The global Veterinary Diagnostics Market is witnessing robust growth, fueled by heightened awareness about animal health testing, the rising incidence of zoonotic diseases, and technological advancements in diagnostic tools. As the world grapples with both pet ownership booms and increasing livestock productivity demands, timely and accurate diagnostics have become central to veterinary care.

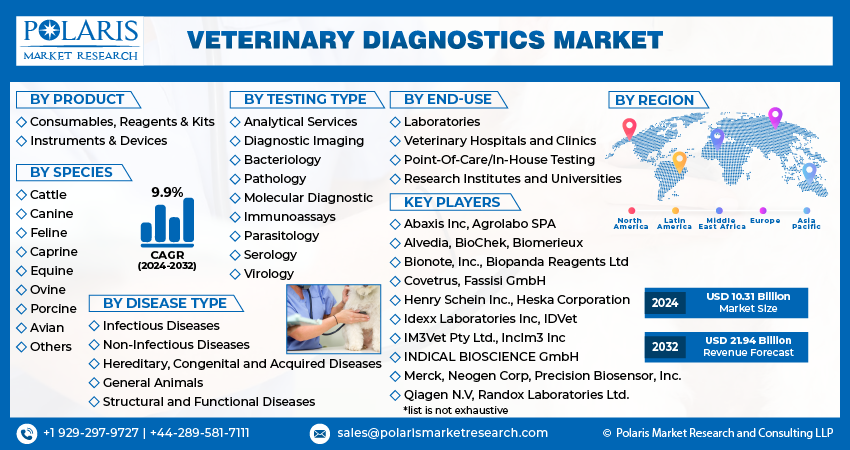

The veterinary diagnostics market size was valued at USD 9.39 billion in 2023. The market is anticipated to grow from USD 10.31 billion in 2024 to USD 21.94 billion by 2032, exhibiting the CAGR of 9.9% during the forecast period. The increasing integration of point-of-care veterinary diagnostics and expanding applications in both companion and production animals are reshaping this dynamic sector.

Market Overview

Veterinary diagnostics encompass a range of tests, devices, and services designed to identify diseases in animals. These include hematology, immunodiagnostics, molecular diagnostics, and clinical biochemistry tools aimed at monitoring animal health, detecting diseases early, and guiding treatment decisions.

The market is broadly segmented by:

-

Product Type: Instruments, test kits, reagents, and software

-

Technology: Immunodiagnostics, molecular diagnostics, clinical biochemistry, hematology, urinalysis, and others

-

Animal Type: Companion animals (dogs, cats, horses) and livestock (cattle, pigs, poultry, sheep)

-

End-Use: Veterinary hospitals, laboratories, research institutions, and point-of-care testing centers

The market’s growth trajectory is being strongly supported by advances in companion animal diagnostics, automation in laboratories, and public-private partnerships to combat zoonoses and ensure food safety.

Key Market Growth Drivers

1. Surge in Pet Ownership and Companion Animal Care

Global pet ownership continues to climb, especially in urban and developed markets. Pet parents are investing in routine companion animal diagnostics for wellness checks, vaccinations, and early disease detection. Veterinary diagnostics are being used to manage conditions like diabetes, cancer, arthritis, and kidney disease in pets, further driving market demand.

2. Rising Demand for Livestock Monitoring and Food Safety

The growing global population and rising meat consumption are placing pressure on livestock producers to ensure herd health and maximize productivity. This has led to widespread adoption of animal health testing to monitor disease outbreaks, reproductive performance, and nutrition. Governments and food companies alike are pushing for better diagnostics to reduce antimicrobial use and improve food quality.

3. Increased Zoonotic Disease Outbreaks

With over 60% of known infectious diseases in humans originating from animals, rapid zoonotic disease detection is critical. Events like COVID-19, avian flu, and African swine fever have underscored the importance of One Health approaches. Veterinary diagnostics help detect cross-species pathogens early, allowing for faster responses and containment.

4. Technological Innovations in Veterinary Diagnostics

The integration of AI, telemedicine, and molecular platforms has modernized animal diagnostics. Rapid diagnostic kits, smartphone-enabled readers, and real-time PCR systems have become essential tools in both field and clinical settings. Innovations in point-of-care veterinary diagnostics are particularly beneficial in remote or emergency situations, enhancing treatment efficiency.

5. Government Initiatives and Funding Support

Several countries are expanding their veterinary surveillance and diagnostic infrastructure through grants, subsidies, and regulatory frameworks. Programs by the World Organisation for Animal Health (WOAH) and regional bodies support veterinary lab capacity building, especially in emerging economies.

Market Challenges

1. High Cost of Advanced Diagnostic Equipment

Although diagnostic technology is evolving rapidly, the high cost of devices such as hematology analyzers, PCR platforms, and imaging equipment can be prohibitive for small clinics and rural practices. The need for skilled personnel to operate these machines also adds to the cost burden.

