Food amino acids are organic compounds that serve as the building blocks of proteins and play a crucial role in numerous physiological processes. In the food industry, these amino acids are either naturally occurring or added to improve nutritional value, enhance flavor, or support specific dietary needs. Key types of food amino acids include essential amino acids like lysine, leucine, and valine, as well as non-essential types such as glutamic acid and alanine.

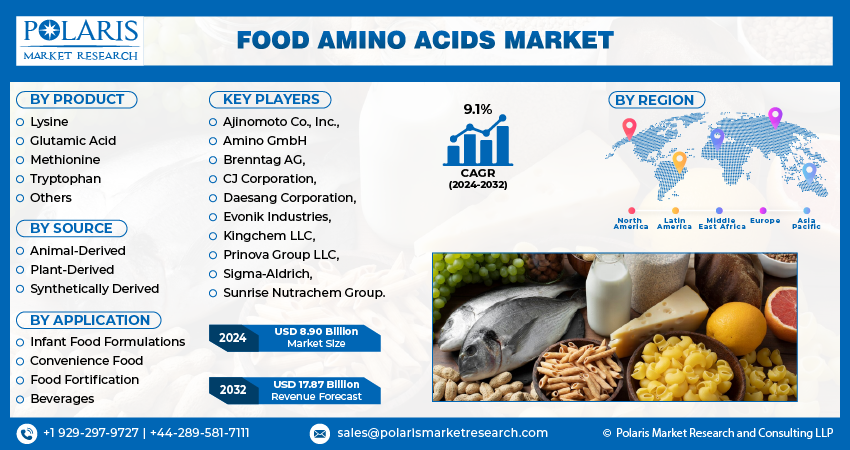

The global food amino acids market was valued at USD 8.90 billion in 2024, and it is projected to reach USD 17.87 billion by 2032, growing at a CAGR of 9.1% during the forecast period. The market’s expansion is propelled by rising demand for high-protein diets, the proliferation of nutritional supplements, and the shift toward functional and fortified food products.

Industries such as sports nutrition, clinical nutrition, and health & wellness have embraced amino acids for their benefits in muscle development, immune support, and metabolic regulation. Simultaneously, the food and beverage industry is integrating amino acids to enhance the nutritional profile of ready-to-eat meals, beverages, and snack products.

Key Market Growth Drivers

- Rising Demand for High-Protein and Fortified Foods

Consumers across the globe are gravitating toward high-protein diets, driven by increased awareness of health, weight management, and fitness. The popularity of keto, paleo, and low-carb dietary plans has spurred the demand for protein fortification, where amino acids play a vital role.

Products such as protein bars, shakes, yogurts, and cereals now often include branched-chain amino acids (BCAAs) like leucine, isoleucine, and valine to support muscle maintenance, recovery, and energy. The shift from traditional carbohydrate-heavy diets to protein-centric meal plans is a powerful growth engine for the food amino acids market.

- Expanding Use of Amino Acids in Nutritional Supplements

The nutritional supplements industry is one of the fastest-growing consumers of food amino acids. Supplements enriched with essential amino acids help meet dietary requirements, support athletic performance, improve digestion, and boost immunity.

With aging populations and growing consumer interest in preventive healthcare, dietary supplements that include amino acids like lysine (for calcium absorption), glutamine (for gut health), and tryptophan (for mood regulation) are in high demand. These compounds are also crucial in therapeutic nutrition for patients dealing with malabsorption, metabolic disorders, or recovery from illness.

- Functional Food and Beverage Industry Growth

The food and beverage industry has embraced amino acids as part of the broader trend toward functional foods—products that deliver health benefits beyond basic nutrition. Energy drinks, fortified waters, dairy products, and plant-based foods are increasingly formulated with amino acids to deliver targeted health claims.

For instance, glutamic acid enhances savory (umami) flavor in soups and broths, while taurine is added to energy beverages for its role in cardiovascular and muscular health. These functionalities are expanding amino acid applications from traditional protein supplements into mainstream packaged food offerings.

- Innovations in Amino Acid Production Technologies

Advancements in fermentation and enzymatic synthesis technologies have enabled the efficient, scalable, and sustainable production of food-grade amino acids. Microbial fermentation using strains like E. coli and Corynebacterium glutamicum is being increasingly utilized to manufacture amino acids with high purity and minimal environmental impact.

Biotechnology companies are also developing novel amino acid blends tailored for specific populations such as vegans, elderly consumers, and athletes. These innovations are helping manufacturers reduce costs, improve performance, and comply with clean-label and natural ingredient demands.

Market Challenges

Despite its promising outlook, the food amino acids market faces several obstacles that could hinder growth.

- High Production Costs

The manufacturing of high-purity amino acids, particularly essential amino acids, often involves complex and capital-intensive processes. While fermentation has improved efficiency, the cost of inputs, process control, and downstream purification remains high. This poses a pricing challenge for product developers aiming to serve cost-sensitive segments.

- Regulatory Compliance and Labeling Restrictions

The addition of amino acids to food and supplements is regulated by food safety authorities such as the FDA, EFSA, and FSSAI. Manufacturers must adhere to strict labeling, dosage, and health claim guidelines, which vary across regions. Delays in regulatory approvals or non-compliance can result in costly recalls or market entry barriers.

