicle emissions, and environmental impact are increasing as Q-commerce services scale up.

Regional Analysis

The Quick Commerce market has seen varied adoption across different regions, with certain areas witnessing faster growth due to favorable factors such as technological advancements, urbanization, and consumer demand for faster delivery.

- North America

North America is one of the leading regions in the quick commerce market, driven by a strong consumer preference for convenience and fast delivery. The U.S. and Canada are major players in this space, with companies like Uber Eats, DoorDash, and Postmates dominating the market. The rapid adoption of mobile apps, along with significant investments in delivery infrastructure, has facilitated the growth of Q-commerce services in this region. Additionally, the increasing number of time-sensitive product categories like groceries, health supplies, and electronics is further fueling the demand for quick delivery.

- Europe

Europe is also experiencing growth in the Q-commerce sector, with countries like the UK, Germany, and France showing significant interest in quick delivery services. European consumers are increasingly adopting online shopping, and the demand for faster deliveries is propelling the market forward. European cities, particularly in the urban areas, are witnessing an increase in Q-commerce startups and investments. The emphasis on sustainability and eco-friendly delivery solutions in this region is encouraging businesses to adopt green practices, such as electric delivery vehicles and carbon-neutral services.

- Asia-Pacific

The Asia-Pacific region is expected to see the highest growth in the quick commerce market due to a combination of urbanization, rising disposable incomes, and growing internet penetration. Countries like China, India, Japan, and South Korea are at the forefront of Q-commerce adoption. The increasing use of smartphones and growing middle-class populations in these countries are contributing to the demand for instant delivery services. Additionally, logistics innovations in Asia, such as the use of drones and autonomous delivery vehicles, are driving efficiency and speed in the region.

- Latin America and Middle East & Africa

While Q-commerce is still in the nascent stage in Latin America and the Middle East and Africa, these regions are expected to witness considerable growth in the coming years. Brazil and Mexico are showing early signs of quick commerce adoption, while the UAE and Saudi Arabia are emerging as strong markets in the Middle East. As urbanization accelerates and more people in these regions embrace online shopping, demand for faster and more efficient delivery solutions will increase.

Key Companies

Several key companies are leading the charge in the Q-commerce market, including:

- Uber Eats

- DoorDash

- Postmates

- Gorillas

- Instacart

- Zapp

- Flink

These companies are leveraging technology, logistics infrastructure, and strategic partnerships to scale their operations and cater to the growing demand for fast and efficient delivery services.

Recent Developments

- In May 2023, Getir has revealed a collaboration with Uber Eats, intending to extend its instant grocery delivery service to Uber Eats users in the UK.

- In October 2023, Carrefour Polska has revealed plans to expand its collaboration with Glovo in Poland. The company will now offer its services in approximately 69 new locations, including Pszczyna, Tomaszów, Zgorzelec, & Mazowiecki.

Conclusion

The quick commerce market is transforming the retail landscape, offering consumers the convenience of rapid product delivery within an hour or less. This market’s growth is driven by consumer demand for instant gratification, advancements in logistics technology, and increased smartphone penetration. While challenges like high operational costs and intense competition remain, the market is expected to continue its expansion, particularly in North America, Europe, and the Asia-Pacific region. The future of Q-commerce looks promising, as companies innovate and streamline their operations to meet the evolving demands of today’s fast-paced consumer environment.