Market Overview

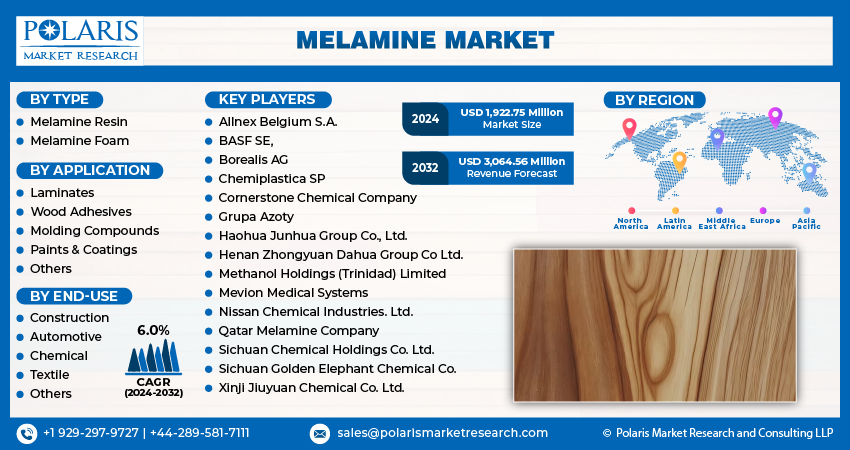

According to the latest industry report, the global melamine market, which was valued at USD 1,817.00 million in 2023, is expected to grow at a compound annual growth rate (CAGR) of 6.0% over the forecast period from 2024 to 2030. This growth is fueled by increasing demand in construction, automotive, and furniture industries, along with technological advancements in manufacturing processes.

Melamine, an organic compound with high nitrogen content, is widely used in the production of melamine formaldehyde resins, a type of thermosetting resin that is prized for its durability, fire resistance, and thermal stability. Its extensive use in laminates, coatings, adhesives, and construction materials is a testament to its versatility and utility across multiple industrial sectors.

The melamine market has evolved significantly over the past decade, driven by technological progress, evolving consumer preferences, and industrial innovations. The rise in construction activities globally, particularly in emerging economies such as India, China, and Brazil, is contributing to an increased demand for melamine-based laminates and adhesives.

Melamine is most commonly used to manufacture melamine-formaldehyde resins, which are valued for their high resistance to heat, water, and chemicals. These resins are used extensively in construction materials, household products, and automotive applications, all of which are experiencing steady growth.

Furthermore, the growing focus on sustainability and energy efficiency in construction practices is prompting manufacturers to explore melamine’s applications in eco-friendly insulation and fire-retardant materials.

Key Market Growth Drivers

- Booming Construction Industry: Infrastructure development and residential construction, particularly in Asia-Pacific and the Middle East, have created strong demand for laminates and panels made using melamine resins.

- Rising Demand in Furniture and Interiors: As disposable incomes rise globally, consumer preference for aesthetically pleasing and durable furniture has surged. Melamine’s ability to mimic wood textures in low-pressure laminates makes it a popular material in the furniture industry.

- Expansion of Automotive Applications: Melamine-based resins are increasingly being used in automobile interiors for their ability to withstand high temperatures and provide scratch-resistant surfaces.

- Sustainability in Manufacturing: The shift toward low-emission materials and sustainable resins has promoted innovations in melamine production, making it a preferred alternative to certain plastics and polymers.

Report Segmentation

The market is primarily segmented based on type, application, end-use, and region.

| By Type | By Application | By End-Use | By Region |

|

|

|

|

Browse Full Insights:

https://www.polarismarketresearch.com/industry-analysis/melamine-market

Regional Analysis

Asia-Pacific:

Asia-Pacific dominates the global melamine market, accounting for more than 50% of global consumption in 2023. China is the largest producer and consumer, with major investments in construction and interior decor fueling the demand. India and Southeast Asian nations are witnessing similar trends, supported by urbanization and government housing initiatives.

Europe:

Europe remains a mature market, with Germany, Italy, and France leading in production and consumption. Stringent environmental regulations are encouraging the adoption of low-emission melamine-based products. The region’s strong presence in automotive and furniture manufacturing further supports market growth.

North America:

North America, led by the United States, holds a significant market share. Technological innovation, coupled with a strong consumer preference for quality interior design and DIY furniture, has positively impacted melamine usage. The construction recovery post-pandemic has further strengthened the market.

Middle East & Africa:

This region is experiencing moderate growth. Increased infrastructure development in Gulf countries and urbanization across Africa contribute to the rising demand for construction materials that use melamine-based resins.

Latin America:

With Brazil and Mexico at the forefront, Latin America’s melamine market is gradually expanding, driven by residential construction and improvements in manufacturing capabilities.

Key Companies Operating in the Melamine Market

The melamine market is moderately consolidated, with major players focusing on innovation, expansion, and sustainability to gain competitive advantage. Prominent companies include:

- OCI N.V. (Netherlands): One of the largest producers of melamine globally, known for high-purity products and sustainability practices.

- BASF SE (Germany): Offers a range of melamine-based products with applications in construction and coatings.

- Qatar Melamine Company (Qatar): Focuses on Middle East and Asia-Pacific markets with growing export capabilities.

- Mitsui Chemicals, Inc. (Japan): A major player in thermosetting resins and specialty chemicals, supplying industries across Asia.

- Cornerstone Chemical Company (USA): A leading manufacturer in North America with a strong distribution network.

- Shandong Shuntian Chemical Group (China): One of the top melamine manufacturers in China, serving domestic and international markets.

These companies are investing in R&D to develop advanced melamine derivatives, improve energy efficiency, and comply with stricter environmental standards.

Challenges and Opportunities

Despite promising growth, the melamine market faces certain challenges:

- Volatile Raw Material Prices: Fluctuations in urea and natural gas prices can impact profit margins for melamine producers.

- Environmental Concerns: The formaldehyde component in melamine resins is under scrutiny for emissions and potential health hazards. This is pushing the market toward low-emission variants and bio-based alternatives.

- Regulatory Pressure: Compliance with global environmental standards such as REACH (EU) and EPA (US) necessitates technological upgrades and R&D investment.

However, these challenges also present opportunities for innovation. The push for sustainable construction materials, low-VOC coatings, and flame-retardant textiles will likely open new avenues for melamine applications. Moreover, strategic mergers and capacity expansions in Asia-Pacific and the Middle East hint at strong market consolidation in the coming years.

Conclusion

melamine As the world shifts toward more sustainable, cost-effective, and durable materials, melamine continues to demonstrate its versatility and relevance across a broad spectrum of industries. The anticipated 6.0% CAGR growth through 2030 reflects strong demand, particularly in thermosetting resins, melamine formaldehyde compounds, laminates, and construction materials.

Driven by innovation, sustainability, and robust demand across developing regions, the global melamine market is poised for transformative growth in the years ahead.

More Trending Latest Reports By Polaris Market Research:

Higher Education Technology Market

The Industry Analysis of Compound Semiconductor Market