Global 2K Protective Coatings Market Outlook

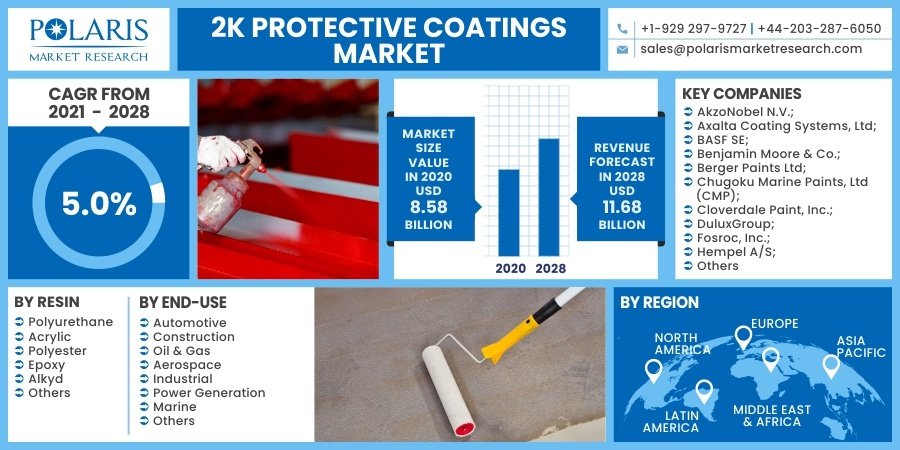

The global 2K protective coatings market size was valued at USD 8.58 billion in 2020 and is expected to grow at a CAGR of 5.0% during the forecast period. The growth is driven by increasing demand from the automotive, aerospace, and industrial sectors, alongside the rising need for superior durability and corrosion resistance in harsh environments. Additionally, the growing awareness of environmental sustainability and the adoption of high-performance coatings is fueling this market expansion.

2K protective coatings, which are two-component coatings that cure when mixed together, are known for their excellent durability, chemical resistance, and ability to withstand harsh conditions. These coatings are widely used in industries such as automotive, construction, and marine to protect surfaces from corrosion, wear, and tear. With increasing industrialization and technological advancements, the demand for high-performance coatings continues to rise globally.

Market Overview

The 2K protective coatings market is benefiting from significant growth due to the increasing demand for long-lasting, high-performance coatings that provide superior protection. The ability of these coatings to resist extreme temperatures, humidity, and chemicals makes them suitable for a wide range of applications, including automotive, aerospace, marine, and industrial equipment.

Key market drivers include rising awareness about the importance of corrosion protection in industries like automotive and infrastructure, along with the increasing adoption of environmentally friendly coatings. These coatings are also gaining traction due to advancements in technology that have led to enhanced durability, reduced drying times, and the ability to meet stringent environmental regulations.

The automotive industry, in particular, is one of the largest consumers of 2K protective coatings. As vehicle manufacturers increasingly focus on improving the durability and aesthetics of vehicles, the demand for high-quality protective coatings has surged. Similarly, the aerospace industry is using these coatings to protect aircraft components from corrosion and wear, ensuring the safety and longevity of aircraft.

Growth Drivers

The growth of the 2K Protective Coatings Market is primarily driven by rising industrialization, urbanization, and increasing commercial activities worldwide. In particular, the demand for 2K protective coatings has surged in the building and construction sector due to the growing need to enhance the durability and stability of structures.

Investments in the construction industry, including the development of offices, factories, manufacturing units, and public infrastructure, are key factors fueling market growth. Furthermore, the use of 2K protective coatings has expanded in industries such as oil & gas exploration, energy, power, and marine sectors.

The continuous growth of the advanced composites market is driven by increasing investments in research and development, technological advancements, and the wide application of these coatings across various industries. However, the high costs associated with 2K protective coatings, including substantial operating expenses, present challenges to market expansion.

The demand for 2K protective coatings is particularly strong in the building and infrastructure sectors. These coatings are widely used in applications like walls, façades, flooring, ceilings, and doors, among others. They are also critical in enhancing the strength, durability, and longevity of infrastructure projects such as bridges, stadiums, and highways.

Economic growth in countries like China, Japan, and India, along with rising industrialization and the growing demand from emerging economies in the Asia Pacific region, further supports the market’s expansion. Global companies are also introducing innovative products to tap into the market potential driven by the energy and construction sectors, providing a further boost to the 2K protective coatings market.

For example, in March 2021, Axalta Coating Systems launched the Imron Industrial 2K Polyurethane High Gloss Clearcoat. Imron 2100 HG-C is a low volatile organic compound (VOC) coating with minimal hazardous air pollutants. This new product offers polyester and acrylic urethane properties for a high-quality finish and simplifies repair work by quickly melting and flowing into damaged areas, further enhancing repair efficiency. This launch expands Axalta’s portfolio in North America.

Report Scope

2K Protective Coatings Resin Outlook (Volume – Kilotons; Revenue, USD Billion, 2016 – 2028)

- Polyurethane

- Acrylic

- Polyester

- Epoxy

- Alkyd

- Others

2K Protective Coatings End-Use Industry Outlook (Volume – Kilotons; Revenue, USD Billion, 2016 – 2028)

- Automotive

- Construction

- Oil and Gas

- Aerospace

- Industrial

- Power Generation

- Marine

- Others

Browse Full Insights:

https://www.polarismarketresearch.com/industry-analysis/2k-protective-coating-market

Regional Analysis

North America

North America is one of the largest markets for 2K protective coatings, led by the U.S. The growing demand from the automotive and aerospace industries is driving the market in the region. Moreover, advancements in manufacturing technologies, coupled with the rising need for durable and high-performance coatings, are contributing to the region’s market growth. The stringent environmental regulations in North America also encourage the adoption of eco-friendly and low-VOC (volatile organic compound) coatings, further driving the demand for high-performance 2K coatings.

Europe

Europe is another key market for 2K protective coatings, with countries like Germany, France, and the U.K. being significant contributors. The region’s automotive and aerospace industries are significant consumers of high-performance coatings. Additionally, the growing emphasis on sustainability and environmentally friendly solutions is driving the adoption of 2K coatings that meet eco-certifications, such as low-emission standards.

Asia-Pacific

The Asia-Pacific region is expected to witness the fastest growth in the 2K protective coatings market. Countries like China, India, and Japan are seeing rapid industrialization, increased manufacturing activities, and higher demand for automobiles, which are driving the need for advanced coatings. Additionally, the rising automotive production in these countries, coupled with the expansion of the aerospace sector, is expected to contribute to the region’s market growth.

Latin America and Middle East & Africa (LAMEA)

In the LAMEA region, demand for 2K protective coatings is increasing, particularly in the automotive and construction sectors. Rapid urbanization and industrial growth in regions such as Brazil, the Middle East, and parts of Africa are fueling demand for high-performance coatings. These regions also benefit from the increasing adoption of protective coatings for infrastructure and industrial applications.

Key Companies in the 2K Protective Coatings Market

Several leading companies are contributing to the growth and development of the 2K protective coatings market. These companies are actively involved in product innovation, strategic acquisitions, and partnerships to strengthen their market position. Key players include:

- AkzoNobel N.V.

As a global leader in coatings, AkzoNobel provides a wide range of 2K protective coatings for automotive, aerospace, and industrial applications. The company focuses on innovation and sustainability, ensuring that its products meet environmental regulations while providing superior protection. - PPG Industries, Inc.

PPG is a major player in the global coatings market, offering a diverse portfolio of 2K coatings for industries such as automotive, aerospace, and construction. The company’s coatings are known for their high performance and resistance to corrosion, wear, and chemicals. - BASF SE

BASF is one of the world’s largest chemical companies, providing high-performance 2K coatings used in various sectors, including automotive, aerospace, and industrial applications. BASF is committed to developing sustainable and eco-friendly coating solutions. - Sherwin-Williams Company

Sherwin-Williams is a leading manufacturer of 2K coatings, providing products for both industrial and commercial applications. The company’s focus on innovation, combined with its global reach, positions it as a key player in the protective coatings market. - Henkel AG & Co. KGaA

Henkel offers a wide range of industrial coatings, including 2K protective coatings. The company’s expertise in adhesive technologies and coating solutions helps it cater to a broad array of industries, from automotive to aerospace.

Conclusion

The global 2K protective coatings market is expected to grow significantly over the next decade, driven by the increasing demand for high-performance coatings from sectors like automotive, aerospace, and industrial applications. As industries focus on improving the durability, safety, and aesthetic appeal of their products, the adoption of advanced coatings continues to rise. Furthermore, the growing emphasis on sustainability and regulatory compliance is shaping the future of the market, encouraging the development of eco-friendly, high-performance solutions. With innovations in resin technologies and application methods, the market is poised to offer new opportunities for growth and innovation.

More Trending Latest Reports By Polaris Market Research:

Pre-owned Luxury Watches Market

3D Secure Payment Authentication Market

Artificial Intelligence (Ai) In Pharmaceutical Market

Distribution Transformer Market

Wafer Vacuum Assembling Equipment Market