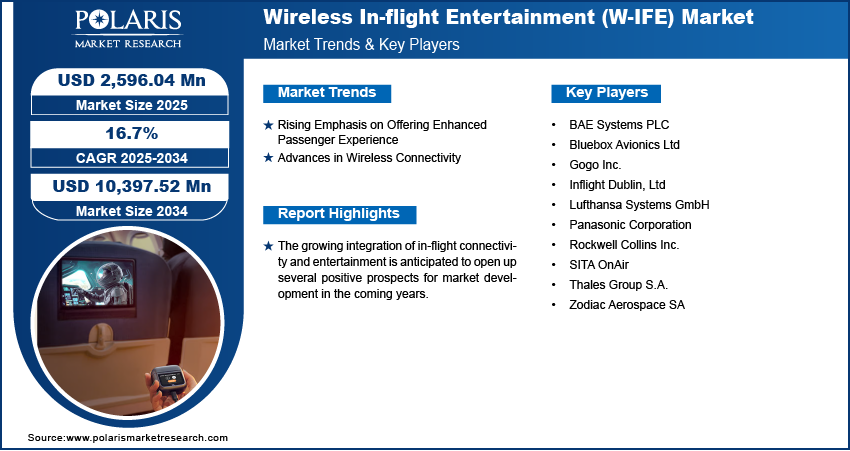

The global wireless in-flight entertainment (W-IFE) market is taking off rapidly as airlines worldwide embrace cutting-edge digital technologies to enhance the passenger experience. According to recent market data, the W-IFE market was valued at USD 2,227.42 million in 2024, with projections estimating growth to USD 10,397.52 million by 2034, demonstrating an impressive compound annual growth rate (CAGR) of 16.7% from 2025 to 2034.

Market Overview

The Wireless In-Flight Entertainment (W-IFE) system allows passengers to access multimedia content on their personal electronic devices (PEDs) without relying on embedded seatback screens. From Hollywood blockbusters and live TV to interactive games and e-commerce options, W-IFE offers a flexible and cost-effective entertainment solution for airlines and passengers alike.

Compared to traditional wired systems, W-IFE reduces aircraft weight and fuel consumption, providing operational cost savings for airlines. It also enables easy content updates and compatibility with real-time streaming platforms, further improving airline passenger experience.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/wireless-in-flight-entertainment-market

Key Growth Drivers

- Rising Demand for Personalized Entertainment

Modern travelers expect uninterrupted access to streaming content during their flights. W-IFE systems cater to this demand by allowing passengers to stream movies, music, and TV shows directly on their own devices, offering a highly customizable experience. This aligns with the broader trend of personalization in the travel sector.

- Technological Advancements in Connectivity

The integration of in-flight connectivity solutions such as satellite-based internet and high-speed Wi-Fi has enabled seamless operation of W-IFE systems. Airlines are partnering with satellite communication providers to deploy robust networks that support simultaneous device streaming and e-commerce transactions.

- Shift Toward Fuel Efficiency and Lightweight Aircraft

Reducing aircraft weight is a key factor in achieving fuel efficiency. By replacing bulky wired systems with lightweight wireless infrastructure, airlines can significantly cut down on fuel usage and carbon emissions. This makes W-IFE a strategic component in airlines’ sustainability initiatives.

- Post-Pandemic Hygiene Awareness

The COVID-19 pandemic has shifted consumer preferences toward contactless services. Passengers now prefer using their own devices over shared in-seat screens, accelerating the adoption of W-IFE systems that support BYOD (bring your own device) functionalities.

Market Challenges

Despite the promising growth trajectory, the W-IFE market faces several challenges:

- High Initial Costs: Implementation of advanced W-IFE systems requires significant capital investment, especially for small and regional carriers.

- Bandwidth Limitations: In certain regions, especially over remote areas and oceans, limited satellite bandwidth can affect streaming quality and system performance.

- Cybersecurity Concerns: As more systems become connected, the risk of cyber-attacks increases. Protecting passenger data and digital infrastructure is a growing concern for airline operators.

- Regulatory Approvals: Certification and compliance with aviation regulations can slow down the deployment of new W-IFE technologies.

Regional Analysis

North America

North America leads the W-IFE market, with major carriers like Delta, American Airlines, and United investing in next-gen streaming entertainment systems. The presence of leading W-IFE service providers such as Gogo and Viasat further strengthens the region’s dominance.

Europe

European airlines are rapidly upgrading their fleets with wireless solutions to meet increasing demand for digital experiences. Strong regulatory backing for sustainable aviation practices also encourages the adoption of lightweight, wireless systems.

Asia-Pacific

The Asia-Pacific region is projected to witness the fastest growth due to increasing air travel demand, expanding middle-class populations, and the rapid fleet modernization by airlines in countries like India, China, and Japan.

Middle East and Africa

With national carriers such as Emirates and Qatar Airways at the forefront of luxury air travel, the Middle East is a key hub for W-IFE innovation. However, infrastructural and economic challenges still hinder widespread adoption in some parts of Africa.

Key Companies in the W-IFE Ecosystem

Several leading technology providers and system integrators are driving innovation and competition in the W-IFE space:

- Gogo LLC: A pioneer in in-flight connectivity and entertainment, Gogo has developed advanced solutions compatible with both commercial and business aircraft.

- Viasat Inc.: Known for its satellite-based connectivity, Viasat offers high-speed streaming capabilities and global coverage.

- Panasonic Avionics Corporation: A major player in both hardware and content services, Panasonic supports hybrid systems combining W-IFE with seatback screens.

- Thales Group: With a strong presence in the aerospace sector, Thales offers cloud-based W-IFE systems with integrated digital services.

- Bluebox Aviation Systems: Specializes in low-cost W-IFE solutions suitable for short-haul and budget airlines.

These companies are actively partnering with content providers, cloud platforms, and satellite operators to deliver end-to-end digital entertainment services on board.

Market Segmentation

By Type:

- Hardware (Wireless access points, servers, antenna systems)

- Content Services (Video on demand, live TV, audio, games)

- Connectivity (Satellite-based, air-to-ground)

By Aircraft Type:

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Regional Jets

- Business Jets

By End-User:

- Commercial Airlines

- Private & Charter Operators

- Military Aircraft

By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Future Outlook

The next decade is expected to be transformative for the W-IFE market. Innovations in aircraft digitalization and AI-powered content curation will redefine how airlines engage passengers. Integration with e-commerce, loyalty programs, and in-flight advertising will also open new revenue streams.

Additionally, emerging technologies like 5G and Low-Earth Orbit (LEO) satellite networks promise to enhance bandwidth and reduce latency, further improving the performance and scalability of W-IFE systems.

As airlines continue to prioritize passenger satisfaction and operational efficiency, the wireless in-flight entertainment market is well-positioned to become a cornerstone of the modern aviation ecosystem.

Conclusion

The global Wireless In-flight Entertainment (W-IFE) market is flying high, propelled by passenger expectations for seamless digital experiences, sustainability goals, and advancements in in-flight connectivity. With a projected CAGR of 16.7% over the next decade, this sector offers substantial opportunities for stakeholders across the aviation and tech industries. As competition intensifies and technologies evolve, the future of streaming entertainment systems in the skies looks brighter than ever.

More Trending Latest Reports By Polaris Market Research:

Targeted Protein Degradation Market

Europe Pipeline Pigging Market