Market Overview

The global Aircraft Leasing Market has witnessed substantial growth in recent years, driven by an increasing demand for air travel, cost-effective financing solutions, and the rise in fleet management practices across the aviation industry. Aircraft leasing involves the renting or leasing of commercial aircraft, primarily by airlines, which prefer this flexible approach over purchasing aircraft. This leasing model offers advantages like reduced capital expenditure, easier fleet upgrades, and improved operational flexibility.

The market for aircraft leasing is growing at a steady pace and is expected to continue its upward trajectory, with projections indicating a significant increase in both the number of leased aircraft and the overall market size over the coming years. A few key factors contributing to the expansion of the market include the recovery of the aviation industry post-pandemic, the rising number of low-cost carriers, and the increasing need for modern and fuel-efficient aircraft fleets.

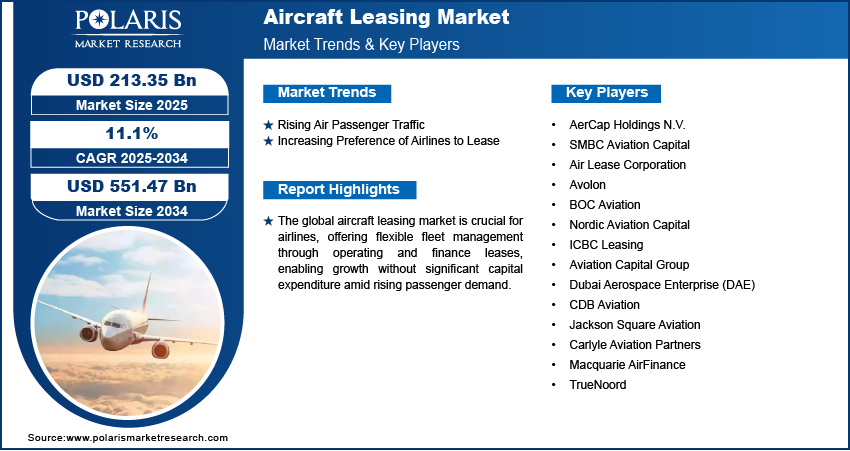

Global Aircraft Leasing Market size and share is currently valued at USD 192.45 billion in 2024 and is anticipated to generate an estimated revenue of USD 551.47 billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 11.1% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 – 2034

Key Market Growth Drivers

-

Increased Demand for Air Travel A crucial driver behind the growth of the Aircraft Leasing Market is the robust demand for air travel across regions. The growth of international tourism, business travel, and the rise of emerging economies with expanding middle classes have all contributed to the surge in air travel. With airlines needing to quickly expand their fleets to cater to this growing demand, leasing provides a cost-effective alternative to aircraft purchase.

-

Cost-Effective Financing and Fleet Expansion Airlines, particularly budget carriers, have found aircraft leasing to be a more financially viable option as it requires less upfront capital investment compared to purchasing new planes. Leasing allows airlines to avoid large-scale capital expenditure and maintain operational flexibility. This is particularly beneficial for airlines operating in highly competitive markets where costs need to be minimized. Additionally, leasing provides airlines with the opportunity to upgrade their fleet more regularly to remain competitive and improve fuel efficiency, thereby reducing overall operating costs.

-

Rising Demand for Fuel-Efficient Aircraft Another significant factor driving the aircraft leasing market is the increasing demand for more fuel-efficient aircraft. With rising fuel costs and environmental concerns, airlines are looking to replace older, less efficient models with newer, more fuel-efficient aircraft. Leasing companies are playing a pivotal role in providing airlines with access to these modern, eco-friendly aircraft. This trend has intensified as governments and international organizations push for stricter environmental regulations, compelling airlines to upgrade to more sustainable and energy-efficient fleets.

-

Flexibility in Fleet Management Aircraft leasing offers airlines greater flexibility in fleet management. Whether it’s adjusting fleet size based on seasonal demand, replacing older models with new ones, or managing fluctuating routes, leasing provides airlines with the ability to adapt more quickly to market changes. This flexibility has made leasing a preferred option, especially for airlines operating in uncertain or volatile markets. Additionally, lessors manage the administrative and regulatory aspects of aircraft maintenance, freeing up airline operators to focus on their core operations.

Challenges in the Aircraft Leasing Market

-

High Costs of Aircraft Maintenance While leasing offers many advantages, one of the primary challenges facing the market is the high costs associated with aircraft maintenance. Aircraft, especially older models, require regular maintenance to ensure safety and efficiency, which can be expensive. For lessors, this represents a significant financial burden as they are often responsible for maintaining and repairing leased aircraft. Additionally, airlines that lease aircraft must also ensure that these planes are kept in good condition, adding another layer of operational complexity.

-

Market Volatility and Economic Fluctuations The global economy plays a significant role in the aircraft leasing market. Economic downturns, like the one experienced during the COVID-19 pandemic, severely impact air travel demand, making it challenging for airlines to maintain or expand their fleets. Volatile fuel prices, fluctuations in exchange rates, and unexpected geopolitical events can create additional challenges for aircraft lessors and lessees alike. This volatility makes it difficult to predict long-term demand for leased aircraft and can lead to financial instability within the industry.

-

Regulatory and Environmental Challenges Aircraft leasing companies must navigate a complex regulatory environment that varies across regions. Airlines are subject to different sets of rules regarding fleet age, maintenance schedules, and safety requirements. Additionally, with the rising emphasis on reducing aviation’s carbon footprint, leasing companies are under pressure to comply with stricter environmental regulations. This includes meeting emissions standards, adhering to noise regulations, and investing in more eco-friendly aircraft. Compliance with these regulations can increase operational costs and affect the bottom line for lessors.

-

Competition from Aircraft Manufacturers Aircraft manufacturers, such as Boeing and Airbus, are increasingly offering tailored financial products, including direct sales or financing options, which may compete with the traditional leasing model. While leasing is still the more flexible option for many airlines, direct purchasing offers its own set of advantages, such as ownership and lower long-term operating costs. This competition could potentially reduce the demand for leased aircraft, especially among larger airlines with the financial resources to purchase their own fleets.

Regional Analysis

-

North America North America dominates the global Aircraft Leasing Market, primarily due to the presence of large, established leasing companies and a significant number of airlines that rely heavily on leasing as a financial strategy. The region’s major players are centered in the United States, which boasts a large aviation market and a substantial number of aircraft leasing firms. Additionally, low-cost carriers have become a major factor in the growth of the leasing market in North America, as these carriers often prefer leasing to avoid large upfront investments.

-

Europe Europe is another key region for aircraft leasing, with a number of leasing companies headquartered in Ireland, Luxembourg, and other aviation-friendly jurisdictions. The growth of low-cost carriers and increased demand for international travel have spurred demand for leased aircraft across Europe. The European Union’s environmental regulations also play a role in pushing airlines toward more fuel-efficient aircraft, further boosting leasing activity in the region.

-

Asia Pacific The Asia Pacific region is expected to experience significant growth in the aircraft leasing market due to the rapid expansion of the aviation sector, particularly in China, India, and Southeast Asia. As the middle class in these regions continues to grow, so does the demand for air travel. Airlines in these regions are turning to leasing as a way to expand their fleets without incurring heavy financial burdens. The region is also home to a number of emerging aircraft leasing companies, creating a competitive landscape.

-

Middle East & Africa The Middle East and Africa are also witnessing growth in the aircraft leasing market, driven by the expansion of airlines such as Emirates and Qatar Airways, which rely heavily on leased aircraft. The region’s strategic location as a hub for international travel also contributes to the increased demand for aircraft leasing. However, political instability and economic fluctuations can pose challenges to the growth prospects in this region.

Key Companies

The global Aircraft Leasing Market is competitive, with several leading companies playing a vital role in driving market dynamics. These companies provide a range of services, including aircraft leasing, fleet management, and financing options for airlines. While many of these companies operate globally, their offerings and strategic approaches differ, influencing the market’s overall structure.

Conclusion

The Aircraft Leasing Market is poised for sustained growth in the coming years, driven by increasing demand for air travel, cost-effective financing solutions, and a shift toward fuel-efficient aircraft. However, challenges such as high maintenance costs, market volatility, and regulatory complexities could slow down this growth. Regional dynamics, particularly in North America, Europe, and Asia Pacific, will continue to shape the market, with leasing companies striving to provide innovative solutions to meet the evolving needs of the aviation industry. The market’s future remains bright, with the continued expansion of low-cost carriers and the adoption of new, greener technologies ensuring that leasing remains a key pillar of the aviation sector.

More Trending Latest Reports By Polaris Market Research:

Europe Non-Automotive Rubber Transmission Belts Market

Europe Digestive Health Supplements Market

Homogeneous Precious Metal Catalyst Market: A Gateway for Superior Catalytic Precision