Market Overview

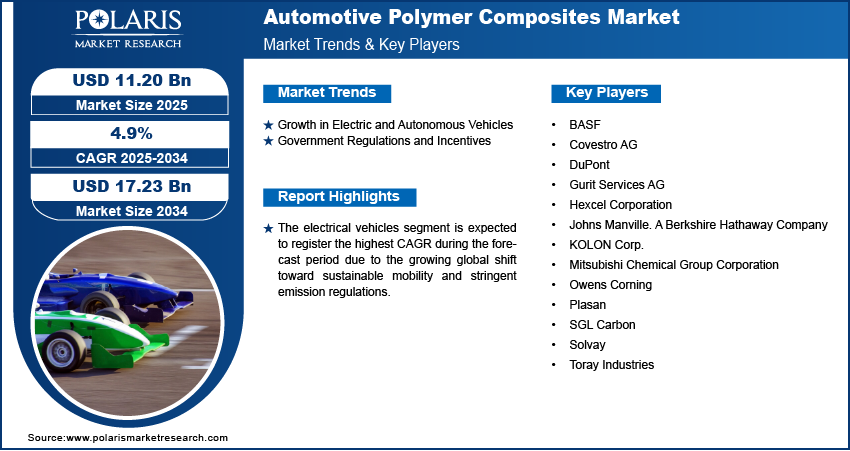

Global Automotive Polymer Composites Market size and share is currently valued at USD 10.69 billion in 2024 and is anticipated to generate an estimated revenue of USD 17.23 billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 4.9% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 – 2034.

The automotive polymer composites market has evolved into a cornerstone of modern vehicle design, driven by its ability to reduce vehicle weight without compromising strength or safety. These materials are commonly used in applications such as body panels, under-hood components, bumpers, interior trims, and structural reinforcements. As electric vehicles (EVs) gain global traction, the emphasis on lightweight materials has never been more critical. Polymer composites, particularly those made with carbon fiber composites, are enabling significant advancements in vehicle efficiency and environmental performance.

Key Market Growth Drivers

- Lightweighting for Improved Fuel Efficiency

Weight reduction has become a key strategy for automakers seeking to improve vehicle efficiency and meet regulatory standards such as the Corporate Average Fuel Economy (CAFE) regulations and EU CO₂ emission targets. By replacing traditional metal components with lightweight materials like polymer composites, manufacturers can reduce overall vehicle mass by up to 30%, directly impacting fuel consumption and emission levels.

- Rising Electric Vehicle Adoption

Electric vehicles (EVs) require lighter materials to offset the weight of batteries and extend driving range. Automotive polymer composites are particularly well-suited for EV platforms due to their high strength-to-weight ratio and thermal stability. As EV sales continue to climb across Asia-Pacific, Europe, and North America, the demand for polymer composites in the automotive sector is expected to surge.

- Technological Advancements in Composite Manufacturing

Advances in manufacturing techniques—such as automated fiber placement, resin transfer molding (RTM), and 3D printing of composites—have significantly reduced production costs and improved scalability. These developments have made high-performance carbon fiber composites more accessible for mainstream automotive applications, expanding their use beyond luxury and sports vehicles into mass-market models.

- Growing Demand for Durability and Safety

Automotive polymer composites offer superior resistance to corrosion, fatigue, and impact compared to metals. These features enhance vehicle longevity and passenger safety, making them ideal for use in automotive structural components. Automakers are investing in composite-intensive designs to meet crash performance standards while maintaining structural integrity.

Browse Full Insights:

https://www.polarismarketresearch.com/industry-analysis/automotive-polymer-composites-market

Market Challenges

Despite their benefits, the automotive polymer composites market faces several challenges:

- High Material and Processing Costs

One of the primary barriers to widespread adoption is the higher cost of carbon fiber composites and their associated processing technologies. While cost-effective alternatives like glass fiber-reinforced plastics (GFRP) are available, they often do not match the strength and stiffness of carbon fiber materials, limiting their application in high-load areas.

- Recyclability and Environmental Concerns

Recycling polymer composites remains a technical and economic hurdle. Most thermoset composites used in automotive manufacturing are not easily recyclable, posing environmental concerns as sustainability becomes a central focus across the value chain.

- Limited Industry Standardization

The absence of standardized testing methods and performance metrics for polymer composites creates inconsistencies in quality, impeding broader market penetration. Industry-wide collaboration is essential to establish clear standards and accelerate adoption.

- Skilled Labor Shortage

Composite manufacturing and design require specialized knowledge. The shortage of trained professionals in this niche field may restrict the pace of innovation and production capacity expansion, particularly in developing economies.

Regional Analysis

North America

North America remains a significant market for automotive polymer composites, driven by technological innovation and strong regulatory backing for lightweighting initiatives. The U.S. auto industry, including major OEMs and tier-1 suppliers, is actively incorporating composites into both ICE (internal combustion engine) and EV platforms. Federal incentives for EV manufacturing and materials R&D are further accelerating market growth in the region.

Europe

Europe is a global leader in the adoption of lightweight materials in automobiles, largely due to stringent environmental regulations and high consumer awareness. Countries like Germany, France, and the U.K. are heavily investing in sustainable mobility solutions, which include the use of carbon fiber composites in luxury and electric vehicles. The region is also home to several cutting-edge composite manufacturing firms and research centers.

Asia-Pacific

Asia-Pacific dominates the global automotive production landscape, and demand for polymer composites is rising in tandem. China, Japan, South Korea, and India are emerging as key markets, fueled by booming EV production and government policies aimed at reducing vehicular emissions. China’s rapidly growing domestic auto brands are increasingly adopting composite materials to meet both local and international market requirements.

Latin America and Middle East & Africa

These regions are still in the nascent stages of composite adoption in the automotive sector. However, rising vehicle ownership and industrial development are expected to create long-term opportunities. Governments and OEMs in these areas are beginning to explore the benefits of automotive structural components made from advanced composites, particularly for export-oriented vehicle production.

Key Companies in the Automotive Polymer Composites Market

Several companies play a pivotal role in shaping the automotive polymer composites landscape. These industry leaders are investing heavily in R&D to improve material performance and lower costs.

- BASF

- Covestro AG

- DuPont

- Gurit Services AG

- Hexcel Corporation

- Johns Manville. A Berkshire Hathaway Company

- KOLON Corp.

- Mitsubishi Chemical Group Corporation

- Owens Corning

- Plasan

- SGL Carbon

- Solvay

- Toray Industries

Outlook

The automotive polymer composites market is set for a transformative decade. While challenges remain, continuous innovation and growing awareness of the long-term benefits of lightweight materials are propelling the industry forward. As regulatory environments tighten and EV adoption accelerates, automakers will increasingly rely on advanced composite technologies to meet the dual demands of performance and sustainability.

More Trending Latest Reports By Polaris Market Research: