Market Overview

Sodium hydroxide (NaOH), an essential inorganic compound, is one of the most widely used and produced chemicals globally. It is predominantly manufactured through the chlor-alkali process, which also yields chlorine and hydrogen as by-products. Its high reactivity and versatility make it crucial in numerous sectors, especially where strong alkalinity is required.

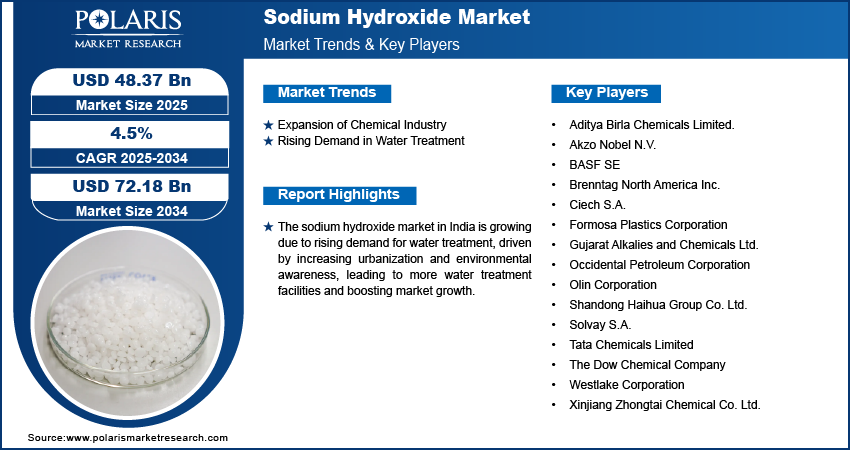

According to the latest study by Polaris Market Research, the global sodium hydroxide market is valued at USD 46.31 billion in 2024 and is projected to reach approximately USD 72.18 billion by 2034. The market is expected to grow at a steady compound annual growth rate (CAGR) of 4.5% throughout the forecast period from 2025 to 2034.

Key Market Growth Drivers

1. Rising Demand from the Paper and Pulp Industry:

One of the primary consumers of sodium hydroxide is the paper and pulp industry. Caustic soda plays a key role in the pulping and bleaching processes, where it helps separate lignin from cellulose fibers. The increasing global demand for packaging materials and tissue papers, driven by e-commerce growth and hygiene awareness, is significantly boosting the consumption of sodium hydroxide.

2. Expanding Textile and Chemical Sectors:

The textile industry uses sodium hydroxide for scouring, mercerizing cotton fabrics, and dyeing processes. With the global fashion industry rebounding and increasing textile exports from countries like India, China, and Bangladesh, the demand for alkali chemicals such as sodium hydroxide is growing steadily.

Simultaneously, the chemical sector uses sodium hydroxide extensively in the production of various inorganic compounds, including sodium hypochlorite, sodium phosphate, and sodium sulfite. Its role as a pH regulator and neutralizing agent further amplifies its necessity across multiple applications.

3. Growth in Water Treatment and Waste Management:

Sodium hydroxide is a key component in water treatment processes. It helps neutralize acidic water and assists in the removal of heavy metals and organic contaminants. With increasing environmental concerns, urbanization, and stricter water quality regulations globally, the demand for effective water treatment chemicals is soaring.

4. Increased Usage in Metallurgy and Petroleum Refining:

In the metallurgy sector, sodium hydroxide is used in alumina extraction from bauxite and in cleaning metal surfaces. The petroleum industry also employs caustic soda for refining crude oil and removing acidic contaminants. The resurgence of oil and gas exploration activities and infrastructure development is indirectly propelling market demand.

Market Challenges

Despite its positive trajectory, the sodium hydroxide market faces several challenges:

1. Environmental and Safety Concerns:

Sodium hydroxide is a highly corrosive substance that can cause severe chemical burns and environmental damage if not handled properly. Governments across various regions are implementing stricter regulations on production, transport, and disposal, increasing the compliance costs for manufacturers.

2. Volatility in Raw Material Prices:

The chlor-alkali process depends on the availability and pricing of raw materials like salt and electricity. Fluctuations in energy costs and raw material supply can disrupt production and affect profit margins, especially for small and mid-sized manufacturers.

3. Waste Disposal and By-product Management:

Managing by-products such as chlorine and hydrogen poses additional logistical and environmental challenges. Companies must invest in efficient by-product utilization or disposal strategies to maintain sustainability and regulatory compliance.

Regional Analysis

Asia-Pacific – Leading the Global Market

Asia-Pacific holds the largest market share in the sodium hydroxide industry, driven by massive industrial output from countries like China, India, Japan, and South Korea. The booming textile, chemical, and paper sectors, coupled with ongoing infrastructural development, have made this region a major hub for caustic soda consumption.

China is the world’s largest producer and consumer of sodium hydroxide, benefiting from a well-established chlor-alkali industry. India is also witnessing increased capacity expansion and investment in water treatment and textiles, propelling demand further.

North America – Mature yet Innovative Market

North America represents a mature but significant market, especially the United States, where sodium hydroxide finds usage in industrial cleaning, petroleum refining, and chemical manufacturing. Environmental regulations and technological innovations in production processes are helping the region maintain steady growth.

Europe – Emphasis on Sustainability and Recycling

Europe’s sodium hydroxide market is marked by stringent environmental standards and a focus on sustainable practices. The region’s circular economy initiatives are fostering the use of sodium hydroxide in recycling processes, such as paper deinking and plastic recovery. Germany, France, and the UK are the top consumers in the region.

Latin America and Middle East & Africa – Emerging Growth Corridors

In Latin America and MEA, industrialization and urbanization are driving moderate but promising growth. Increasing investments in infrastructure, water sanitation, and agriculture are encouraging the uptake of sodium hydroxide, especially in Brazil, Saudi Arabia, and South Africa.

Key Companies in the Sodium Hydroxide Market

Several multinational corporations and regional players are actively shaping the competitive landscape of the sodium hydroxide market. Some of the key players include:

-

Dow Chemical Company (USA): A leading global manufacturer of caustic soda with a vast supply chain and production base.

-

Olin Corporation (USA): Specializes in chlor-alkali products and operates several large-scale sodium hydroxide plants.

-

Tata Chemicals Limited (India): A significant producer in Asia, with operations spanning chemicals and consumer products.

-

Westlake Corporation (USA): Focuses on vinyls and chlor-alkali products, with a robust presence in North America.

-

Formosa Plastics Corporation (Taiwan): Produces sodium hydroxide primarily for industrial and plastic applications.

-

INEOS Group (UK): Operates a broad chemicals portfolio with a strong foothold in Europe’s chlor-alkali market.

-

Hanwha Solutions (South Korea): An emerging player focusing on clean energy and chemicals, expanding sodium hydroxide production capacity.

These companies are actively investing in technology upgrades, strategic mergers, and expansion into emerging markets to consolidate their positions and address environmental concerns.

Future Outlook

The future of the sodium hydroxide market looks promising, driven by the compound’s irreplaceable role in essential industrial processes. Sustainable innovations, such as energy-efficient electrolysis and eco-friendly disposal methods, are expected to reshape the production landscape.

As industries seek alternatives to conventional processes and regulations continue to tighten, companies that prioritize innovation, compliance, and strategic expansion will thrive. The global demand for sodium hydroxide is expected to maintain its upward trajectory, supported by emerging applications and increased consumption in developing regions.

More Trending Latest Reports By Polaris Market Research: