Market Overview

In a world increasingly moving toward digitized financial ecosystems, stablecoins and Central Bank Digital Currencies (CBDCs) are at the forefront of financial innovation. These digital assets represent the next wave of currency evolution—merging the benefits of blockchain technology with the stability of traditional fiat currencies.

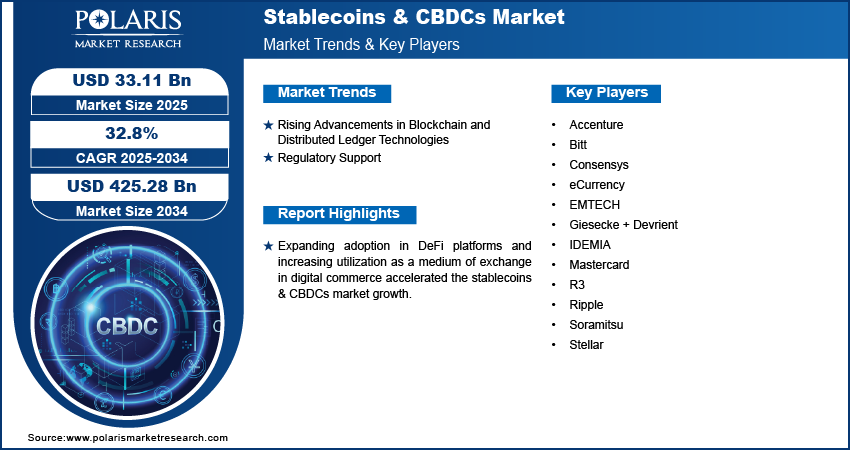

According to recent estimates, the global stablecoins and CBDCs market was valued at USD 25.20 billion in 2024, projected to grow to USD 33.11 billion by 2025, and expected to skyrocket to USD 425.28 billion by 2034. This extraordinary growth reflects a Compound Annual Growth Rate (CAGR) of 32.8% between 2025 and 2034. The figures signify more than just technological adoption—they indicate a paradigm shift in how value is stored, transferred, and governed in the global economy.

Understanding Stablecoins & CBDCs

- Stablecoins are digital currencies typically pegged to a reserve asset like the US Dollar or Euro. Examples include Tether (USDT), USD Coin (USDC), and DAI. Their main appeal lies in combining the stability of fiat with the flexibility of cryptocurrencies.

- CBDCs are digital versions of a country’s official currency, issued and regulated by the central bank. Unlike decentralized cryptocurrencies, CBDCs are fully backed by governments and designed to function as legal tender. China’s digital yuan (e-CNY) and the European Central Bank’s digital euro initiative are key examples.

While both types of assets share the goal of modernizing money, their use cases, governance models, and technological underpinnings vary. However, both are playing essential roles in reshaping global finance.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/stablecoins-and-cbdcs-market

Market Growth Drivers

- Global Push for Financial Inclusion

In many emerging markets, millions remain unbanked or underbanked. Stablecoins and CBDCs offer an accessible alternative to traditional banking by enabling peer-to-peer digital payments using smartphones. Governments and fintech firms alike are leveraging this technology to reach remote populations and promote inclusive financial participation.

- Rising Demand for Cross-Border Payments

Cross-border transactions are typically slow, costly, and complex. Stablecoins have emerged as a go-to solution for seamless international transfers, offering near-instant transactions with lower fees. Simultaneously, CBDCs have the potential to create interoperable networks between countries, enabling more efficient foreign exchange settlements.

- Monetary Policy Modernization

Central banks around the globe are exploring CBDCs as a means of enhancing monetary control, especially in an increasingly cashless society. Digital currencies allow central banks to track money flow in real-time, implement negative interest rates, and respond more dynamically to economic crises.

- Institutional Adoption

Major financial institutions, including Visa, Mastercard, and PayPal, are integrating stablecoins into their services. Their involvement provides legitimacy, broadens adoption, and helps bridge the gap between traditional finance and decentralized finance (DeFi). At the same time, central banks are collaborating with tech firms to pilot and deploy CBDCs.

- Private Sector Innovation

Big Tech companies like Meta (formerly Facebook) and fintech startups are investing in stablecoin projects or CBDC infrastructure. This surge in private-sector participation is accelerating innovation, driving competitive development, and encouraging governments to fast-track their digital currency initiatives.

