EV Battery Market Overlook

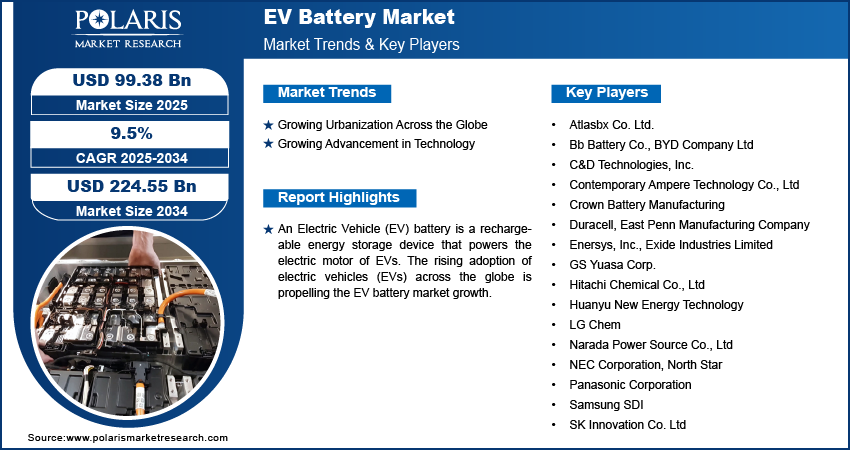

The global EV battery market size was valued at USD 90.94 billion in 2024. The market is projected to grow from USD 99.38 billion in 2025 to USD 224.55 billion by 2034, exhibiting a CAGR of 9.5 % during 2025–2034. This growth can be attributed to the rapidly increasing demand for electric vehicles, advancements in battery technology, and the growing emphasis on reducing carbon emissions and achieving sustainability in the automotive sector.

As governments across the world focus on environmental policies and subsidies for EV adoption, and consumers continue to prioritize energy-efficient and eco-friendly transportation options, the demand for high-performance EV batteries is expected to rise exponentially. Additionally, the ongoing evolution of battery technology, including the development of solid-state batteries and innovations in lithium-ion chemistry, will contribute significantly to the market’s expansion.

Market Overview

The electric vehicle battery is a crucial component of electric vehicles, responsible for storing and supplying power to the electric motor. The primary types of batteries used in EVs include lithium-ion (Li-ion), lithium iron phosphate (LFP), and newer technologies such as solid-state batteries and sodium-ion batteries. Lithium-ion batteries dominate the market due to their high energy density, long life, and cost-effectiveness compared to other alternatives.

The rapid growth of the electric vehicle market, driven by environmental awareness and favorable government policies, is directly fueling the demand for EV batteries. Major automakers are increasingly shifting towards electric mobility, and as a result, the need for advanced batteries capable of offering longer ranges, faster charging times, and improved overall performance is becoming critical. At the same time, the focus on reducing the cost per kilowatt-hour (kWh) of battery storage is encouraging technological innovations and driving down prices, making EVs more affordable for the mass market.

The market is also witnessing a surge in the development of charging infrastructure, including ultra-fast charging stations, which are designed to complement the growth of electric vehicles and ensure that EV owners have reliable access to charging networks.

Browse Full Insights:

https://www.polarismarketresearch.com/industry-analysis/electric-vehicle-battery-market

Key Companies in the EV Battery Market

Several leading players are driving innovation and shaping the future of the EV battery market. These companies are focused on advancing battery technologies, improving energy density, and lowering costs to meet the evolving demands of electric vehicle manufacturers and consumers.

1. Tesla Inc.

Tesla is a dominant player in the EV battery market, known for its electric vehicles, such as the Model 3, Model S, and Model X. Tesla also develops and manufactures batteries through its Gigafactory in Nevada, focusing on lithium-ion batteries for both passenger and commercial vehicles. Tesla’s battery innovations are crucial in driving the EV market’s growth.

2. LG Chem

LG Chem is one of the largest suppliers of EV batteries globally. The company supplies lithium-ion batteries to major automakers, including GM, Hyundai, and Ford. With a strong focus on increasing energy density and reducing charging times, LG Chem continues to expand its production capacity and technological capabilities.

