Market Overview

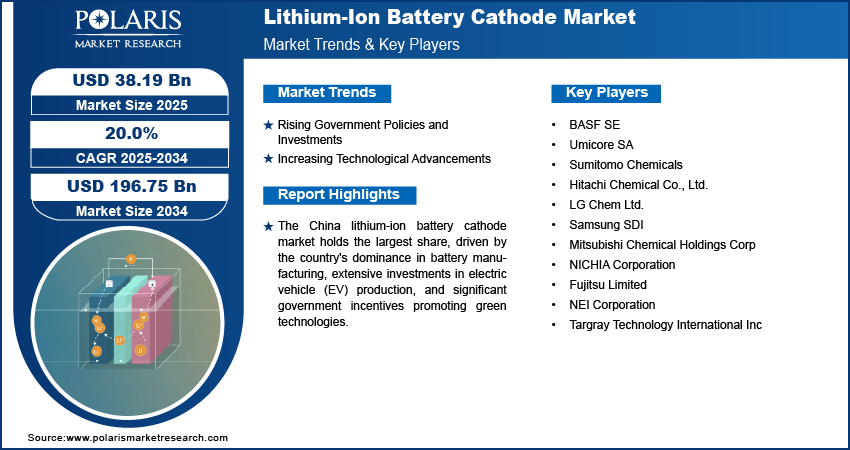

The global Lithium-ion battery cathodes is currently valued at USD 31.86 billion in 2024 and is projected to reach approximately USD 196.75 billion by 2034, according to the latest analysis by Polaris Market Research. The report highlights that the market is set to expand at a strong compound annual growth rate (CAGR) of 20.0% throughout the forecast period from 2025 to 2034.

Lithium-ion battery cathodes are one of the most critical components in rechargeable batteries, directly influencing the battery’s energy density, life cycle, thermal stability, and overall performance. Cathode materials are typically made from a variety of compounds, including lithium cobalt oxide (LCO), lithium iron phosphate (LFP), lithium manganese oxide (LMO), and nickel-manganese-cobalt (NMC) or nickel-cobalt-aluminum (NCA) chemistries.

As demand for high-energy-density batteries continues to surge across automotive, industrial, and consumer electronics sectors, cathode materials have become a focal point for innovation and strategic investment. Manufacturers are exploring cost-effective, efficient, and sustainable alternatives to improve battery performance while reducing reliance on critical materials like cobalt.

LSI Keywords:

-

High-energy-density batteries

-

Electric vehicle battery components

-

Lithium nickel manganese cobalt oxide (NMC)

-

Cathode material recycling

Key Market Growth Drivers

1. Surging Demand for Electric Vehicles (EVs)

The global push toward vehicle electrification is one of the most significant factors boosting demand for lithium-ion battery cathode materials. As automakers transition from internal combustion engines (ICEs) to electric drivetrains, the need for high-performance, long-range battery solutions is paramount. NMC and NCA cathodes, known for their high energy densities, are widely used in EV batteries, making them central to market expansion.

Governments in North America, Europe, and Asia-Pacific are offering incentives and regulatory mandates to accelerate EV adoption. Major OEMs like Tesla, Ford, BYD, and Volkswagen are investing heavily in next-generation battery technologies and establishing supply agreements with cathode material manufacturers to ensure secure sourcing.

2. Growth in Renewable Energy Storage

With renewable energy sources such as solar and wind becoming mainstream, energy storage systems (ESS) are vital for managing intermittent supply and ensuring grid stability. Lithium iron phosphate (LFP) cathodes are particularly popular in large-scale energy storage applications due to their thermal stability, long cycle life, and cost-effectiveness.

The deployment of grid storage systems, microgrids, and backup power solutions across industrial and residential sectors is expected to further drive demand for robust cathode materials.

3. Technological Advancements in Cathode Chemistry

Innovation in cathode chemistry is playing a crucial role in the evolution of lithium-ion batteries. Companies are experimenting with high-nickel and low-cobalt compositions to achieve better performance while addressing sustainability and cost challenges.

Solid-state batteries, which promise enhanced safety and energy density, also present opportunities for novel cathode material development. Additionally, emerging trends such as cathode material recycling and second-life battery applications are expected to impact market dynamics positively.

4. Rising Demand for Portable Electronics

Smartphones, laptops, tablets, and wearable devices continue to witness strong consumer demand globally. Lithium cobalt oxide (LCO), despite its limitations in large-scale applications, remains a preferred cathode material for compact consumer electronics due to its high volumetric energy density.

As the Internet of Things (IoT) and 5G-enabled devices proliferate, the demand for compact, efficient, and fast-charging batteries will fuel cathode material consumption.

