Micro-Pumps Market Outlook

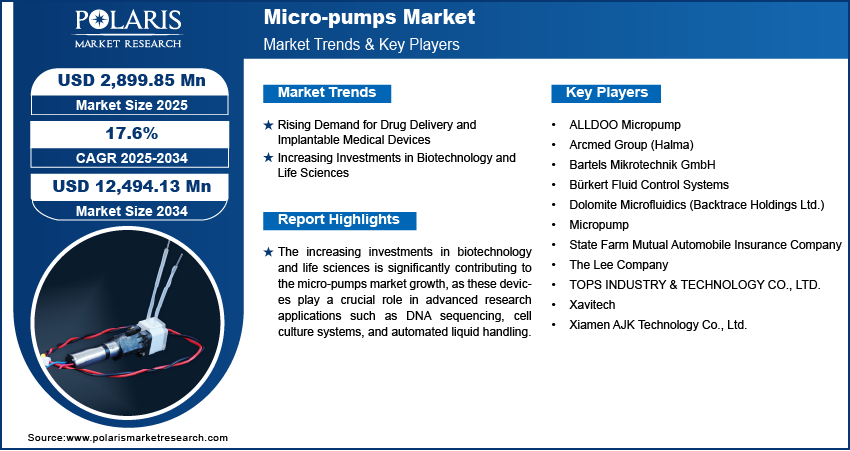

The global micro-pumps market size was valued at USD 2,466.49 million in 2024 and is expected to reach USD 2,899.85 million by 2025 and USD 12,494.13 million by 2034, exhibiting a CAGR of 17.6% during 2025–2034. Micro-pumps, which are small and highly efficient pumps used for fluid delivery in various applications, are becoming increasingly essential across a wide range of industries, including healthcare, automotive, chemical, and consumer electronics. These pumps are known for their precise fluid control capabilities, small size, and energy efficiency, which make them ideal for use in systems requiring controlled, low-flow pumping solutions.

As industries continue to seek smaller, more efficient, and environmentally friendly solutions for fluid management, the demand for micro-pumps is on the rise. Micro-pumps are gaining traction in medical devices for drug delivery systems, in automotive applications for fuel systems, and in industrial processes where precision fluid handling is required. This press release explores the key trends driving the growth of the micro-pumps market, market segmentation, regional analysis, and highlights the key companies playing a vital role in shaping the future of the micro-pumps industry.

Market Overview

Micro-pumps are devices designed to transfer liquids or gases in small quantities with high precision. These pumps have found applications in various sectors such as medical devices, automotive, chemicals, and pharmaceuticals. The primary drivers behind the increasing demand for micro-pumps include the growing need for more compact, efficient, and precise fluid delivery solutions. Micro-pumps offer significant advantages over traditional pumping mechanisms due to their small size, low energy consumption, and high accuracy in controlling the flow rate.

In the healthcare sector, micro-pumps are particularly valued for their role in drug delivery systems. With the rise in chronic diseases, personalized medicine, and the need for continuous drug administration, micro-pumps are becoming critical components in infusion pumps, insulin delivery devices, and implantable drug delivery systems. Similarly, in the automotive industry, micro-pumps are being used in fuel injection systems and other applications that require precise fluid control.

Technological advancements are also playing a key role in expanding the applications of micro-pumps. Recent innovations in pump design, materials, and manufacturing processes are making micro-pumps more durable, energy-efficient, and cost-effective. As a result, their adoption is increasing across various industries, and their market presence is expected to grow exponentially in the coming years.

Browse Full Insights:

https://www.polarismarketresearch.com/industry-analysis/micro-pumps-marketrket Segmentation

The micro-pumps market is segmented based on type, application, and region. Each of these segments plays a crucial role in driving the overall market growth.

1. By Type:

- Peristaltic Pumps: Peristaltic micro-pumps are widely used for applications that require the handling of viscous fluids or liquids with particulates. These pumps are ideal for medical devices, laboratories, and food and beverage applications where fluid integrity must be maintained.

- Diaphragm Pumps: Diaphragm micro-pumps are used in situations requiring accurate flow control and are often found in applications such as medical devices and analytical instruments. These pumps provide excellent flow stability and are highly reliable for precise fluid handling.

- Screw Pumps: Screw micro-pumps are commonly used in applications where high-pressure fluid transfer is required. They are typically found in automotive and chemical industries due to their ability to handle both liquids and gases with high efficiency.

- Other Types: This includes a variety of other pump types, such as gear pumps, piston pumps, and more, each catering to specific application needs.

2. By Application:

- Medical Devices: The medical device segment is the largest and fastest-growing application area for micro-pumps. These pumps are used in drug delivery systems, insulin pumps, infusion pumps, and other medical applications where precision fluid control is critical. Micro-pumps are also key components in implantable drug delivery devices, which are becoming more prevalent in the treatment of chronic diseases like diabetes and cancer.

- Automotive: In the automotive sector, micro-pumps are used in fuel injection systems, emission control systems, and other critical fluid handling applications. The demand for fuel-efficient and environmentally friendly vehicles has led to the increasing use of micro-pumps in automotive fuel systems.

- Chemical and Industrial Applications: Micro-pumps are essential in the chemical industry for precise dosing of chemicals in various processes. They are used in applications like water treatment, petrochemical processing, and fluid management in industrial machinery.

- Consumer Electronics: In consumer electronics, micro-pumps are used in cooling systems for electronic devices and other applications where small, efficient fluid pumps are required for heat management and other purposes.

- Others: This includes applications in laboratory research, food and beverage processing, and more, where micro-pumps are used for precise fluid handling and delivery.

3. By Region:

The micro-pumps market is analyzed based on different geographic regions, each presenting unique growth opportunities and challenges. The key regions include North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

- North America: North America is one of the leading markets for micro-pumps, with the United States being the major contributor to market growth. The demand for micro-pumps in medical devices, particularly in drug delivery systems, is driving the market in this region. The region also benefits from technological advancements in micro-pump design and a strong healthcare infrastructure, making it a key hub for market development.

- Europe: Europe is another prominent region for the micro-pumps market, with Germany, France, and the United Kingdom being key markets. The European market is driven by the increasing demand for medical devices, as well as the growing use of micro-pumps in industrial applications such as chemical processing and automotive systems. Government regulations promoting energy efficiency and sustainability are also contributing to market growth.

- Asia Pacific: Asia Pacific is expected to experience the highest growth in the micro-pumps market during the forecast period. The rapid industrialization in countries like China, India, and Japan, combined with increasing healthcare investments and growing automotive manufacturing, is driving demand for micro-pumps. The region is also seeing an increased focus on precision medicine and the development of new medical devices, further boosting market expansion.

- Latin America: Latin America is witnessing steady growth in the micro-pumps market, particularly in Brazil and Mexico, where there is rising demand for medical devices and industrial applications. The region’s expanding healthcare sector and focus on improving manufacturing capabilities are key drivers of market growth.

- Middle East & Africa: The Middle East and Africa are witnessing moderate growth in the micro-pumps market. Countries in the region are investing in healthcare infrastructure and industrial sectors, with growing demand for energy-efficient solutions in fluid management driving the adoption of micro-pumps.

Key Companies in the Micro-Pumps Market

The micro-pumps market is highly competitive, with numerous players offering a range of products tailored to different applications. Key players in the market are focusing on innovation, product development, and strategic partnerships to expand their market presence. Some of the major companies in the micro-pumps market include:

- Rainin Instrument LLC (Mettler Toledo)

- Parker Hannifin Corporation

- Idex Corporation

- KNF Neuberger Inc.

- Tecan Group Ltd.

- Festo AG & Co. KG

- Cole-Parmer Instrument Company LLC

- HNP Mikrosysteme GmbH

These companies are investing in research and development to introduce new micro-pump technologies that meet the growing demand for energy-efficient, compact, and reliable fluid control systems. Additionally, companies are expanding their product portfolios to address diverse industry needs, from medical applications to industrial processes.

Report Scope

Micro-pumps Market, Product Outlook (Revenue – USD Million, 2020-2034)

- Mechanical

- Piezoelectric Micro-pump

- Peristaltic Pump

- Others

- Non-mechanical

Micro-pumps Market, Applications Outlook (Revenue – USD Million, 2020-2034)

- Drug Delivery

- In-vitro Diagnostics

- Medical Devices

- Others

Micro-pumps Market, End-use Outlook (Revenue – USD Million, 2020-2034)

- Biotechnological & Pharmaceutical Companies

- Hospitals & Diagnostic Centers

- Academic & Research Institutes

Recent Developments in the Micro-Pumps Industry

November 2023: PSG Biotech, a subsidiary of PSG and Dover, introduced the Quattroflow QB2-Standard (QB2-SD), a single-use precision micropump. This new product is designed to offer high-accuracy fluid control for a variety of applications, including biotechnology and pharmaceutical industries, enhancing the flexibility and reliability of single-use systems.

August 2023: Micropump entered into a strategic partnership with CEME Group to bolster its global presence in fluid control systems. This collaboration combines Micropump’s technological expertise with CEME’s industrial assets, resulting in an expanded product portfolio that includes solenoid valves, rotary vane pumps, gear pumps, and other specialized solutions aimed at advancing fluid management across various industries.

September 2022: The Lee Company acquired TTP Ventus Limited from TTP Group, further enhancing its portfolio with silent, compact micropumps and pump modules. These innovative products are designed to support the life science and medical sectors, complementing The Lee Company’s existing range of miniature fluid control components and positioning it as a leader in precision fluid management solutions.

Conclusion

The global micro-pumps market is set to experience significant growth, driven by the increasing demand for precise fluid control systems across various industries, particularly in healthcare, automotive, and industrial applications. With a projected market size of USD 23.6 billion by 2034 and a CAGR of 9.8%, micro-pumps are becoming an essential component of modern systems that require efficient and reliable fluid handling.

Technological advancements, growing industrialization in emerging economies, and the increasing adoption of micro-pumps in medical devices are key factors propelling the market’s growth. As companies continue to innovate and expand their product offerings, the micro-pumps market is expected to witness continued expansion in the coming years.

More Trending Latest Reports By Polaris Market Research:

Reason to Invest in Animal Ultrasound Market

Automated Guided Vehicle (Agv) Market