Market Overview

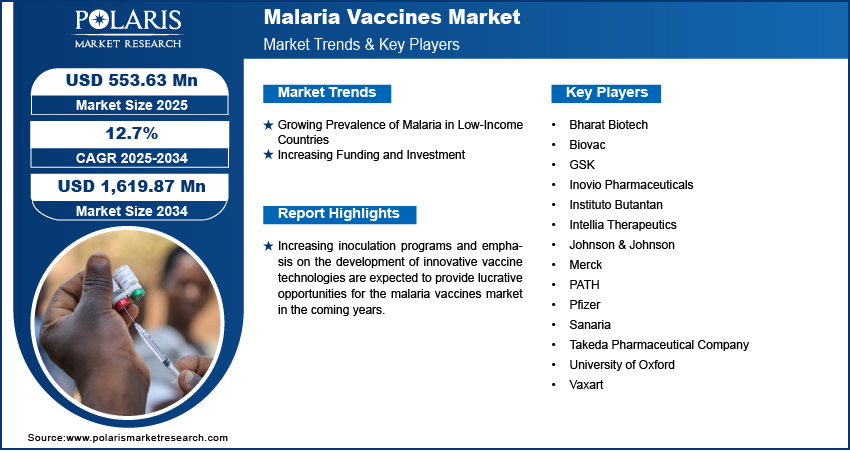

Global Malaria Vaccines Market size and share is currently valued at USD 491.90 million in 2024 and is anticipated to generate an estimated revenue of USD 1,619.87 million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 12.7% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 – 2034

The malaria vaccines market consists of prophylactic vaccines aimed at preventing the onset of the disease, therapeutic vaccines to reduce disease severity, and transmission-blocking vaccines that target the lifecycle of the Plasmodium falciparum parasite in mosquitoes. Recent approvals and large-scale pilot programs, such as the roll-out of the RTS,S/AS01 vaccine in African countries, have catalyzed momentum in the sector.

This market includes products under development, those in clinical trials, and newly commercialized vaccines being distributed through global health initiatives and national immunization programs.

Key Market Growth Drivers

- Burden of Malaria in Endemic Regions

Malaria continues to impose a heavy burden in many parts of the world, particularly in Africa, where more than 90% of malaria-related deaths occur. According to the World Health Organization (WHO), there were an estimated 249 million malaria cases and over 600,000 deaths globally in 2023, with children under five being the most vulnerable.

This persistent public health challenge is intensifying efforts to deploy vaccines alongside traditional control strategies like insecticide-treated nets and antimalarial drugs.

- First-Ever Approved Malaria Vaccines

The introduction of RTS,S/AS01—the first malaria vaccine to receive WHO recommendation in 2021—has been a breakthrough. Targeting Plasmodium falciparum, it has shown moderate vaccine efficacy, especially when administered in a four-dose regimen in children aged 5 months and older.

In 2023, a second vaccine, R21/Matrix-M, received regulatory approval in several African countries and has demonstrated higher efficacy in Phase 3 trials. These approvals have instilled confidence in vaccine development and bolstered investments in production infrastructure.

- Expansion of Immunization Programs

Several countries have launched pilot immunization programs with support from Gavi, the Global Fund, and the WHO. These programs are integrating malaria vaccination into existing childhood vaccination schedules, improving access in rural and underserved areas.

The scale-up of these programs, particularly in Malawi, Ghana, and Kenya, is paving the way for broader market adoption across the African continent and potentially in Southeast Asia.

- Rising Investments in Research and Innovation

Global health organizations, governments, and private foundations are pouring resources into malaria vaccine research. Technologies such as mRNA platforms, recombinant proteins, and nanoparticle delivery systems are being explored to enhance vaccine efficacy and safety profiles.

Clinical pipelines are expanding, with several candidates in Phase 1 to Phase 3 trials aiming to provide long-lasting immunity and cross-protection against multiple Plasmodium species.

Browse Full Insights:

https://www.polarismarketresearch.com/industry-analysis/malaria-vaccines-market

Market Challenges

- Limited Vaccine Efficacy and Durability

Despite recent advancements, existing malaria vaccines still face challenges related to vaccine efficacy. RTS,S/AS01, for instance, shows approximately 30–50% efficacy, depending on age, exposure level, and dosing adherence. Moreover, immunity wanes over time, necessitating booster doses.

Developers are working to address this by optimizing antigen selection and adjuvant systems, but achieving durable, sterilizing immunity remains a significant hurdle.

- Complex Parasite Biology

Malaria parasites—especially Plasmodium falciparum—exhibit complex life cycles and high genetic diversity. This biological complexity complicates vaccine design, as antigens must target various stages of the parasite’s lifecycle within both humans and mosquitoes.

The risk of antigenic variation and immune evasion makes it difficult to develop universally effective vaccines, especially in regions with multiple circulating strains.

- Infrastructure and Logistical Barriers

Rolling out vaccines in malaria-endemic regions presents substantial logistical challenges. Many high-burden areas suffer from weak healthcare infrastructure, limited cold chain capabilities, and workforce shortages. These issues can delay vaccine distribution and reduce uptake, even when funding and supply are available.

Coordinating vaccination campaigns with broader health system strengthening efforts is essential to maximize impact.

- Public Awareness and Acceptance

Vaccine hesitancy, often driven by misinformation or low trust in government health initiatives, can limit the success of immunization programs. Educating communities, especially in rural areas, on the benefits and safety of malaria vaccines is crucial.

Strong engagement with local leaders, healthcare workers, and civil society organizations will play a key role in improving public confidence and participation.

Regional Analysis

Sub-Saharan Africa

Sub-Saharan Africa is both the largest and fastest-growing regional market for malaria vaccines. Countries like Nigeria, the Democratic Republic of Congo, Mozambique, and Uganda are focal points of global malaria control efforts.

Governments are working with WHO, Gavi, and UNICEF to incorporate vaccines into national immunization programs, with an emphasis on reaching children under five—the most affected demographic. The recent expansion of pilot programs to include broader populations is expected to drive strong market growth.

Asia-Pacific

The Asia-Pacific region, particularly countries like India, Indonesia, and Myanmar, also bears a significant malaria burden. However, the prevalence of Plasmodium vivax, which is not fully targeted by current vaccines, presents a unique challenge.

Ongoing surveillance and vaccine development efforts aim to address these regional variations. India’s increasing investment in biotechnology and pharmaceutical R&D could position it as both a market and a manufacturer of future malaria vaccines.

Latin America

While malaria incidence is lower compared to Africa and Asia, parts of the Amazon Basin, particularly in Brazil, Colombia, and Peru, remain high-risk zones. Latin America’s interest in malaria vaccines is growing, particularly as drug-resistant Plasmodium strains spread and environmental conditions change due to deforestation and climate change.

Public-private partnerships and regional health initiatives such as PAHO (Pan American Health Organization) are exploring options for vaccine deployment as a preventive strategy.

Middle East and North Africa

The Middle East and North Africa region has largely controlled malaria transmission, but imported cases still pose a risk in some countries. The region is expected to remain a relatively smaller but stable market, primarily for travel vaccines and for refugees or migrant populations.

North America and Europe

These regions have limited demand for routine malaria vaccination due to low endemicity. However, they play a critical role in funding, research, and global vaccine development efforts. Additionally, vaccines targeting travelers and military personnel heading to endemic regions are available and constitute a niche market segment.

Key Companies

Several key players are leading the malaria vaccines market through innovation, partnerships, and large-scale production capacity. These companies are engaged in R&D, clinical trials, and collaboration with global health organizations to expand vaccine accessibility and impact:

- Bharat Biotech

- Biovac

- GSK

- Inovio Pharmaceuticals

- Instituto Butantan

- Intellia Therapeutics

- Johnson & Johnson

- Merck

- PATH

- Pfizer

- Sanaria

- Takeda Pharmaceutical Company

- University of Oxford

- Vaxart

Conclusion

The Malaria Vaccines Market is on the cusp of a historic transformation, with technological breakthroughs, sustained global funding, and political will converging to address one of the most persistent mosquito-borne diseases. While challenges such as vaccine efficacy, infrastructure gaps, and biological complexity remain, the expanding reach of immunization programs offers hope for significantly reducing malaria cases and deaths in the coming decade.

More Trending Latest Reports By Polaris Market Research: