Market Overview

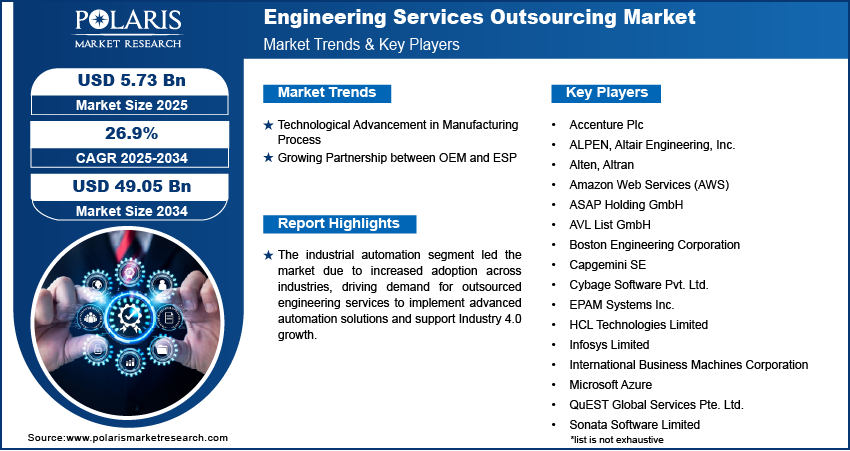

Global Engineering Services Outsourcing Market size and share is currently valued at USD 4.54 billion in 2024 and is anticipated to generate an estimated revenue of USD 49.05 billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 26.9% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 – 2034

The engineering services outsourcing market encompasses various categories, including mechanical engineering, civil engineering, electrical engineering, software engineering, and digital engineering solutions. Key services include product design and development, testing and simulation, prototyping, and software development, along with embedded systems and system integration. The shift towards digitalization, Industry 4.0, and automation in manufacturing and other sectors has led to the growing demand for specialized engineering services that integrate advanced technologies and data analytics.

As companies strive to reduce operational costs and enhance their global reach, ESO offers a viable pathway to accessing skilled engineering talent without the need for significant capital investment. By outsourcing non-core functions, organizations can achieve faster time-to-market, optimize resource allocation, and leverage the global pool of expertise. Engineering service providers have been expanding their offerings to include end-to-end solutions, from conceptual design to product lifecycle management, to meet diverse client requirements.

Key Market Growth Drivers

Several factors are driving the growth of the engineering services outsourcing market:

- Cost Efficiency and Resource Optimization

Outsourcing engineering services offers significant cost savings, especially for companies based in high-wage economies. By leveraging low-cost regions such as India, China, and Eastern Europe, companies can access top-tier engineering talent without the financial burden of maintaining an in-house team. This resource optimization enables businesses to allocate funds to critical areas such as research and development (R&D) and core operations. - Increased Demand for Innovation and Technology Integration

As industries become more technology-driven, the need for innovative engineering solutions has surged. Engineering services outsourcing enables companies to tap into advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), machine learning, and robotics. By collaborating with engineering service providers, businesses can incorporate these technologies into their products and processes, enhancing product functionality, performance, and overall market competitiveness. - Focus on Core Competencies

Outsourcing non-core engineering functions allows businesses to focus on their primary areas of expertise, such as marketing, sales, and customer engagement, while leaving specialized tasks to experienced engineering service providers. As companies grow and diversify, the ability to manage multiple projects and operations becomes increasingly complex. ESO offers an efficient solution for handling specialized tasks without diverting resources from strategic goals. - Globalization and Expansion into Emerging Markets

With businesses looking to expand into emerging markets, outsourcing engineering services allows them to rapidly scale operations without the challenges associated with setting up new facilities or hiring large teams locally. By outsourcing, companies can quickly access skilled engineering talent in regions with growing industrial sectors, such as Asia-Pacific and Latin America. This expansion is also fueled by favorable government policies and incentives aimed at boosting industrialization and technology adoption in these regions. - Demand for Digital Engineering Solutions

The rise of digital engineering solutions has transformed the way engineering tasks are performed, with services such as 3D modeling, simulation, and virtual prototyping gaining prominence. These digital engineering tools allow companies to design, test, and optimize products virtually before physical production, reducing development time and costs. As a result, businesses are increasingly turning to engineering service providers for these specialized services, accelerating the adoption of digital engineering outsourcing.

Key Companies in Engineering Services Outsourcing Market

- Accenture Plc

- ALPEN

- Altair Engineering, Inc.

- Alten

- Altran

- Amazon Web Services (AWS)

- ASAP Holding GmbH

- AVL List GmbH

- Boston Engineering Corporation

- Capgemini SE

- Cybage Software Pvt. Ltd.

- EPAM Systems Inc.

- HCL Technologies Limited

- Infosys Limited

- International Business Machines Corporation

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/engineering-services-outsourcing-market

Engineering Services Outsourcing Market Developments

February 2024 – MGS launched its Global Engineering Services Group, bringing together more than 200 toolmakers and 85 engineers across the globe. This strategic move significantly strengthens the company’s engineering capabilities and boosts global production support for healthcare innovators.

March 2023 – Deloitte acquired the assets of Optimal Design Co., a leading provider of product engineering services specializing in smart connected products and IoT solutions. This acquisition enhances Deloitte’s ability to support clients in accelerating innovation and achieving their digital transformation goals by leveraging the combined strengths of both organizations.

Engineering Services Outsourcing Market Segmentation

By Application Outlook (Revenue USD Billion, 2020–2034)

- Automotive

- Energy

- Network & Communications

- Industrial Automation

- Medical Technology

- Industrial Electronics & Automated Embedded Service

- Consumer Electronics

- Semiconductors

- Construction

- Aerospace

By Location Outlook (Revenue USD Billion, 2020–2034)

- Onshore

- Offshore

Regional Analysis

The engineering services outsourcing market is experiencing growth across various regions, each with its own unique dynamics and opportunities.

North America

North America remains one of the largest markets for engineering services outsourcing, driven by the region’s robust industrial base and ongoing investments in innovation and technology. The United States, in particular, is home to a vast number of multinational corporations, many of which are increasingly outsourcing engineering functions to global service providers to maintain a competitive edge. The demand for contract engineering services in sectors such as aerospace, automotive, and energy is strong, with companies looking to outsource specialized tasks like product design, testing, and simulation to service providers in lower-cost regions.

Europe

Europe’s engineering services outsourcing market is thriving, especially in countries like Germany, the UK, and France. The region’s manufacturing sector, particularly in automotive, aerospace, and energy, is a major driver of demand for ESO. Companies are outsourcing engineering tasks related to product development, prototyping, and digital engineering solutions to improve operational efficiency and reduce time-to-market. Additionally, Europe’s emphasis on sustainability and green technologies has led to the rise of specialized engineering services related to energy efficiency and renewable energy projects.

Asia-Pacific

Asia-Pacific is expected to see the fastest growth in the engineering services outsourcing market, largely due to the presence of emerging economies like India, China, and Southeast Asian nations, which are increasingly becoming key hubs for engineering talent. India, in particular, has emerged as a global leader in providing outsourced engineering services, with a large pool of skilled engineers offering cost-effective solutions for clients worldwide. As demand for engineering services rises across industries such as automotive, telecom, and electronics, outsourcing to Asia-Pacific is poised to grow significantly.

Latin America

Latin America is becoming an attractive destination for outsourcing engineering services due to its proximity to North America and the availability of highly skilled engineering professionals in countries such as Brazil, Mexico, and Argentina. With the increasing focus on industrialization and infrastructure development in the region, demand for contract engineering services is on the rise. Additionally, the region’s growing tech industry and adoption of digital engineering solutions are contributing to the market’s expansion.

Middle East & Africa

The Middle East and Africa region is also witnessing growing adoption of engineering services outsourcing, particularly in sectors such as oil and gas, construction, and renewable energy. As companies in the region continue to diversify their economies and adopt advanced technologies, the demand for specialized engineering services, including digital and automation solutions, is expected to increase.

Conclusion

The engineering services outsourcing market is undergoing significant transformation as companies look for ways to reduce costs, increase efficiency, and foster innovation. Driven by the demand for digital engineering solutions, cost efficiency, and access to global talent, the ESO market is expanding across industries and regions. As outsourcing continues to play a vital role in the engineering ecosystem, businesses will increasingly rely on engineering service providers to support their product development, manufacturing, and technological integration needs, positioning the market for continued growth in the coming years.

More Trending Latest Reports By Polaris Market Research:

US Organoid and Spheroid Market