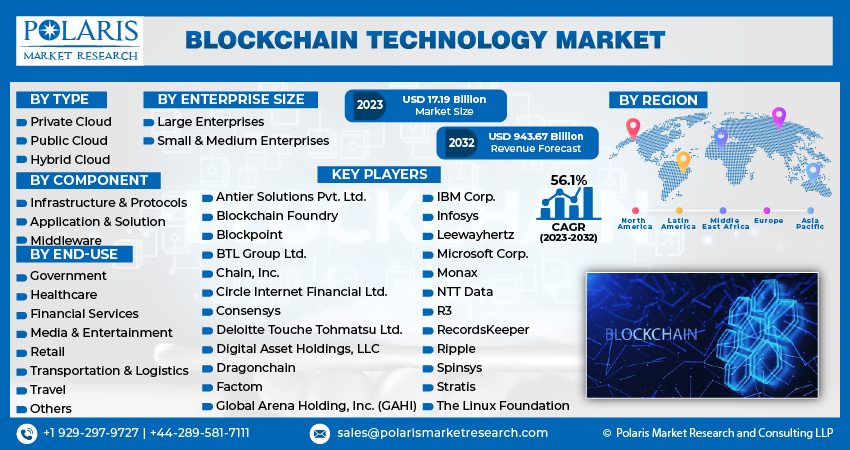

Once synonymous solely with cryptocurrencies, blockchain technology has evolved into a transformative force across a myriad of industries—from finance and supply chain to healthcare, government, and beyond. The global blockchain technology market, valued at USD 11.09 billion in 2022, is poised for explosive growth, projected to reach USD 943.67 billion by 2032, expanding at a staggering CAGR of 56.1% over the forecast period (2023–2032).

Blockchain’s core promise lies in its ability to create decentralized, immutable, and transparent digital records, drastically enhancing trust, traceability, and operational efficiency. As businesses increasingly explore digitization and secure data-sharing models, blockchain is set to become the backbone of next-generation digital infrastructure.

Market Growth Drivers

- Rising Demand for Transparency and Security

At the heart of blockchain’s appeal is its ability to offer tamper-proof, transparent, and decentralized ledgers, which drastically reduce the chances of fraud, data manipulation, and unauthorized access. This is particularly critical in sectors like finance, supply chain, and healthcare, where data integrity is non-negotiable.

- Adoption in Financial Services

While blockchain’s earliest adopters were in the cryptocurrency and financial services space, its relevance has only expanded. Banks and fintechs are leveraging blockchain for cross-border payments, smart contracts, KYC processes, fraud detection, and decentralized finance (DeFi) applications—driving major investments into blockchain-based platforms.

- Increased Venture Capital and Government Support

Startups focused on blockchain are drawing significant venture capital funding, while government initiatives are creating favorable environments for research and pilot projects. Countries like Estonia, Singapore, UAE, and China have introduced national blockchain strategies to boost innovation and public sector adoption.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/blockchain-technology-market

- Growth of Web3 and Decentralized Applications (dApps)

The rise of Web3 and the transition toward decentralized applications are redefining how internet services are built and accessed. Blockchain underpins this new wave, offering users greater control over data, privacy, and ownership, fueling long-term growth.

- Integration with Emerging Technologies

Blockchain is increasingly integrated with AI, IoT, cloud computing, and edge technologies, expanding its application across real-time analytics, autonomous devices, and secure peer-to-peer communications.

Key Trends in the Blockchain Technology Market

- Enterprise Blockchain Adoption

Businesses are moving beyond proof-of-concepts to full-fledged enterprise blockchain deployments, particularly for applications in logistics, identity verification, and procurement. Platforms like Hyperledger Fabric, Corda, and Quorum are gaining traction for their permissioned frameworks suited for enterprise use.

- Tokenization of Assets

Blockchain is enabling the tokenization of real-world assets—from real estate and art to equities and bonds. These tokens can be traded on blockchain platforms, bringing liquidity to traditionally illiquid assets and democratizing access to investments.

- Sustainability and Green Blockchain Initiatives

With criticism over the energy consumption of proof-of-work (PoW) systems like Bitcoin, many innovators are turning to proof-of-stake (PoS) and energy-efficient consensus algorithms. Additionally, blockchain is being explored to track carbon footprints and enhance ESG transparency.

- Central Bank Digital Currencies (CBDCs)

Central banks globally are piloting or researching CBDCs, using blockchain as the underlying architecture. Projects in China (Digital Yuan), the European Union (Digital Euro), and the U.S. (FedNow) are shaping the future of digital money.

- Growth of Decentralized Finance (DeFi)

DeFi platforms leverage blockchain to provide peer-to-peer lending, decentralized exchanges (DEXs), and yield farming, eliminating traditional intermediaries. The rapid expansion of DeFi is creating new opportunities but also new regulatory challenges.

Research Scope

The scope of blockchain research is both technologically diverse and industry-specific. Key areas include:

- Consensus Mechanisms: Efficiency, scalability, and security of PoS, PoW, DAG, and other protocols

- Interoperability and Scalability Solutions: Layer 2 protocols, sidechains, and cross-chain bridges

- Security and Privacy: Zero-knowledge proofs, multi-party computation, and data encryption

- Smart Contracts: Auditing, lifecycle management, and automation use cases

- Governance Models: DAOs (Decentralized Autonomous Organizations) and protocol-level decision-making

- Economic Models: Tokenomics, staking incentives, and value distribution

Research is also expanding to regulatory frameworks, real-world integration challenges, and user adoption behavior.

Market Segmentation

- By Component

- Platform/Protocol

- Services

Platform providers dominate the market, with major players offering blockchain infrastructure that supports transaction processing, smart contracts, and consensus. Meanwhile, blockchain-as-a-service (BaaS) is growing fast, enabling companies to deploy solutions without deep technical know-how.

- By Type

- Public Blockchain

- Private Blockchain

- Consortium Blockchain

- Hybrid Blockchain

Public blockchains (e.g., Ethereum, Bitcoin) offer decentralization and transparency, suitable for dApps and DeFi. In contrast, private and consortium blockchains are preferred by enterprises and government institutions for their controlled access and faster processing.

- By Application

- Payments and Digital Currency

- Smart Contracts

- Supply Chain Management

- Identity Management

- Voting Systems

- Healthcare Data Management

- Trade Finance

- Insurance

- Media and Entertainment

Payments and smart contracts continue to be the leading application areas. However, supply chain transparency, particularly in food, pharma, and logistics, is rapidly gaining momentum.

- By Industry Vertical

- Banking, Financial Services & Insurance (BFSI)

- Healthcare

- Retail & eCommerce

- Government

- Real Estate

- Energy & Utilities

- Transportation & Logistics

- IT & Telecom

- Media & Entertainment

The BFSI sector leads in blockchain adoption, but healthcare and government are closing in fast. Blockchain’s ability to securely manage medical records, citizen data, and digital identities is making it indispensable.

- By Region

- North America

Leading the market in terms of technological innovation, startup ecosystem, and regulatory sandboxes. - Europe

Pioneering blockchain for digital identity and cross-border payments, backed by EU’s Blockchain Services Infrastructure (EBSI). - Asia-Pacific

Fastest-growing region with strong government backing (e.g., China’s BSN, India’s blockchain-based land registry). - Latin America

Exploring blockchain for financial inclusion, supply chain, and voting systems in countries like Brazil and Argentina. - Middle East & Africa

Focused on oil and gas supply chains, fintech innovation, and blockchain-based governance initiatives.

Competitive Landscape

The blockchain ecosystem includes protocol developers, infrastructure providers, consulting firms, and application developers. Key players include:

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Amazon Web Services (AWS)

- SAP SE

- R3

- ConsenSys

- Blockstream

- Ripple Labs Inc.

- Chainalysis

These companies are investing heavily in platform scalability, ecosystem development, and BaaS offerings to maintain competitive edge. Startups are also shaping the market with innovative applications in NFTs, gaming (GameFi), DAO platforms, and identity verification.

Market Challenges

Despite its rapid ascent, the blockchain market faces notable obstacles:

- Regulatory Uncertainty

Governments are still catching up with the technology, creating a regulatory gray zone. Issues around taxation, token classification, data privacy, and jurisdiction are unresolved in many regions.

- Scalability Concerns

Blockchains often suffer from low transaction throughput and high latency, particularly public blockchains during peak demand. Solutions like sharding, sidechains, and Layer 2 protocols are being developed but are still maturing.

- Interoperability Issues

Many blockchains operate in silos, making cross-chain communication difficult. This limits data mobility and seamless interactions across networks.

- Security Vulnerabilities

Despite being tamper-resistant, blockchains are not immune to attacks, especially at the application layer (e.g., smart contract exploits, DeFi hacks).

- User Adoption and Awareness

Lack of technical knowledge, complex onboarding processes, and unclear value propositions continue to hinder mainstream adoption, especially among small and medium enterprises.

Future Outlook and Opportunities

The blockchain technology market is evolving at a breakneck pace. Opportunities include:

- Blockchain in AI model training and federated learning

- Tokenized carbon credits and sustainability tracking

- NFT marketplaces in entertainment and fashion

- Digital identity frameworks for refugees and stateless individuals

- Blockchain-enabled voting and governance models

As the world shifts toward decentralization, transparency, and trustless systems, blockchain is no longer an experimental technology—it’s a strategic digital infrastructure for the next decade.

Conclusion

The blockchain technology market is on the brink of a paradigm shift, from niche to necessity. Its evolution from cryptocurrency infrastructure to a foundational layer of digital transformation illustrates a market brimming with opportunity, disruption, and long-term relevance.

With its projected rise to USD 943.67 billion by 2032, blockchain is set to reshape industries, empower consumers, and redefine digital trust—proving that its potential goes far beyond the chain.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐌𝐨𝐫𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Photoacoustic Tomography Market

Self-Learning Autonomous Infrastructure Market

Sustainable Fashion Supply Chain Solutions Market

AI-Powered Enterprise Automation Market

Memory-Augmenting Neural Devices Market

Automotive Lead-Acid Battery Market