Key Market Trends

- Programmable Money and Smart Contracts

One of the most compelling innovations in digital currency is programmable money. Stablecoins and CBDCs can be integrated with smart contracts—self-executing agreements that automate transactions based on predefined conditions. This capability is revolutionizing sectors like supply chain, insurance, and lending.

- Interoperability and Cross-Chain Solutions

As the number of stablecoins and CBDCs grows, ensuring that they can work seamlessly with one another becomes crucial. Emerging protocols and standards are being developed to support interoperability across blockchain networks, which is essential for global adoption.

- Focus on Regulation and Compliance

Regulators worldwide are paying close attention to the rapid expansion of digital currencies. While some countries have outright banned stablecoins or crypto, others are creating frameworks to ensure safe, transparent use. Regulation will be a major determinant in shaping the market’s future, with an emphasis on anti-money laundering (AML) and know-your-customer (KYC) protocols.

- Retail vs. Wholesale CBDCs

CBDCs are being designed in two primary models: retail (for public use) and wholesale (for interbank settlements). While retail CBDCs aim to replace cash for citizens, wholesale versions are meant to enhance institutional money transfers. Both segments are developing simultaneously, often with different technological and policy considerations.

- CBDCs as a Tool for De-dollarization

Countries like China and Russia are exploring CBDCs as a way to reduce dependency on the US dollar in international trade. This trend could potentially shift global power dynamics in currency reserves and payment systems.

Research Scope

The scope of research in the stablecoins and CBDCs space includes:

- Pilot Programs & Use Case Trials: Researching real-world applications of CBDCs in retail environments and international settlements.

- Blockchain Scalability & Energy Efficiency: Developing next-gen consensus mechanisms and eco-friendly networks for issuing stablecoins and CBDCs.

- Cybersecurity Protocols: Designing robust systems to protect against hacking, fraud, and systemic attacks.

- Consumer Behavior Analysis: Studying user adoption rates, preferences, and concerns around privacy, control, and ease of use.

- Cross-border Collaboration Models: Exploring frameworks for CBDC interoperability across sovereign monetary systems.

These research efforts are being conducted by governments, think tanks, financial institutions, and tech companies alike, creating a highly dynamic and collaborative ecosystem.

Market Segmentation

By Type:

- Fiat-Collateralized Stablecoins: Backed 1:1 by fiat reserves (e.g., USDC, USDT).

- Crypto-Collateralized Stablecoins: Backed by other cryptocurrencies (e.g., DAI).

- Algorithmic Stablecoins: Maintain peg through algorithms and smart contracts.

- Retail CBDCs: Digital currencies for general public use.

- Wholesale CBDCs: Designed for financial institutions.

By Application:

- Payments & Remittances

- Cross-Border Transactions

- DeFi and Lending

- Government Disbursements

- Monetary Policy Implementation

- Trade Settlements

By End-User:

- Retail Consumers

- Banks and Financial Institutions

- Central Banks

- E-commerce Platforms

- Government Agencies

By Region:

- North America: Dominated by private sector innovation and regulatory debates.

- Europe: Strong focus on CBDC pilots led by the European Central Bank.

- Asia-Pacific: China leads global CBDC adoption; stablecoin usage rising in Southeast Asia.

- Middle East & Africa: Early-stage development, with focus on financial inclusion.

- Latin America: Stablecoins gaining traction due to economic instability and inflation.

Conclusion

The global stablecoins and CBDCs market is not merely a financial trend—it is a foundational shift in how the world perceives and utilizes money. The rapid acceleration from USD 25.20 billion in 2024 to an expected USD 425.28 billion by 2034 reflects more than just technological advancement; it symbolizes a global consensus toward reimagining monetary infrastructure.

With both public and private sectors collaborating at an unprecedented pace, the landscape of digital currency will continue to evolve, driven by innovation, necessity, and opportunity. Whether it’s streamlining cross-border payments, boosting financial inclusion, or giving central banks new tools for policy implementation, the future of finance is being written in digital code—and it’s happening faster than anyone imagined.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐌𝐨𝐫𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

AI-Powered Enterprise Automation Market

Asia Pacific Radiopharmaceuticals Market

Joint Replacement Devices Market

High Protein Bakery Products Market

Livestock Identification Market

Grain Oriented Electrical Steel Market

𝐁𝐫𝐨𝐰𝐬𝐞 𝐌𝐨𝐫𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐀𝐫𝐭𝐢𝐜𝐥𝐞𝐬: