Market Overview

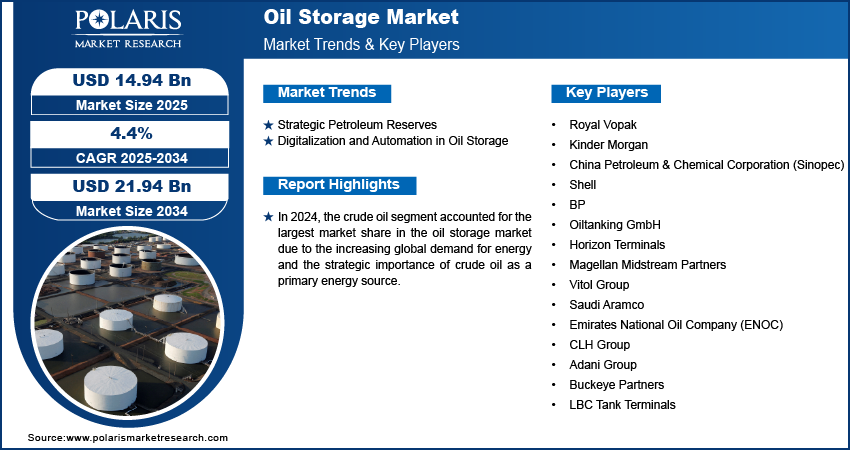

Global Oil Storage Market size and share is currently valued at USD 14.33 billion in 2024 and is anticipated to generate an estimated revenue of USD 21.94 billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 4.4% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 – 2034

The oil storage market consists of storage terminals, tank farms, and underground reservoirs designed for both short-term and long-term oil retention. The market spans across upstream, midstream, and downstream segments of the oil and gas value chain. As energy markets evolve and demand patterns shift, storage has emerged as a strategic asset that enables producers and traders to hedge against price volatility, optimize logistics, and ensure supply reliability.

Storage solutions vary by type and purpose, including floating roof tanks, fixed roof tanks, spherical tanks, and underground storage. Floating roof tanks are particularly favored for storing crude oil due to their vapor control capabilities, while fixed roof tanks are commonly used for refined products.

Key Market Growth Drivers

- Strategic Petroleum Reserve (SPR) Initiatives

Governments across the globe are investing heavily in building and maintaining strategic petroleum reserves to enhance national energy security. These reserves act as buffers during supply disruptions, geopolitical tensions, or natural disasters. As countries expand their SPR capacities, the demand for secure and efficient storage facilities is on the rise. - Volatility in Oil Prices

The oil market is highly susceptible to supply-demand imbalances and geopolitical shifts, leading to price fluctuations. Storage facilities provide traders and refiners with the flexibility to store crude oil when prices are low and sell when prices rebound. This need for price risk mitigation continues to drive demand for accessible and scalable oil storage infrastructure. - Expansion of Refining Capacity

As developing regions build new refineries and upgrade existing facilities, the need for downstream storage of refined products is growing. Refiners require large storage capacities for feedstocks and finished products to ensure uninterrupted operations and to manage transportation logistics more efficiently. - Growth in International Trade and Oil Logistics

Global oil trade routes are becoming more complex, with crude and refined products flowing across continents. Ports, trading hubs, and pipeline networks rely heavily on oil storage to manage shipment schedules, buffer supply, and accommodate transit delays. The development of new oil terminals near major ports and refining centers is a direct response to increasing trade volumes.

Competitive Landscape

The oil storage market is fragmented, with both public and private entities participating in infrastructure development and operation. Independent storage providers, oil companies, and energy logistics firms are all contributing to the sector’s expansion. Key industry players are also adopting new technologies to enhance safety, reduce emissions, and increase operational efficiency.

Notable companies in the global oil storage market include:

- Lutron Electronics

- Acuity Brands

- Artemide Group

- Louis Poulsen

- FLOS S.p.A

- Tech Lighting

- Visual Comfort & Co.

- Restoration Hardware

- Circa Lighting

- Hubbardton Forge

- Delta Light

- Moooi

- Baccarat

These firms are leveraging joint ventures, acquisitions, and long-term contracts to expand their footprint and adapt to the changing dynamics of global oil trade and supply chain management.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/oil-storage-market

Regional Analysis

North America remains a major player in the global oil storage market, driven by significant crude oil production from shale formations and robust refining activity. The United States, in particular, has extensive storage capacity spread across the Gulf Coast, Cushing (Oklahoma), and the Strategic Petroleum Reserve sites. Canada is also investing in storage expansion, particularly in Alberta and British Columbia, to support its oil sands operations and pipeline infrastructure.

Asia-Pacific is witnessing rapid growth, fueled by rising energy demand, increasing refinery output, and strategic stockpiling initiatives. China and India, as major importers of crude oil, are expanding their SPR capacities and building large-scale storage terminals near coastal and inland refineries. Southeast Asian nations are also developing oil storage infrastructure to position themselves as regional trading and transshipment hubs.

Europe shows a mature yet evolving oil storage market, driven by stringent environmental regulations, aging infrastructure upgrades, and energy diversification efforts. The North Sea region, along with key trading hubs like Rotterdam and Antwerp, continues to be a focal point for storage activity. European countries are also incorporating renewable fuels into existing storage systems, signaling a transition in the energy storage landscape.

Middle East & Africa plays a dual role as both a leading oil producer and a growing storage center. The region is expanding its oil storage capabilities to support increased export volumes and attract foreign investment in storage terminals and tank farms. The UAE and Saudi Arabia are leading initiatives to establish strategic and commercial oil storage facilities, leveraging their geographical advantage and surplus production.

Latin America is gradually expanding its oil storage capacity in response to fluctuating production levels and logistical challenges. Countries like Brazil and Mexico are investing in downstream infrastructure, including terminals and tank farms, to enhance refining throughput and export capacity.

Emerging Trends

The oil storage industry is evolving in line with modern energy needs and environmental concerns. Several emerging trends are shaping its future:

- Digitalization of Storage Operations: The use of real-time monitoring, AI-based forecasting, and automation systems is enhancing efficiency and safety in oil storage facilities.

- Environmental and Regulatory Compliance: Operators are upgrading infrastructure to meet environmental regulations related to emissions control, spill prevention, and vapor recovery systems.

- Integration of Alternative Fuels: Storage operators are increasingly accommodating alternative energy sources such as biofuels, LNG, and hydrogen, signaling a diversification beyond conventional petroleum products.

- Underground Oil Storage: Salt caverns and depleted oil fields are being repurposed for underground oil storage, offering higher security and lower environmental risk compared to surface tanks.

Conclusion

As the global energy landscape becomes more dynamic, the oil storage market is poised to play a central role in managing supply chains, ensuring energy security, and adapting to future energy demands. With increasing geopolitical tensions, growing trade volumes, and shifting energy policies, the need for efficient, secure, and scalable oil storage infrastructure is greater than ever. Stakeholders across the value chain are investing in innovations and infrastructure to meet these challenges and seize new growth opportunities in this vital sector.

More Trending Latest Reports By Polaris Market Research:

Protein Hydrolysis Enzymes Market

Space Situational Awareness Market

Software Defined Data Center Market

Southeast Asia Wood Pellet Market

Satellite Ground Station Market