Market Overview

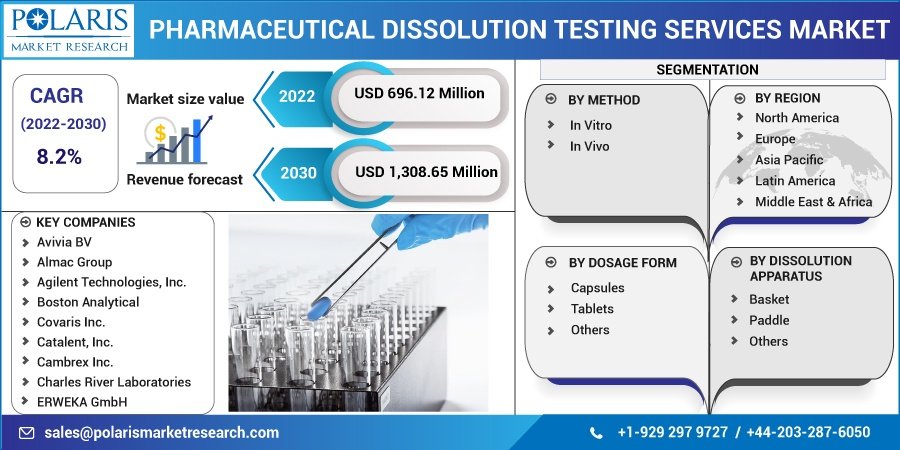

The global pharmaceutical dissolution testing services market was valued at USD 643.84 million in 2021 and is projected to reach approximately USD 1.45 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.2% during the forecast period. Dissolution testing is a critical analytical procedure that evaluates the rate at which an active pharmaceutical ingredient (API) is released from a solid dosage form into solution. It is a fundamental requirement for pharmaceutical quality control and plays a vital role in bioequivalence studies for generic drug approval.

The market’s growth is primarily fueled by rising R&D expenditures by pharmaceutical companies, increasing demand for generics, stringent regulatory compliance mandates, and the complexity of modern formulations. As solid oral dosage forms remain the most common drug delivery type globally, the need for accurate and validated drug release testing services continues to rise.

Market Segmentation

Pharmaceutical Dissolution Testing Services Market, Method Outlook (Revenue – USD Million, 2018 – 2030)

- In Vitro

- In Vivo

Pharmaceutical Dissolution Testing Services Market, Dosage Form Outlook (Revenue – USD Million, 2018 – 2030)

- Capsules

- Tablets

- Others

Pharmaceutical Dissolution Testing Services Market, Dissolution Apparatus Outlook (Revenue – USD Million, 2018 – 2030)

- Basket

- Paddle

- Others

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

Growth Drivers

- Expansion of the Generic Drug Industry The surge in generic drug manufacturing globally is driving the demand for bioequivalence testing, which includes comparative dissolution testing. Regulatory agencies such as the FDA and EMA mandate dissolution profile matching for generic formulations, making it a critical service offering.

- Stringent Regulatory Guidelines Dissolution testing is required across the drug development lifecycle — from early-phase development to post-market surveillance. Regulatory bodies worldwide are increasingly emphasizing quality by design (QbD) and analytical robustness, increasing demand for specialized, validated testing services.

- Rise in Complex and Controlled-Release Formulations The pharmaceutical industry is shifting toward complex dosage forms like multiparticulate systems, osmotic pumps, and enteric-coated tablets. These systems require more sophisticated dissolution testing protocols, increasing reliance on experienced service providers.

- Cost and Time Efficiency Through Outsourcing Pharma companies are increasingly outsourcing pharmaceutical dissolution testing services to reduce operational costs and accelerate time-to-market. Third-party laboratories offer scalable capacity, regulatory expertise, and access to advanced instrumentation.

- Technological Advancements in Dissolution Testing The development of automated dissolution systems, online UV/Vis detection, and fiber optic technology has significantly improved accuracy, throughput, and real-time monitoring capabilities. These advancements are enhancing the efficiency and precision of dissolution testing operations.

Market Challenges

- High Cost of Equipment and Testing Services Advanced dissolution testing equipment and instrumentation come with high acquisition and maintenance costs. For small companies, outsourcing may also become financially burdensome, especially for routine batch testing.

- Variability and Complexity of Testing Protocols The complexity of testing parameters—such as media selection, agitation speed, temperature control, and sampling interval—can create variability, especially for modified-release formulations, requiring high levels of expertise.

- Intellectual Property and Data Security Concerns Companies outsourcing critical R&D activities often face concerns related to IP protection and data confidentiality. Ensuring compliance with data integrity standards is essential to maintain trust and regulatory approval.

- Regulatory and Compliance Hurdles Regional differences in dissolution standards and evolving regulatory requirements can pose challenges to global service providers, who must maintain rigorous quality and documentation standards to satisfy diverse oversight agencies.

Regional Analysis

North America holds the largest market share due to a mature pharmaceutical industry, high R&D investments, and well-established regulatory frameworks led by the FDA. The United States accounts for a major share, with significant demand for dissolution testing in both innovator and generic sectors.

Europe is the second-largest market, driven by strong pharmaceutical activity in countries like Germany, Switzerland, and the UK. The region benefits from a robust network of CROs and independent testing labs that support local and global pharma companies in meeting EMA regulations.

Asia-Pacific is expected to witness the fastest growth during the forecast period. Increasing pharmaceutical manufacturing in India and China, rising government support for drug development, and a growing generics market are major contributors. The region is becoming a hub for contract testing services, offering cost advantages without compromising quality.

Latin America and the Middle East & Africa represent emerging markets. Although currently smaller in market share, improving healthcare infrastructure and regulatory frameworks are expected to encourage outsourcing of pharmaceutical testing services, including dissolution.

Key Companies in the Market

The pharmaceutical dissolution testing services market is highly fragmented, with numerous global and regional players offering specialized services. Key market participants include:

- Avivia BV

- Almac Group

- Agilent Technologies Inc.

- Boston Analytical

- Covaris Inc.

- Catalent Inc.

- Cambrex Inc.

- Charles River Laboratories

- ERWEKA GmbH

- Eurofins Scientific Incorporation

- Intertek Group Plc.

- Kinesis Ltd.

- Pace Analytical Life Sciences

- SGS SA

- Sotax AG

- Thermo Fisher Scientific Inc.

- Toxikon Inc.

- Teledyne Hanson Research Inc.

- West Pharmaceutical Services Inc.

Agilent Technologies Inc., Sotax AG, ERWEKA GmbH, and Teledyne Hanson Research Inc. are among the top manufacturers of dissolution testing equipment, offering high-throughput, automated, and compliant systems used widely in contract testing labs.

SGS SA, Eurofins Scientific, Intertek Group Plc., and Charles River Laboratories provide comprehensive analytical laboratory services, including dissolution profiling, content uniformity, and stability testing.

Catalent Inc. and Almac Group are major players offering integrated CDMO solutions, including dissolution testing within broader drug development workflows. Pace Analytical Life Sciences and Boston Analytical are notable for their expertise in regulatory compliance and advanced instrumentation.

Recent Developments

- In 2024, Agilent Technologies Inc. introduced an upgraded 708-DS dissolution apparatus with integrated UV analysis to improve analytical sensitivity and real-time data acquisition.

- Sotax AG launched a new series of semi-automated testers tailored for delayed- and sustained-release formulations, expanding its user base in Europe and North America.

- Eurofins Scientific expanded its North American analytical lab footprint with a new cGMP-compliant facility specializing in dissolution and stability testing for oral solids.

- Catalent Inc. partnered with emerging biotechs to provide dissolution profiling support for novel drug candidates entering Phase I clinical trials.

Future Outlook

The outlook for the pharmaceutical dissolution testing services market remains strong, driven by innovations in drug delivery, increasing regulatory scrutiny, and demand for cost-effective quality control solutions. Key trends shaping the market include:

- Adoption of real-time monitoring and automated testing systems for greater precision and efficiency.

- Growing use of in silico modeling and simulation tools to predict dissolution behavior before in vitro testing.

- Integration of artificial intelligence (AI) and machine learning for data analysis and predictive performance.

- Expansion of CDMO partnerships that combine formulation development, dissolution testing, and manufacturing.

- Increasing demand for personalized medicines and 3D-printed drug formulations, requiring customized testing protocols.

Conclusion

The pharmaceutical dissolution testing services market is poised for sustained growth, driven by rising pharmaceutical innovation, the expansion of generics, and increasing demand for quality assurance in drug development. As outsourcing becomes a strategic necessity for efficiency and regulatory compliance, market players offering specialized and reliable testing services will continue to play a crucial role in the global pharmaceutical landscape. With a strong pipeline of new drugs and advances in analytical methodologies, the industry is well-positioned to meet the evolving needs of drug developers, regulators, and patients alike.

More Trending Latest Reports By Polaris Market Research:

Voluntary Carbon Credit Market

Undersea Warfare Systems Market

Marketing Attribution Software Market

Canada Tactical Data Link Market: Harnessing Connectivity for Enhanced Defense Capabilities