3. CATL (Contemporary Amperex Technology Co. Ltd.)

As one of the world’s largest manufacturers of EV batteries, CATL provides lithium-ion batteries for various electric vehicle applications. The company is known for its cutting-edge battery technology and manufacturing expertise. CATL is also heavily invested in the development of solid-state battery technologies.

4. Panasonic Corporation

Panasonic is a key player in the EV battery market, supplying batteries for Tesla’s electric vehicles. The company is focused on improving the efficiency, energy density, and lifespan of its lithium-ion batteries. Panasonic has also expanded its production capacity to meet the growing demand for EV batteries.

5. BYD Company Ltd.

BYD is a major Chinese company that manufactures both electric vehicles and batteries. With its extensive portfolio of electric vehicles, including buses and trucks, BYD is a significant supplier of EV batteries, contributing to the market’s growth, especially in Asia.

Report Scope

EV Battery Market, Battery Outlook (Revenue, USD Billion, 2020 – 2034)

- Lead-Acid

- Lithium-Ion

- Positive Electrode

- Negative Electrode

- Electrolyte

- Separator

- Nickel-Metal Hydride

- Sodium-Ion

- Solid-State

EV Battery Market, Propulsion Outlook (Revenue, USD Billion, 2020 – 2034)

- BEV

- HEV

- PHEV

- FCEV

EV Battery Market, Vehicle Outlook (Revenue, USD Billion, 2020 – 2034)

- Passenger Cars

- Vans/Light Trucks

- Medium & Heavy Trucks

- Buses

- Off-Highway Vehicles

EV Battery Market, Method Outlook (Revenue, USD Billion, 2020 – 2034)

- Wire Bonding

- Laser Bonding

EV Battery Market, Capacity Outlook (Revenue, USD Billion, 2020 – 2034)

- 5o kWh

- 50-11o kWh

- 11-200 kWh

- 201-300 kWh

- >300 kWh

EV Battery Market, Form Outlook (Revenue, USD Billion, 2020 – 2034)

- Prismatic

- Cylindrical

- Pouch

EV Battery Market, Material Outlook (Revenue, USD Billion, 2020 – 2034)

- Lithium

- Cobalt

- Manganese

EV Battery Industry Developments

March 2025: SK On and Nissan have entered into a strategic battery supply agreement to bolster Nissan’s electric vehicle (EV) production in North America. Under the terms of the deal, SK On will supply nearly 100 GWh of U.S.-manufactured batteries, starting in 2028 and extending through 2033. This partnership underscores the growing importance of localizing EV battery production to meet the rising demand for electric vehicles in the region.

February 2025: Hyundai, the South Korean multinational automotive giant, unveiled plans to publicly showcase its all-solid-state EV battery pilot line for the first time. This breakthrough technology is poised to revolutionize the EV battery industry by offering higher energy densities, faster charging times, and enhanced safety features compared to traditional lithium-ion batteries. Hyundai’s move represents a significant step forward in the transition to more efficient and sustainable electric vehicles.

April 2024: CATL, one of the leading players in the global EV battery market, introduced a new battery pack with an impressive warranty of up to 1 million miles (1.5 million km) or 15 years. This development highlights CATL’s commitment to enhancing the durability and longevity of EV batteries, addressing one of the primary concerns for consumers and manufacturers alike in the electric vehicle space.

Conclusion

The EV battery market is witnessing exponential growth as electric vehicles become an increasingly integral part of the global automotive landscape. With advancements in battery technology, rising consumer demand for eco-friendly transportation, and the focus on reducing greenhouse gas emissions, the market for EV batteries is set to thrive in the coming years. Leading companies in the sector are innovating with new battery chemistries, energy storage solutions, and manufacturing techniques, which will further drive the global shift towards electric mobility. As governments and automakers continue to prioritize sustainable transportation, the EV battery market is expected to remain a key player in the transition to a cleaner, greener future.

More Trending Latest Reports By Polaris Market Research:

Automotive Brake System Market