Market Challenges

Despite the promising growth trajectory, the lithium-ion battery cathode market faces several significant challenges:

-

Raw Material Constraints and Pricing Volatility: Critical materials such as cobalt, nickel, and lithium are subject to supply constraints and price fluctuations. Geopolitical tensions, mining limitations, and environmental regulations can disrupt supply chains and increase production costs.

-

Sustainability and Environmental Impact: The extraction and processing of cathode materials have raised concerns about carbon emissions, water usage, and labor practices. Regulatory scrutiny and the push for ethical sourcing are compelling manufacturers to adopt cleaner production methods and develop cathode material recycling solutions.

-

Technical Limitations and Degradation: Over time, cathode materials degrade, leading to reduced battery capacity and life. Issues such as thermal runaway, capacity fade, and voltage decay remain technical hurdles that require ongoing R&D.

-

Intense Market Competition: The growing number of entrants and rapid technology shifts create a highly competitive environment. Players must differentiate through innovation, strategic alliances, and cost optimization.

Regional Analysis

Asia-Pacific

Asia-Pacific leads the global lithium-ion battery cathode market, primarily driven by manufacturing dominance in China, South Korea, and Japan. China accounts for a substantial share of global cathode production and raw material processing. Companies such as CATL, BYD, and LG Energy Solution have invested in local supply chains and battery gigafactories to meet regional and global demand.

India is also emerging as a key player with government-backed initiatives like the PLI scheme for battery manufacturing and EV adoption.

North America

North America is witnessing a surge in investment toward domestic battery manufacturing, supported by policy frameworks such as the Inflation Reduction Act (IRA) in the U.S. which incentivizes local production of battery components, including electric vehicle battery components. Partnerships between automakers and battery material suppliers are reshaping the regional landscape, with a focus on high-nickel and cobalt-reduced cathode chemistries.

Europe

Europe is accelerating its green energy transition, with ambitious EV targets and energy storage installations. The EU’s Battery Directive emphasizes sustainability and circular economy principles, making cathode material recycling a priority. Countries like Germany, France, and Norway are spearheading efforts in battery R&D, cell manufacturing, and ethical sourcing of raw materials.

Latin America, Middle East & Africa

Latin America, particularly countries like Chile and Argentina, plays a vital role in lithium supply. While cathode manufacturing is still emerging in this region, growing interest in establishing local battery value chains is expected. The Middle East and Africa are gradually exploring battery storage as part of their renewable energy strategies, which may drive future demand.

Key Companies in the Lithium-Ion Battery Cathode Market

The market is moderately consolidated, with a mix of established conglomerates and emerging innovators. Leading companies are focused on capacity expansion, technological innovation, vertical integration, and securing long-term supply agreements with OEMs and energy providers.

1. Umicore

A global leader in battery material manufacturing, Umicore produces a wide range of advanced cathode materials, including NMC and NCA chemistries. The company emphasizes sustainable sourcing and closed-loop recycling processes.

2. BASF SE

BASF is heavily investing in high-performance cathode active materials and operates manufacturing facilities in Europe and North America. Its strong R&D capabilities are focused on next-gen materials with improved energy density and durability.

3. LG Chem / LG Energy Solution

LG Chem is a major player in both battery cell manufacturing and cathode materials. Its innovations in high-nickel cathode chemistries have positioned the company as a strategic partner for global EV manufacturers.

4. Nichia Corporation

Known for its LCO and other specialty cathode materials, Nichia caters to the consumer electronics market. The company continues to expand its footprint in battery materials through partnerships and product innovation.

5. POSCO Future M (formerly POSCO Chemical)

POSCO Future M is emerging as a key cathode supplier, particularly in the high-nickel NCM segment. Its integration with upstream mining and refining capabilities gives it a competitive edge.

Other notable players include Targray, American Battery Technology Company, Sumitomo Metal Mining Co., Ltd., Shanghai Putailai New Energy Technology, and Hitachi Chemical.

Future Outlook

The future of the lithium-ion battery cathode market looks promising as the world transitions to clean energy and electrified mobility. Innovations in solid-state batteries, improvements in cathode energy density, and emphasis on recycling and sustainability will shape the next phase of market evolution.

Strategic collaborations across the value chain—from mining and processing to cell production and recycling—will be key to meeting growing global demand while managing environmental and ethical challenges.

Conclusion

The lithium-ion battery cathode market stands at the core of the global energy revolution. As nations invest in electrification and renewables, the demand for high-performance, cost-effective, and sustainable cathode materials will continue to climb. Market players who prioritize innovation, localization, and environmental stewardship will be best positioned to lead this rapidly evolving landscape.

More Trending Latest Reports By Polaris Market Research: