The Polyurethane Dispersions (PUD) Market is undergoing significant growth as the demand for eco-friendly, high-performance, and low-VOC coatings and adhesives continues to surge across multiple industries. With an increasing shift toward sustainable materials and regulatory mandates favoring low-emission products, polyurethane dispersions—especially waterborne polyurethane—are emerging as a key component in coatings, textiles, automotive, leather, and wood finishes.

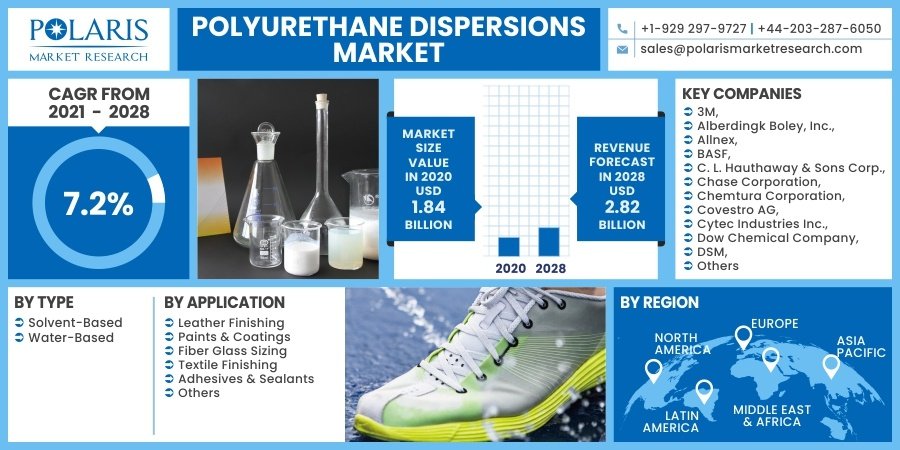

According to the research report published by Polaris Market Research, the Global Polyurethane Dispersions Market Size Is Expected To Reach USD 2.82 Billion By 2028., at a CAGR of 7.2% during the forecast period.

Market Overview

Polyurethane dispersions (PUDs) are colloidal systems in which polyurethane polymers are dispersed in water rather than organic solvents. These water-based systems deliver excellent film-forming capabilities, flexibility, chemical resistance, and adhesion. Because they emit low VOC emissions and comply with strict environmental regulations, they are favored in industries that require durable, aesthetic finishes without compromising health or sustainability standards.

A surge in demand for high-performance coatings in automotive interiors, construction materials, consumer electronics, textiles, and synthetic leather applications has positioned PUDs as a valuable alternative to conventional solvent-borne systems.

Key Market Growth Drivers

1. Environmental Regulations and Green Chemistry Initiatives

The growing global emphasis on green chemistry and sustainable manufacturing practices is a major catalyst for the PUD market. Governments across North America, Europe, and Asia-Pacific are tightening restrictions on volatile organic compounds (VOCs), driving the replacement of solvent-based formulations with low VOC emissions alternatives like PUDs.

In response, industries are increasingly adopting waterborne polyurethane systems for applications ranging from wood coatings to footwear and packaging adhesives, aligning with environmental standards such as REACH and the U.S. EPA Clean Air Act.

2. Boom in Automotive and Construction Sectors

In the automotive sector, polyurethane dispersions are widely used for interior parts, seats, and trim components due to their abrasion resistance, softness, and resilience. As the EV market continues to grow, demand for lightweight and sustainable materials with low emissions is boosting PUD usage.

Similarly, the construction industry is turning to PUDs for high-performance coatings in flooring, insulation, roofing, and sealants. These materials provide superior weather resistance and durability while remaining environmentally friendly.

3. Textile and Synthetic Leather Demand

PUDs are extensively used in textile finishes and artificial leather coatings due to their elasticity, softness, and mechanical strength. The fashion and upholstery industries are under pressure to eliminate harmful solvents and adopt water-based alternatives, making PUDs an ideal solution for both aesthetics and sustainability.

Moreover, the growing popularity of vegan leather and sustainable fashion is further propelling the market for polyurethane dispersions in clothing, footwear, and accessories.

4. Advancements in Formulation Technology

Technological innovations have significantly improved the performance of PUDs, making them more competitive with solvent-borne systems. Modern formulations offer enhanced abrasion resistance, gloss retention, water resistance, and hardness—characteristics critical for consumer products and industrial applications.

New crosslinking agents and hybrid PUD systems (e.g., with acrylic or silicone additives) have expanded the application range while maintaining eco-friendly profiles.

Browse Full Insights:

https://www.polarismarketresearch.com/industry-analysis/polyurethane-dispersions-market

Market Challenges

Despite strong growth prospects, the polyurethane dispersions market faces several challenges that may impact its expansion trajectory:

1. High Production Costs

Producing high-quality PUDs can be more expensive compared to traditional solvent-based systems. The need for advanced formulation technology and premium raw materials, such as isocyanates and polyols, contributes to elevated costs—making it less appealing for price-sensitive end users.

2. Performance Trade-Offs in Harsh Conditions

While waterborne PUDs are generally high-performing, their durability in extreme chemical or thermal environments may still lag behind certain solvent-based counterparts. This limitation can hinder their adoption in highly demanding industrial settings like marine or aerospace applications.

3. Complex Formulation and Stability Issues

Creating stable dispersions with consistent particle size, shelf life, and performance can be technically challenging. Formulators must carefully balance hydrophilic and hydrophobic components to ensure long-term product reliability, particularly in multi-layered coating systems.

Regional Analysis

Asia-Pacific

Asia-Pacific leads the global polyurethane dispersions market, holding over 40% of total revenue. Rapid industrialization, a booming construction sector, and expanding automotive production in countries like China, India, South Korea, and Japan have driven the adoption of PUDs.

China, in particular, is a major producer and consumer, thanks to strong governmental support for environmental reforms and the development of sustainable infrastructure. The region’s large population base and growing middle class also drive demand for PUD-based textiles and consumer goods.

North America

North America is a mature yet steadily growing market for polyurethane dispersions. Stringent VOC regulations enforced by the Environmental Protection Agency (EPA) and increasing preference for green chemistry in consumer goods have made PUDs a mainstay in the U.S. and Canada.

The region’s large automotive, electronics, and furniture manufacturing bases further bolster demand. Notably, the trend toward low-emission homes and LEED-certified construction is accelerating PUD usage in interior and architectural coatings.

Europe

Europe continues to be a stronghold for environmentally compliant chemical products. Countries such as Germany, France, and the Netherlands are home to major chemical producers and have robust demand for high-performance coatings in the automotive, construction, and furniture industries.

The European Union’s Green Deal and REACH regulations are major drivers, with increasing investment in R&D for bio-based and water-based materials. The market is also supported by consumer demand for sustainable fashion, pushing PUDs into apparel and accessories.

Latin America & Middle East and Africa (MEA)

Emerging economies in Latin America and MEA are gradually adopting polyurethane dispersions, particularly in construction and consumer goods sectors. Brazil and Mexico are key markets in Latin America, while countries in the GCC are beginning to explore sustainable coatings for infrastructure and oil-related facilities.

Though adoption is slower than in developed markets, increased awareness of environmental regulations and economic development are expected to boost regional growth over the next decade.

Key Companies and Market Landscape

- 3M

- Alberdingk Boley Inc.

- Allnex

- BASF

- C. L. Hauthaway & Sons Corp.

- Chase Corporation

- Chemtura Corporation

- Covestro AG

- Cytec Industries Inc.

- Dow Chemical Company

- DSM

- Hauthaway Corporation.

- Huntsman Corporation

- Lamberti

- Lanxess

- Lubrizol Corporation

- Mitsui Chemical

- Perstorp

- Stahl Holding

- Wanhua Chemical Group.

Innovation Trends

Bio-Based Polyurethane Dispersions

To meet green chemistry goals, several manufacturers are developing bio-based PUDs derived from soy, castor, or other renewable oils. These innovations reduce reliance on petroleum-based feedstocks and improve biodegradability without compromising performance.

Smart and Functional Coatings

Advanced PUD formulations now incorporate functionalities such as UV resistance, antimicrobial properties, and self-healing characteristics. These smart coatings are seeing increased use in healthcare, electronics, and aerospace applications.

Hybrid Dispersions

Hybrid systems combining PUDs with acrylics or silicones are gaining traction for offering a broader property profile, especially in areas where flexibility, weatherability, and chemical resistance are needed.

Conclusion

The polyurethane dispersions market is entering a new era of growth driven by innovation, sustainability, and performance. With strong momentum from regulations favoring low VOC emissions, advancements in waterborne polyurethane technology, and increasing use across diverse industries, PUDs are poised to become the dominant platform for future coatings and adhesives.

Despite challenges in cost and formulation complexity, the advantages in safety, compliance, and versatility give PUDs a competitive edge in a world moving toward cleaner, more responsible chemical solutions.

As industries increasingly align with green chemistry and consumers demand eco-friendly products, polyurethane dispersions are not just a trend—they’re the future of coatings technology.

More Trending Latest Reports By Polaris Market Research:

Targeting the future: A look into the remote weapon station market

Penetration Testing as a Service Market