Additionally, consumer skepticism around synthetic additives or unfamiliar ingredients can impact adoption unless clear education and transparency are maintained.

- Market Saturation in Developed Regions

While demand for protein-fortified foods is growing, many developed markets such as North America and Western Europe are nearing saturation in categories like sports nutrition and ready-to-drink supplements. This intense competition limits margin potential and increases the need for product differentiation, flavor innovation, and consumer education.

- Raw Material Availability and Supply Chain Issues

The production of amino acids relies heavily on raw materials like sugar, starch, and agricultural byproducts, which are subject to price fluctuations, environmental challenges, and geopolitical instability. Recent global supply chain disruptions due to the pandemic and geopolitical tensions have increased delivery times and production costs for amino acid manufacturers.

Key Market Players:

- Ajinomoto Co., Inc.,

- Amino GmbH

- Brenntag AG,

- CJ Corporation,

- Daesang Corporation,

- Evonik Industries,

- Kingchem LLC,

- Prinova Group LLC,

- Sigma-Aldrich,

- Sunrise Nutrachem Group.

Polaris Market Research has segmented the food amino acids market report based on product, source, application:

Food amino acids, Product Outlook (Revenue – USD Billion, 2019 – 2032)

- Lysine

- Glutamic acid

- Methionine

- Tryptophan

- Others

Food amino acids, source Outlook (Revenue – USD Billion, 2019 – 2032)

- Animal derived

- Plant derived

- Synthetically derived

Food amino acids, application Outlook (Revenue – USD Billion, 2019 – 2032)

- Infant food formulations

- Convenience food

- Food fortification

- Beverages

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞 @ https://www.polarismarketresearch.com/industry-analysis/food-amino-acids-market

Regional Analysis

Asia-Pacific

Asia-Pacific is the largest and fastest-growing regional market for food amino acids, accounting for more than 40% of global consumption. Countries such as China, India, Japan, and South Korea are leading the charge due to high population densities, increasing health awareness, and growing disposable incomes.

In China and India, the rapid expansion of the middle class has resulted in higher demand for nutritional supplements, fortified foods, and high-protein snacks. Japan, a mature market, focuses on functional foods tailored for the aging population, particularly those containing glutamine, arginine, and lysine for muscle maintenance and cognitive health.

Government initiatives to combat malnutrition and promote healthy diets are also supporting the use of amino acid-enriched products in schools, hospitals, and community programs.

North America

North America holds a significant share of the food amino acids market, driven by well-established sports nutrition, clinical nutrition, and functional food industries. The U.S. leads the region in terms of product innovation and consumption of protein fortification products.

Consumers in this region are highly receptive to clean-label, plant-based, and science-backed nutritional products. The demand for amino acids like leucine and tryptophan in protein powders, functional beverages, and mental wellness supplements is particularly strong. Additionally, food technology startups and biotech firms are collaborating to develop sustainable amino acid production solutions.

Europe

Europe remains a robust market, especially in Western countries like Germany, France, the UK, and the Netherlands. The region’s emphasis on food safety, regulatory compliance, and sustainable practices is shaping the adoption of naturally derived amino acids.

The popularity of vegan and vegetarian diets is increasing the demand for amino acid fortification in plant-based products. Manufacturers are focusing on amino acid profiles in vegan meat analogs and dairy-free formulations to ensure nutritional equivalence to animal-based products.

Latin America

Latin America is an emerging market for food amino acids, with Brazil, Mexico, and Argentina at the forefront. The region is seeing rising demand for fortified cereals, infant formula, and sports nutrition products.

Local governments are promoting health awareness programs, and urbanization is increasing the consumption of processed and convenience foods, driving the incorporation of amino acids for added nutrition.

Middle East and Africa

The Middle East and Africa are gradually embracing food amino acids, particularly in the UAE, Saudi Arabia, and South Africa. The growing demand for halal-certified nutritional supplements and protein-enriched products is creating new opportunities for amino acid manufacturers.

The expansion of retail chains, e-commerce platforms, and Western dietary habits is further boosting the demand for essential amino acids in the region.

Conclusion

The global food amino acids market is on a solid growth trajectory, fueled by a rising focus on health-conscious diets, protein enrichment, and functional nutrition. As consumers demand more from their food—be it better health, better taste, or better sustainability—amino acids are stepping into the spotlight as versatile and essential ingredients.

The increasing use of essential amino acids for protein fortification, the surge in nutritional supplements, and innovations within the food and beverage industry underscore the critical role of amino acids in shaping the future of nutrition. Though the industry faces hurdles like regulatory complexity and cost pressures, the overall momentum remains firmly positive.

As market dynamics evolve, collaboration between biotech firms, food producers, and nutrition scientists will be key to unlocking the full potential of food amino acids and delivering tailored health benefits to diverse consumer segments across the globe.

More Trending Latest Reports By Polaris Market Research:

Intravenous Immunoglobulin Market

Top 10 Sports Analytics Companies in 2024: Effective Organization of Activities Using Data Analytics

Pregnancy Tracking and Postpartum Care Apps Market