The Global Healthy Snacks Market Is Experiencing Significant Growth, Driven By Increasing Consumer Awareness Of Nutrition, The Demand For Functional Foods, And The Need For Convenient, On-The-Go Options. As Lifestyles Become Busier And Health Consciousness Rises, Consumers Are Seeking Snacks That Align With Their Dietary Preferences And Wellness Goals.

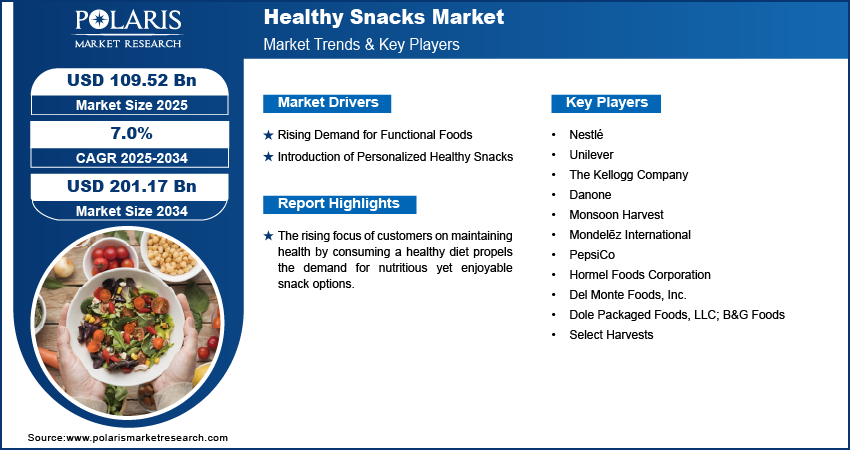

Global Healthy Snacks Market size and share is currently valued at USD 102.46 billion in 2024 and is anticipated to generate an estimated revenue of USD 201.17 billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 7.0% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 – 2034

Market Overview

Healthy snacks encompass a wide range of products, including fruit and nut mixes, protein bars, yogurt, and baked goods, designed to provide nutritional benefits without compromising on taste. The market’s expansion is fueled by the growing preference for snacks that offer functional benefits, such as improved digestion, weight management, and energy boosts.

Growth Drivers

Several factors contribute to the healthy snacks market’s robust growth:

- Functional Foods Demand: Consumers are increasingly seeking snacks enriched with proteins, fibers, vitamins, and minerals to support overall health. Functional ingredients are now mainstream in retail channels, promoting digestive health and reducing the risk of chronic diseases.

- Convenience and On-the-Go Consumption: Busy lifestyles have led to a surge in demand for ready-to-eat snacks that are both nutritious and portable. Approximately 59% of adults worldwide prefer multiple small meals throughout the day, highlighting the shift towards snacking as a primary eating occasion.

- Clean Label and Plant-Based Trends: There’s a growing preference for snacks made with natural, organic, and plant-based ingredients. Consumers are scrutinizing labels for transparency, seeking products free from artificial additives and preservatives.

- Health Awareness and Chronic Disease Prevention: Rising concerns about obesity, diabetes, and heart disease are prompting consumers to choose healthier snack options. The World Health Organization notes that 80% of strokes, heart diseases, and type II diabetes can be prevented through healthy eating, underscoring the importance of nutritious snacks.

Market Segmentation

Global Healthy Snacks Market, by Product

5.1. Key Findings

5.2. Introduction

5.2.1. Global Healthy Snacks Market, by Product, 2020–2034 (USD Billion)

5.3. Fruits and Fruits Bars

5.3.1. Global Healthy Snacks Market, by Fruits and Fruits Bars, by Region, 2020–2034 (USD Billion)

5.4. Savory

5.4.1. Global Healthy Snacks Market, by Savory, by Region, 2020–2034 (USD Billion)

5.5. Cereal and Granola Bars

5.5.1. Global Healthy Snacks Market, by Cereal and Granola Bars, by Region, 2020–2034 (USD Billion)

5.6. Nuts and Seeds

5.6.1. Global Healthy Snacks Market, by Nuts and Seeds, by Region, 2020–2034 (USD Billion)

5.7. Trail Mix

5.7.1. Global Healthy Snacks Market, by Trail Mix, by Region, 2020–2034 (USD Billion)

5.8. Frozen & Refrigerated

5.8.1. Global Healthy Snacks Market, by Frozen & Refrigerated, by Region, 2020–2034 (USD Billion)

5.9. Confectionery

5.9.1. Global Healthy Snacks Market, by Confectionery, by Region, 2020–2034 (USD Billion)

5.10. Dairy

5.10.1. Global Healthy Snacks Market, by Dairy, by Region, 2020–2034 (USD Billion)

5.11. Bakery

5.11.1. Global Healthy Snacks Market, by Bakery, by Region, 2020–2034 (USD Billion)

Global Healthy Snacks Market, by Claim

6.1. Key Findings

6.2. Introduction

6.2.1. Global Healthy Snacks Market, by Claim, 2020–2034 (USD Billion)

6.3. Gluten-free

6.3.1. Global Healthy Snacks Market, by Gluten-free, by Region, 2020–2034 (USD Billion)

6.4. Low-fat

6.4.1. Global Healthy Snacks Market, by Low-fat, by Region, 2020–2034 (USD Billion)

6.5. Sugar-free

6.5.1. Global Healthy Snacks Market, by Sugar-free, by Region, 2020–2034 (USD Billion)

6.6. Others

6.6.1. Global Healthy Snacks Market, by Others, by Region, 2020–2034 (USD Billion)

Global Healthy Snacks Market, by Packaging

7.1. Key Findings

7.2. Introduction

7.2.1. Global Healthy Snacks Market, by Packaging, 2020–2034 (USD Billion)

7.3. Jars

7.3.1. Global Healthy Snacks Market, by Jars, by Region, 2020–2034 (USD Billion)

7.4. Boxes

7.4.1. Global Healthy Snacks Market, by Boxes, by Region, 2020–2034 (USD Billion)

7.5. Pouches

7.5.1. Global Healthy Snacks Market, by Pouches, by Region, 2020–2034 (USD Billion)

7.6. Cans

7.6.1. Global Healthy Snacks Market, by Cans, by Region, 2020–2034 (USD Billion)

7.7. Others

7.7.1. Global Healthy Snacks Market, by Others, by Region, 2020–2034 (USD Billion)

Global Healthy Snacks Market, by Distribution Channel

8.1. Key Findings

8.2. Introduction

8.2.1. Global Healthy Snacks Market, by Distribution Channel, 2020–2034 (USD Billion)

8.3. Supermarkets

8.3.1. Global Healthy Snacks Market, by Supermarkets, by Region, 2020–2034 (USD Billion)

8.4. Hypermarkets

8.4.1. Global Healthy Snacks Market, by Hypermarkets, by Region, 2020–2034 (USD Billion)

8.5. Convenience Stores

8.5.1. Global Healthy Snacks Market, by Convenience Stores, by Region, 2020–2034 (USD Billion)

8.6. Online Retail Stores

8.6.1 Global Healthy Snacks Market, by Online Retail Stores, by Region, 2020–2034 (USD Billion)

Regional Analysis

- North America: The region accounted for the largest market share in 2024, driven by high health consciousness and a demand for convenience foods. The U.S. healthy snacks market is projected to grow significantly, reflecting the population’s shift towards healthier eating habits.

- Europe: Europe’s market growth is fueled by increasing awareness of health and wellness, a demand for sustainable and organic snack products, and regulatory developments promoting healthier food options.

- Asia Pacific: Expected to register the fastest growth during the forecast period, driven by increasing health awareness in countries like India, China, and Japan. Urbanization and exposure to global food trends are influencing consumer preferences towards healthier snacks.

- Latin America and Middle East & Africa: These regions are witnessing gradual growth, with emerging markets showing increased demand for nutritious and convenient snack options.

Key Companies

- Nestlé

- Unilever

- The Kellogg Company

- Danone

- Monsoon Harvest

- Mondelēz International

- PepsiCo

- Hormel Foods Corporation

- Del Monte Foods, Inc.

- Dole Packaged Foods, LLC; B&G Foods

- Select Harvests

Explore The Complete Comprehensive Report Here:

https://www.polarismarketresearch.com/industry-analysis/healthy-snacks-market

Developments in the Healthy Snacks Industry

- September 2023: Danone UK and Ireland launched GetPRO, a new high-protein dairy range. The collection includes puddings, mousses, yogurts, and drinks, catering to individuals looking to support their fitness goals while enjoying tasty, healthy snacks.

- June 2023: Unilever completed its acquisition of Yasso Holdings, Inc., a premium frozen Greek yogurt brand in the U.S. This acquisition is part of Unilever’s strategy to enhance its ice cream portfolio in North America, focusing on premium offerings.

Conclusion

The healthy snacks market is poised for continued growth, driven by consumer demand for nutritious, convenient, and functional food options. As health awareness rises and lifestyles become increasingly fast-paced, the market will likely see further innovation and diversification to meet evolving consumer preferences.

More Trending Latest Reports By Polaris Market Research:

Medical Waste Management Market

Private Nursing Services Market

North America Heat Transfer Fluids Market