2. Lack of Infrastructure in Emerging Markets

In regions such as sub-Saharan Africa and parts of Southeast Asia, underdeveloped veterinary infrastructure limits access to reliable diagnostic services. Many rural areas still rely on empirical treatment due to the absence of timely lab support.

3. Regulatory Complexity and Standardization Issues

Veterinary diagnostics face varying approval processes across regions. Inconsistent regulation and the absence of standardized protocols hinder smooth product launches and cross-border use. Additionally, quality control remains a concern in some developing nations.

4. Limited Awareness Among Livestock Farmers

Despite increasing outreach, many small and medium-scale livestock farmers remain unaware of the benefits of regular animal health monitoring. This limits the routine use of diagnostics outside of commercial agribusiness operations.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞: https://www.polarismarketresearch.com/industry-analysis/veterinary-diagnostic-market

Regional Analysis

North America

North America dominates the veterinary diagnostics market, accounting for the largest share due to:

-

High pet adoption rates and spending on companion animal diagnostics

-

Well-established veterinary healthcare infrastructure

-

Continuous innovation in diagnostic technologies

-

Strong focus on animal disease surveillance by public health authorities

The U.S. leads globally in veterinary diagnostic testing volume and has seen rapid growth in tele-veterinary services and mobile diagnostic units.

Europe

Europe is the second-largest market, with growth driven by:

-

High awareness of animal welfare and disease prevention

-

Rigorous livestock monitoring systems supported by the European Food Safety Authority (EFSA)

-

Integration of point-of-care veterinary diagnostics in routine veterinary practice

-

Leading academic and research institutions driving innovation

Germany, France, and the U.K. are the major contributors, with Eastern Europe showing promising growth due to government initiatives in animal health.

Asia-Pacific

Asia-Pacific is expected to experience the fastest growth in the coming years due to:

-

Rapidly growing livestock industry in China, India, and Southeast Asia

-

Expansion of commercial poultry and dairy operations

-

Increasing pet adoption among the middle class

-

Rising investments in veterinary infrastructure

Despite infrastructure gaps, countries like China and India are pushing forward with rural diagnostic schemes and public health collaborations.

Latin America

The Latin American market is expanding gradually, supported by:

-

Increasing awareness about animal health in Brazil, Mexico, and Argentina

-

Growth in livestock exports and related testing requirements

-

Development of veterinary research centers

Challenges include inconsistent regulations and limited investment in diagnostic technologies in rural areas.

Middle East & Africa

Although the smallest market, MEA is showing signs of improvement:

-

Gulf countries are investing in advanced veterinary services and diagnostics

-

Pan-African programs are being launched to curb zoonoses and improve food security

-

Demand is growing for disease detection systems in livestock due to economic reliance on animal farming

Infrastructure development and education remain critical for sustained growth in the region.

Key Companies in the Veterinary Diagnostics Market

Several global and regional companies are at the forefront of advancing veterinary diagnostic technologies:

IDEXX Laboratories, Inc.

A global leader in companion animal diagnostics, IDEXX offers a wide range of instruments and test kits, including chemistry analyzers, hematology systems, and diagnostic imaging tools.

Zoetis Inc.

Zoetis has a strong presence in both livestock and companion animal diagnostics. Their portfolio includes tests for parasitic, viral, and bacterial diseases, with a strong focus on point-of-care veterinary diagnostics.

Thermo Fisher Scientific Inc.

This company provides a range of molecular and immunoassay solutions for animal health. Its advanced PCR kits are widely used for zoonotic disease detection and food safety applications.

Heska Corporation

Known for offering in-house diagnostic solutions for veterinary clinics, Heska provides chemistry analyzers, blood analyzers, and allergy testing solutions.

Bio-Rad Laboratories, Inc.

Bio-Rad supports the veterinary sector with reliable tools for animal health testing, including serology and ELISA-based products.

Neogen Corporation

Neogen has a strong footprint in livestock diagnostics, especially for dairy and meat production animals. They offer testing for foodborne pathogens and herd health screening.

Conclusion

The Veterinary Diagnostics Market is undergoing a transformative phase, driven by the convergence of rising pet care standards, food safety imperatives, and infectious disease threats. As point-of-care veterinary diagnostics, molecular tools, and AI-integrated platforms evolve, the future of animal health management will be defined by speed, accuracy, and accessibility.

While the industry faces challenges in affordability, infrastructure, and regulation, the growing recognition of veterinary diagnostics as a public health and economic priority is ensuring steady global progress. With sustained innovation and investment, this sector is set to play a pivotal role in shaping the future of animal health testing and One Health integration.

More Trending Latest Reports By Polaris Market Research:

Diesel Particulate Filter Market