Press Release: Compact Construction Equipment Market – Growth, Trends, and Forecasts

Market Overview

The compact construction equipment (CCE) market has witnessed significant growth in recent years, driven by increasing infrastructure development across the globe. Compact construction equipment refers to a range of machinery that includes mini excavators, skid steer loaders, compact track loaders, backhoe loaders, and more, designed to work in confined or small areas where larger machinery may not be efficient. These machines are favored for their maneuverability, efficiency, and versatility, making them ideal for urban construction projects, landscaping, and small-scale infrastructure works.

The demand for compact construction equipment has risen due to the growth in residential and commercial construction, along with ongoing urbanization trends. This market is poised for further expansion, fueled by advancements in technology, the need for efficient operations, and growing adoption of automation in construction projects. In this press release, we explore the key factors driving market growth, challenges faced by industry players, regional trends, and the outlook for the coming years.

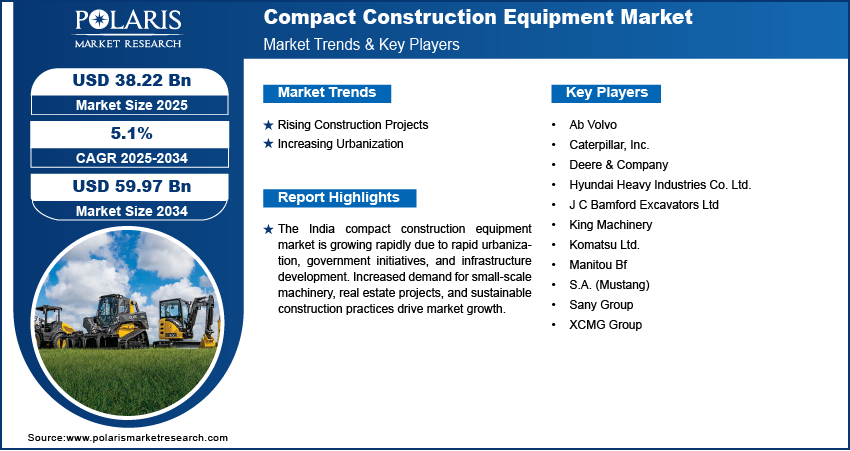

Global Compact Construction Equipment Market size and share is currently valued at USD 36.40 billion in 2024 and is anticipated to generate an estimated revenue of USD 59.97 billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 5.1% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 – 2034.

Key Market Growth Drivers

-

Infrastructure Development and Urbanization The rapid urbanization and infrastructure development in emerging economies have increased the demand for compact construction equipment. With a growing need for roads, bridges, buildings, and utilities, compact construction machines are becoming a staple for construction contractors who require flexible, space-efficient machinery. These machines are ideal for confined spaces, such as urban building sites, where traditional heavy equipment cannot operate effectively.

-

Technological Advancements The compact construction equipment market is benefiting from the rise of innovative technologies like telematics, GPS tracking, and automation. These technologies help improve the performance and productivity of the equipment, as well as monitor operations in real-time, leading to reduced downtime and increased operational efficiency. In addition, the trend towards electric and hybrid compact construction machines is gaining traction as part of the construction industry’s efforts to reduce its carbon footprint and enhance sustainability.

-

Cost-Effectiveness and Productivity One of the primary drivers of compact construction equipment adoption is its cost-effectiveness. Compared to larger machinery, compact equipment offers lower initial costs, reduced maintenance expenses, and better fuel efficiency. Small contractors and businesses looking to enter the construction market can leverage this affordability while maintaining high productivity levels. The compact size of these machines allows for quicker project turnaround times, which is crucial for contractors managing multiple projects simultaneously.

-

Growing Demand for Landscaping and Agricultural Applications Beyond traditional construction, compact construction equipment is increasingly being utilized in landscaping, agriculture, and forestry. The growing trend of urban green spaces and agricultural modernization requires efficient and versatile machinery that can perform a variety of tasks, from soil excavation to material handling. The adaptability of compact loaders, mini excavators, and backhoe loaders makes them an essential tool in these sectors, further driving the market growth.

