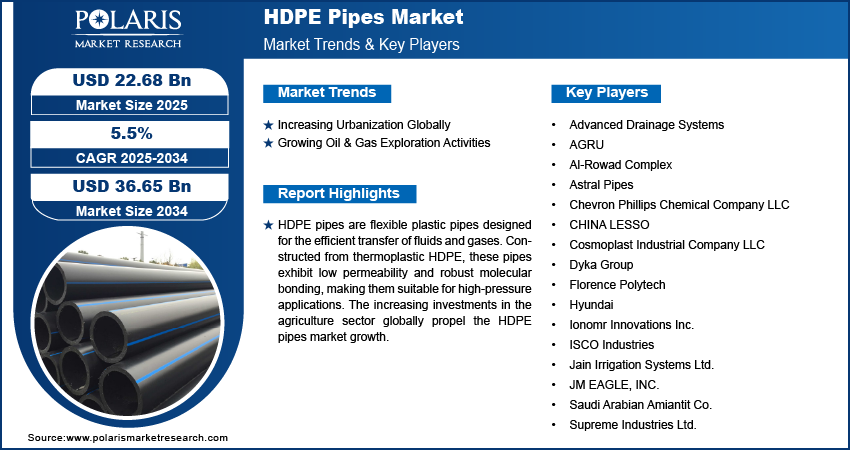

Global HDPE Pipes Market size and share is currently valued at USD 21.54 billion in 2024 and is anticipated to generate an estimated revenue of USD 36.65 billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 5.5% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 – 2034

The global High-Density Polyethylene (HDPE) pipes market is experiencing significant growth, driven by increasing infrastructure development, environmental sustainability initiatives, and advancements in polymer technology. HDPE pipes are renowned for their durability, flexibility, and resistance to corrosion, making them a preferred choice for various applications across industries.

Market Overview

HDPE pipes are extensively used in water supply, sewage systems, agricultural irrigation, and industrial applications. Their lightweight nature and ease of installation contribute to cost savings and efficiency in large-scale projects. The market’s expansion is further supported by the global emphasis on replacing aging infrastructure with modern, sustainable solutions.

Growth Drivers

Several factors are propelling the HDPE pipes market forward:

- Infrastructure Development: Rapid urbanization and the need for reliable water and sewage systems are increasing the demand for HDPE pipes in municipal projects.

- Environmental Sustainability: HDPE pipes are recyclable and have a lower environmental impact compared to traditional materials, aligning with global sustainability goals.

- Technological Advancements: Innovations in manufacturing processes, such as advanced extrusion techniques, have enhanced the performance and application range of HDPE pipes.

- Agricultural Needs: The growing requirement for efficient irrigation systems in agriculture is boosting the adoption of HDPE pipes due to their durability and resistance to chemicals.

Market Segmentation

Global HDPE Pipes Market, by Diameter

5.1. Key Findings

5.2. Introduction

5.2.1. Global HDPE Pipes Market, by Diameter, 2020-2034 (USD Billion)

5.3. <500 MM

5.3.1. Global HDPE Pipes Market, by <500 MM, by Region, 2020-2034 (USD Billion)

5.4. 500-1000 MM

5.4.1. Global HDPE Pipes Market, by 500-1000 MM, by Region, 2020-2034 (USD Billion)

5.5. 1000-2000 MM

5.5.1. Global HDPE Pipes Market, by 1000-2000 MM, by Region, 2020-2034 (USD Billion)

5.6. 2000-3000 MM

5.6.1. Global HDPE Pipes Market, by 2000-3000 MM, by Region, 2020-2034 (USD Billion)

5.7. >3000 MM

5.7.1. Global HDPE Pipes Market, by >3000 MM, by Region, 2020-2034 (USD Billion)

Global HDPE Pipes Market, by Grade

6.1. Key Findings

6.2. Introduction

6.2.1. Global HDPE Pipes Market, by Grade, 2020-2034 (USD Billion)

6.3. PE 80

6.3.1. Global HDPE Pipes Market, by PE 80, by Region, 2020-2034 (USD Billion)

6.4. PE 100

6.4.1. Global HDPE Pipes Market, by PE 100, by Region, 2020-2034 (USD Billion)

Global HDPE Pipes Market, by Application

7.1. Key Findings

7.2. Introduction

7.2.1. Global HDPE Pipes Market, by Application, 2020-2034 (USD Billion)

7.3. Irrigation Systems

7.3.1. Global HDPE Pipes Market, by Irrigation Systems, by Region, 2020-2034 (USD Billion)

7.4. Drainage & Sewage

7.4.1. Global HDPE Pipes Market, by Drainage & Sewage, by Region, 2020-2034 (USD Billion)

7.5. Chemical Processing

7.5.1. Global HDPE Pipes Market, by Chemical Processing, by Region, 2020-2034 (USD Billion)

7.6. Electrofusion Fittings

7.6.1. Global HDPE Pipes Market, by Electrofusion Fittings, by Region, 2020-2034 (USD Billion)

7.7. Others

7.7.1. Global HDPE Pipes Market, by Others, by Region, 2020-2034 (USD Billion)

Global HDPE Pipes Market, by End User

8.1. Key Findings

8.2. Introduction

8.2.1. Global HDPE Pipes Market, by End User, 2020-2034 (USD Billion)

8.3. Municipal Corporation

8.3.1. Global HDPE Pipes Market, by Municipal Corporation, by Region, 2020-2034 (USD Billion)

8.4. Farmers

8.4.1. Global HDPE Pipes Market, by Farmers, by Region, 2020-2034 (USD Billion)

8.5. Oil & Gas Explorer

8.5.1. Global HDPE Pipes Market, by Oil & Gas Explorer, by Region, 2020-2034 (USD Billion)

8.6. Builders

8.6.1. Global HDPE Pipes Market, by Builders, by Region, 2020-2034 (USD Billion)

8.7. Others

8.7.1. Global HDPE Pipes Market, by Others, by Region, 2020-2034 (USD Billion)

Regional Analysis

- Asia-Pacific: This region leads the global HDPE pipes market, driven by rapid industrialization, urbanization, and significant investments in infrastructure projects. Countries like China and India are at the forefront, focusing on water conservation and sustainable development.

- North America: The market is growing due to the replacement of aging water infrastructure and the adoption of HDPE pipes in oil and gas industries. The U.S. and Canada are investing in modernizing their municipal water systems.

- Europe: Environmental regulations and the push for sustainable infrastructure are propelling the HDPE pipes market. Countries like Germany, the UK, and France are emphasizing green construction practices.

- Latin America and Middle East & Africa: These regions are emerging markets for HDPE pipes, with growth driven by urban expansion and investments in water and sewage systems.

Key Companies

- Advanced Drainage Systems

- AGRU

- Al-Rowad Complex

- Astral Pipes

- Chevron Phillips Chemical Company LLC

- CHINA LESSO

- Cosmoplast Industrial Company LLC

- Dyka Group

- Florence Polytech

- Ionomr Innovations Inc.

- ISCO Industries

- Jain Irrigation Systems Ltd.

- JM EAGLE, INC.

- Saudi Arabian Amiantit Co.

- Supreme Industries Ltd.

Explore The Complete Comprehensive Report Here:

https://www.polarismarketresearch.com/industry-analysis/hdpe-pipes-market

Developments in the HDPE Pipes Industry

- August 2021: Varuna Neeravari established a new manufacturing unit for HDPE pipes and fittings in the Dobaspet 4th Phase Industrial Area, Bangalore Rural, India. The facility is focused on producing a range of HDPE pipes and fittings.

- April 2021: Malaxmi Polymers obtained approval from the Telangana State Pollution Control Board to set up a new HDPE pipe manufacturing facility in Maheswaram, Telangana. The plant is designed to produce HDPE pipes with a capacity of 78 tons per month (TPM).

- January 2021: Presvels received clearance from the Madhya Pradesh Pollution Control Board to establish an HDPE pipe manufacturing unit in Mandideep, Raisen district, Madhya Pradesh. The facility will have a production capacity of 3,000 metric tons per year.

Conclusion

The HDPE pipes market is poised for continued growth, supported by the global emphasis on sustainable infrastructure, technological advancements, and the need for efficient water and waste management systems. As industries and governments prioritize eco-friendly and durable solutions, HDPE pipes are set to play a pivotal role in shaping the future of infrastructure development worldwide.

More Trending Latest Reports By Polaris Market Research:

Us Midstream Oil & Gas Equipment Market

Soft Tissue Sarcoma Treatment Market

Next Generation Emergency Response System Market