Market Challenges

-

High Operational and Maintenance Costs While compact construction equipment offers initial cost savings, the long-term operational and maintenance expenses can become significant, particularly for small contractors. Fuel costs, regular servicing, and the potential for machinery breakdowns can place financial strain on businesses. Additionally, operators must be adequately trained to use these machines efficiently, as improper use can lead to costly repairs or reduced productivity.

-

Limited Load Capacity and Work Area Although compact construction equipment excels in maneuverability and efficiency in confined spaces, they have limitations in terms of load capacity and work area compared to their larger counterparts. These limitations can hinder their use in larger construction projects, where heavy-duty machinery may be required. Contractors may need to deploy multiple compact machines to handle different tasks, which can increase operational complexity and costs.

-

Economic Uncertainty and Supply Chain Disruptions The construction equipment market is not immune to the challenges of global economic fluctuations and supply chain disruptions. Rising raw material costs, logistical challenges, and geopolitical tensions can lead to delays in production and delivery, affecting the availability of compact construction equipment. Economic downturns may also lead to reduced construction spending, slowing down the demand for new equipment and impacting market growth.

-

Competition from Rental Equipment The availability of construction equipment rental services is another challenge for the compact construction equipment market. Many construction firms prefer renting equipment rather than purchasing it, particularly for short-term projects or projects that require specialized machinery. This trend poses a threat to the growth of the market, as it reduces the need for contractors to invest in their own equipment.

Regional Analysis

-

North America North America has long been a key region for the compact construction equipment market, with significant demand coming from the United States and Canada. The robust construction industry in North America, coupled with the increasing focus on infrastructure development and smart city projects, drives the demand for compact equipment. Additionally, technological innovations and the rising trend of sustainability in construction practices are pushing the adoption of electric and hybrid compact machines in this region.

-

Europe The European market for compact construction equipment is expected to witness steady growth, driven by the demand for infrastructure projects and the ongoing transition towards green construction practices. Countries like Germany, the UK, and France are witnessing a rise in the adoption of compact machines, particularly in urban construction and road development projects. The European Union’s focus on sustainability and energy-efficient construction is also contributing to the shift toward electric and hybrid compact machinery.

-

Asia-Pacific The Asia-Pacific region holds the largest share of the global compact construction equipment market. The rapid urbanization, infrastructure boom, and growth in the construction industry in countries like China, India, and Japan are significant factors driving demand. The region’s large-scale infrastructure projects, particularly in emerging economies, present substantial opportunities for the growth of compact construction equipment. Additionally, the demand for compact machinery in agriculture and landscaping is growing in countries like India and Southeast Asia.

-

Latin America In Latin America, the compact construction equipment market is experiencing growth driven by the increasing demand for infrastructure development and real estate projects. The growing urban population in countries like Brazil and Mexico is contributing to the need for compact machines that can efficiently navigate crowded urban environments. While the region faces economic challenges, the demand for compact equipment remains strong due to the flexibility and versatility these machines offer.

-

Middle East & Africa The Middle East and Africa (MEA) region is showing potential for the growth of compact construction equipment, particularly in the GCC (Gulf Cooperation Council) countries, where large-scale construction projects are prevalent. The demand for infrastructure, including roads, airports, and residential complexes, is driving the adoption of compact machines. Additionally, the region’s focus on sustainable construction and energy-efficient solutions is influencing the demand for electric and hybrid construction equipment.

Key Companies in the Market

The compact construction equipment market is highly competitive, with several global and regional players offering a wide range of products to cater to diverse customer needs. These companies focus on innovation, technological advancements, and customer service to maintain their market positions. Some of the key players include manufacturers of mini excavators, skid steer loaders, and compact track loaders, offering diverse product portfolios and customized solutions for their customers.

Conclusion

The compact construction equipment market is poised for strong growth, driven by factors such as urbanization, infrastructure development, technological advancements, and increasing demand from various sectors, including agriculture and landscaping. Despite challenges related to high maintenance costs and competition from rental equipment, the market presents substantial opportunities for innovation and expansion. As global construction projects continue to scale and evolve, the compact construction equipment market is expected to play a crucial role in shaping the future of the construction industry.

More Trending Latest Reports By Polaris Market Research:

Testing, Inspection, and Certification Market

Automated Material Handling Equipment Market

The Resistant Maltodextrin Market: Unlocking Growth Opportunities and Gaining a Competitive Edge